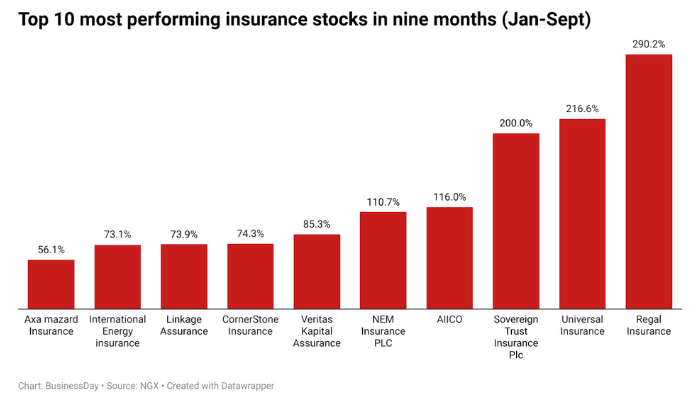

Regal Insurance, Universal Insurance, and Sovereign Trust Insurance Plc have emerged as the most performing insurance stocks in the nine months of 2025, reflecting renewed investor confidence in Nigeria’s insurance sector.

According to data from the Nigerian Exchange Group (NGX), insurance stocks closed September with the sector’s index growing by 67.7 percent year-to-date to N1,191.04, up from N710.08 recorded on January 31st. This growth outpaced several other sectors of the equities market, underscoring the renewed appetite for insurance equities.

Regal Insurance led the market, with its share price soaring 290.2 percent from N0.41 in January to N1.6 by the end of September.

Universal Insurance followed closely, rising by 216.6 percent, from N0.36 in January to N1.14 in September. Sovereign Trust Insurance Plc ranked third, appreciating by 200 percent, moving from N1.00 to N3.00 within the same period.

AIICO Insurance and NEM Insurance joined the rally, with both companies more than doubling their share value, gaining 116 percent and 110 percent, respectively.

Read also: Nigeria’s top insurers hold over N1trn ahead of recapitalisation rules

The momentum was equally felt among mid-tier players. Veritas Kapital Assurance advanced by 85 percent, while Cornerstone Insurance, Linkage Assurance, and International Energy Insurance all recorded growth of more than 70 percent year-to-date.

AXA Mansard Insurance, one of the most capitalised players in the market, rounded off the rally with a gain of 56 percent, reinforcing the broad-based recovery across the industry.

A major factor shaping sentiment is the recently passed Nigeria Insurance Industry Reform Act (NIIRA), which introduces stringent capital requirements aimed at strengthening the sector’s resilience.

Under the new regime, insurers must raise their minimum paid-up capital to N15 billion for non-life businesses, N10 billion for life, and N35 billion for reinsurance. Operators that fail to comply within 12 months risk losing their licences.

Industry experts say that while the recapitalisation exercise could lead to market consolidation through mergers, acquisitions, or exits, it will ultimately create fewer but stronger players.

Similarly, the insurance sector’s contribution to the nation’s GDP also recorded double-digit growth in the second quarter, rising to 15.7 percent compared to 7.08 percent in the first quarter.