…As returns hit 65.37% in 2022, 49% in 2025

Nigeria’s top mutual funds delivered inflation-beating returns for five consecutive years, underscoring the strength of diversified investment vehicles as a hedge against macroeconomic volatility.

A mutual fund pools money from several entities/individuals and invests it in a mix of assets such as stocks, bonds, or money market instruments. It is like a cooperative investment where everyone puts money together and the fund manager decides where to invest.

BusinessDay’s analysis of the 10 top-performing mutual funds from 2021 to 2025 reveals a trend of outperformance. While Nigeria’s inflation rate steadily climbed from 17.2 percent in 2021 to 33.5 percent in 2024, before dropping to 20.1 percent in 2025, the average returns from these funds proved to be more than effective countermeasures.

The funds’ average real return – the return after accounting for inflation – remained positive each year. The standout periods were 2022 and 2025, with impressive real returns of 65.37 percent and 48.81percent, respectively, demonstrating the funds’ ability to deliver substantial wealth.

The volatility of the mutual fund returns and their ability to exceed inflation can be linked to broader economic trends. The strong performance in 2023 coincides with a bullish run on the Nigerian Exchange (NGX).

Read also: Ten best-performing mutual funds in H1

The NGX All-Share Index (ASI) demonstrated an uptrend during this period, with a return of 45.9 percent. This suggests that mutual funds, which allocated a significant portion of their portfolios to equities, benefited directly from the stock market’s upward trajectory, which explains why nine of the 10 best-performing funds were equities fund.

They are: Futureview Equity Fund (86 percent), Futureview Equity Fund (64.39 percent), and FBN Nigeria Smart Beta Equity Fund (63.75 percent).

In 2022, the 10 funds – mostly bond and balanced funds – delivered an impressive average return of 84.22 percent. This strong performance was directly caused by the Central Bank of Nigeria’s (CBN) aggressive rate hikes, which raised the Monetary Policy Rate (MPR) from 11.5 percent to 16.5 percent in a bid to fight rising inflation.

This raised government securities like treasury bills and FGN Bonds. As expected, the NGX-ASI had a much more modest performance, gaining 19.98 percent for the year.

In 2022, some of the top-performing mutual funds were: ARM Fixed Income Fund (124.3 percent), Capital Express Balanced Fund, (31.26 percent), and ARM Eurobond Fund (101 percent).

In the five year span, some funds and asset management firms consistently appeared on the list of top performers, indicating their ability to adapt and maintain strong returns across various market conditions.

Stanbic IBTC Asset Management Limited dominated the list, with eight funds making it to the top performers’ list. This indicates a wide-ranging expertise across different fund types.

Asset & Resources Management Co. Ltd (ARM followed closely with seven funds, highlighting its consistent strong performance.

FBNQuest Asset Management Limited and Capital Express Asset and Trust Limited were also notable, with four and three funds, respectively.

Read also: Coral, Zrosk, Stanbic top mutual funds with over 50% returns

Capital Express Balanced Fund, Stanbic IBTC Nigerian Equity Fund, and FBN Nigeria Smart Beta Equity Fund each appeared three times on the list of top performers. Their consistent presence suggested they were resilient funds with strong management.

Other funds such as the ValuAlliance Value Fund, ARM Aggressive Growth Fund, and Stanbic IBTC Aggressive Fund (Sub Fund) were also repetitive, each appearing twice over the five years.

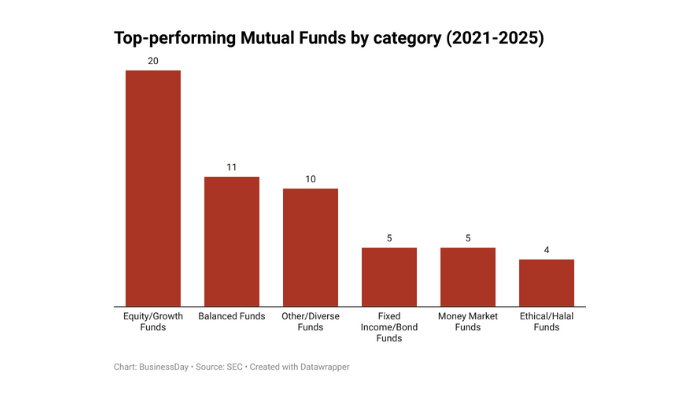

Among the top performers, the most common type of fund was the equity/growth funds. This category, which includes funds focused on growth and market indexes, made up 20 of the top-performing entries.

Interestingly, balanced funds also had 11 entries. While fixed-income and bond funds did well in specific years (like 2022), they were not as common among the top performers over the entire five-year period like equity and balanced funds.

Analysts at MoneyAfrica advise beginners to investing in mutual funds as they allow experienced professionals to manage their investments. They are also excellent options for those who lack the time to actively monitor market trends, since the fund manager handles all the day-to-day decisions.

“ Match your financial goals to the right fund type. Choose a money market fund for short-term goals, a balanced or bond fund for medium-term goals of two to five years, and an equity fund for long-term goals of five-10 years,” they said.