Away from the trading halls of the Nigerian Exchange (NGX), it is important to glance through the much quieter corridors of Nigeria’s unlisted securities market. These securities are represented by their presence on the NASD Over the Counter (NASD OTC) market.

As of December 15, the NASD Share Index has appreciated by 19.9 percent, with market capitalisation expanding by N109 billion to reach N2.15 trillion. At the core of this growth has been the addition of new listings on the platform. In 2025, the market welcomed new listings from MRS Oil Nigeria, Infrastructure Credit Guarantee Company, and Paintcom.

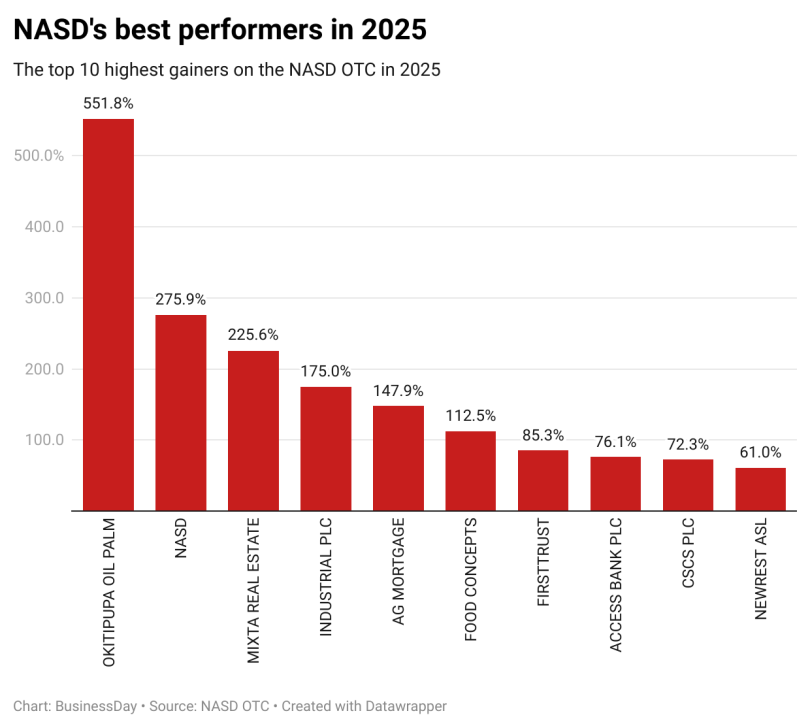

However, in this story, BusinessDay reviews some of the best-performing equities on the NASD OTC market, highlighting the top 10 exceptional performers that have delivered strong returns to investors.

The palm oil rally has spread from the NGX to the NASD, with Okitipupa Oil Palm Company emerging as the standout performer. The stock moved from N35.99 per share at the start of the year to N234.60 as of December 15. This represents a 551.8 percent surge, outperforming listed peers such as Okomu Oil Palm and Presco on the NGX.

In the first half of 2025, the Ondo-based palm oil producer generated N2.39 billion in revenue, representing a 45 percent year-on-year increase from the N1.65 billion recorded in 2024. Net income for the period rose to N992.5 million, almost double the N510.5 million posted in the corresponding period of H1 2024.

NASD Plc has also been on a strong run in 2025, delivering a 275.9 percent year-to-date gain. The company opened the year at N15.50 per share and closed at N58.30 as of December 15. NASD Plc, which has 268 shareholders, reported a profit of N408.8 million at the end of 2024, reflecting a sharp improvement from the N69.6 million recorded in the prior year.

In the first quarter of 2025 alone, NASD’s net income of N212.5 million had already surpassed half of its FY 2024 earnings.

Mixta Real Estate Plc, the property development company, began the year at a share price of N2.15 and closed at N7.00 as of December 15.

Although Mixta has lagged in terms of timely corporate disclosures, the company is behind the development of Lagos New Town. It is also the developer and promoter of residential projects such as Résidence de la Paix, Beechwood Park Homes, and Marula Park.

Industrial and General Insurance Plc (IGI) has gained 175 percent year-to-date, with its share price rising from N0.20 to N0.55 as of December 15.

The company last released its financial statements publicly in 2022, making it difficult to assess its recent financial performance. Despite this, IGI’s equity has continued to attract trading interest on the NASD platform.

AG Mortgage Bank Plc, one of the mortgage banks listed on the NASD, advanced from a share price of N0.48 at the start of the year to N1.19 as of December 15. The bank currently has a market capitalisation of N9.2 billion.

Food Concepts Plc, the parent company of Nigeria’s largest quick service restaurant chain, Chicken Republic, is also listed on the NASD. Year-to-date, the company’s shares have risen by 112.5 per cent, moving from N1.60 to N3.40 as of December 15.

The company currently has a market capitalisation of N189.9 billion, making it the third-largest listed entity on the NASD. In 2024, Food Concepts, which also owns ChopBox and PieXpress, recorded a net income of N3.3 billion after posting revenues of N92.3 billion.

FirstTrust Mortgage Bank Plc moved from a share price of 34 kobo to 63 kobo, reflecting an 83.5 per cent increase. Despite being one of the seven mortgage banks blacklisted by the National Pension Commission (PenCom), FirstTrust continues to record trading activity on the NASD.

The bank currently has a market capitalisation of N2.9 billion.

Access Bank Plc, the flagship banking subsidiary of Access Holdings, is also listed on the NASD. In 2025, the bank’s share price moved from N9.68 to N17.05, translating to a market capitalisation of N909.1 billion as of December 15. Since its listing on the NASD in 2022, Access Bank has remained the largest listed entity on the platform.

In 2024, the bank posted a net income of N749.1 billion, representing a 16 percent increase from the N645.5 billion recorded in 2023.

CSCS Plc, the central securities depository for both the NGX and the NASD, has also recorded strong growth in 2025. The stock advanced from N23.05 at the start of the year to N39.71 as of December 15.

In the first quarter of 2025, CSCS reported a net profit of N2.7 billion, marking a 29 percent increase from the N2.0 billion posted in Q1 2024. CSCS is the second-largest equity listed on the NASD, with a market capitalisation of N198 billion.

Catering company Newrest ASL Nigeria Plc has also posted solid gains in 2025. The stock moved from N28.53 at the start of the year to N45.94 as of December 15.

Newrest has been a major player in Nigeria’s in-flight catering and airport services sector since 1996, operating modern, international-standard facilities in Lagos and Abuja. The company runs in-flight catering units, airport lounges, and retail services at the Lagos and Abuja international airports. Its operations produce over 7,500 meals daily for nine airline clients and serve more than 100,000 lounge guests annually.