As Nigeria prepares to roll out the new Nigerian Tax Act (NTA) in 2026, individuals have a short window to reassess their personal finances and tax positions. The changes are expected to affect how both residents and international assignees are taxed on income, investments, and global earnings, making year-end planning more critical than ever.

KPMG, in its GMS flash alert report titled, ‘Nigeria-Reforms of the Personal Income Tax Regime Bring Important Changes,’ advises that individual taxpayers, including international assignees, should “consider how the NTA would impact their finances, explore tax planning opportunities, and seek guidance from professionals to fully understand and prepare for the implementation.

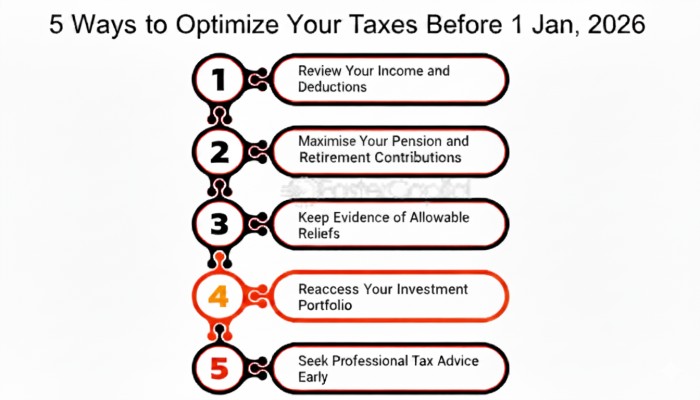

Here are five smart moves to make before January 1, 2026:

Review your income and deductions

To review your income and deductions for tax filing, you must first gather all relevant financial documents, such as proof of income, proof of deductions. “Individual taxpayers may wish to consider how the NTA would impact their finances, explore tax planning opportunities, ” KPMG said

Reconcile the information with official tax forms, and finally confirm the accuracy of all entries before submission. If you earned irregular income through side gigs, consulting, or bonuses, estimate your total and check your tax exposure early. Accelerate deductible expenses such as rent, professional fees, or donations to reduce your taxable income before the year closes.

Maximize your pension and retirement contributions

Pension remains one of the most reliable tax shields under the Pension Reform Act. To maximize your pension and retirement contributions to lower your taxable income for the 2025 tax year, focus on contributing the maximum amounts allowed to tax-deferred accounts. Contributions to traditional retirement plans are generally tax-deductible.

Top up your contributions before year-end or set up a Voluntary Contributory Pension Scheme if you’re self-employed. These contributions are fully tax-deductible and build your long-term wealth.

Keep evidence of allowable reliefs

To correctly file your taxes and ensure you can claim all eligible deductions and credits (allowable reliefs), it is crucial to maintain thorough records. Collect receipts for insurance premiums, mortgage interest, charitable donations, and other claimable expenses. Good record-keeping ensures you receive your full Relief Allowances and other deductions under the Personal Income Tax Act (PITA).

The NTA eliminates the Consolidated Relief Allowance (CRA) and introduces the rent relief of 20 percent of annual rent paid, capped at N500,000.

“ To claim this relief, individuals will be required to declare their annual rent and provide supporting information as may be required by the relevant tax authorities. Homeowners and others who do not pay rent are not eligible, leaving their only personal relief limited to the first ₦800,000 of income under the revised tax bands,” KPMG said in the report.

Reassess your investment portfolio

With the NTA expected to tighten rules around global income and capital gains, review your investment exposure. Confirm that the correct withholding taxes were deducted from dividends and interest, and assess whether to realize or defer capital gains before the new framework takes effect.

Seek professional tax advice early

Don’t wait for tax season chaos. Schedule a consultation now with a licensed tax adviser to understand how the new NTA will affect your personal and business income, especially if you hold foreign assets. Early guidance could help you avoid double taxation and unnecessary penalties.

“ Individual taxpayers – this includes international assignees subject to Nigerian tax law – may wish to consider how the NTA would impact their finances, explore tax planning opportunities, and seek guidance from professionals to fully understand and prepare for the implementation of the NTA, ” KPMG said.