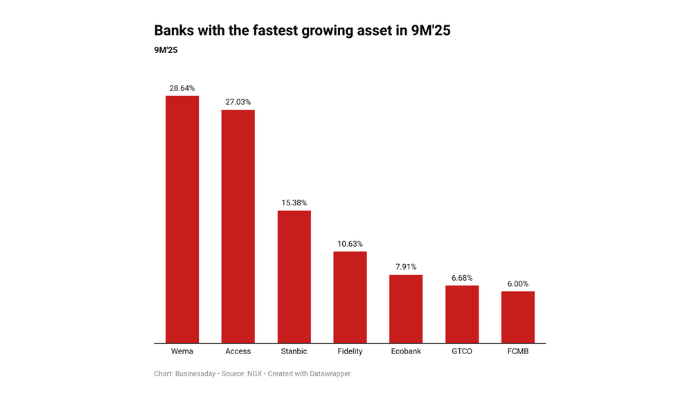

Nigeria’s banking sector has delivered an outstanding and ever-evolving performance in the nine month period of 2025. Despite thinning profits and revaluation gains drying up, several banks have distinguished themselves by recording an impressive asset growth.

According to the data obtained from the bank’s financial statement, Wema Bank topped the sector, with an asset growth of 28.64 percent to 3.9 trillion in 9M’25 from 3.0 trillion in the same period of last year.

Access Bank recorded 27.03 percent growth, Stanbic 15.38 percent, Fidelity 10.63 percent, Ecobank 7.91 percent, GTCO 6.68 percent, FCMB 6.0 percent.

Others are Zenith 2.61 percent, UBA 2.17 percent. FBN recorded a negative growth of 3.98 percent.

Bank assets refer to the total resources a bank controls and uses to generate income, including loans and advances to customers, investments in securities, cash and balances with the central bank, and other financial and physical holdings recorded on its balance sheet.

The banking sector has shown considerable resilience even though it’s undergoing a recapitalisation process that’ll see lenders shore up their capital base to weather any shocks.

Below is a breakdown of the performance

Bank Analysis

Stanbic IBTC Holdings

Stanbic IBTC Limited, a subsidiary of Stanbic IBTC Holdings Plc and part of the Standard Bank Group , reported total assets of N8.38 trillion as of September 2025, up from N7.26 trillion in the same period of 2024.

The major components include loans and advances at N2.62 trillion and cash and cash equivalents at N1.67 trillion.

Wema Bank

Wema Bank recorded the first fastest growth of 28.64 percent in terms of assets in the first nine months of 2025.

Wema’s total asset value for the period amounted to N3.98 trillion in the period under review from N3.09 trillion recorded in the same period of 2024. The primary contributors were loans and advances to customers at N1.56 trillion, followed by restricted deposit with cbn at 782.1 billion.

While it remains relatively smaller than Nigeria’s tier-1 banks, Wema Bank continues to strengthen its presence, particularly through investments in digital banking.

Access Holdings

Access Bank earns the spot of Nigeria’s largest bank by total asset size in 9M’25, reinforcing its leadership role in the country’s financial sector.

The lender records total assets in the first nine months of 2025, amounting to N52.20 trillion from N41.09 billion recorded in 2024.

Notably, loans and advances to customers dominated, amounting to N12.89 trillion, followed by investment securities at N15.25 trillion, among other key line items.

Fidelity Bank

Fidelity’s total asset value for the period amounted to N10.55 trillion, from N9.54 trillion recorded in the same period of 2024.

The major components include loans and advances at N4.84 trillion, and cash and cash equivalents at N1.30 trillion.

Read also: NCR Nigeria leads ICT stock rally on NGX in 2025

Ecobank Transnational Incorporated

Ecobank Nigeria ranks as Nigeria’s second largest by total assets in 9M’25. The value of total assets for the period under review amounted to N47.97 trillion from N44.46 trillion recorded in the same period of 2024.

Loans and advances to customers amounted to N16.78 trillion, investment securities amounted to N11.98 trillion, among other line items.

Guaranty Trust Holding Company

Guaranty Trust Holding Company’s total assets reached N16.66 trillion in the first nine months of 2025, reflecting an increase from N15.62 trillion in 2024.

Loans and advances to customers amounted to N3.24 trillion in the period under review, and cash and bank balances amounted to N5.10 trillion.

First City Monument Bank Group