Royal Exchange Plc is out of the woods, as its recent restructuring has paid off with strong bottom line at the end of 2024 financial year.

The Company, which currently has base in asset management, says it has positioned its operations to deliver value in the financial services market for value creation to its teaming shareholders.

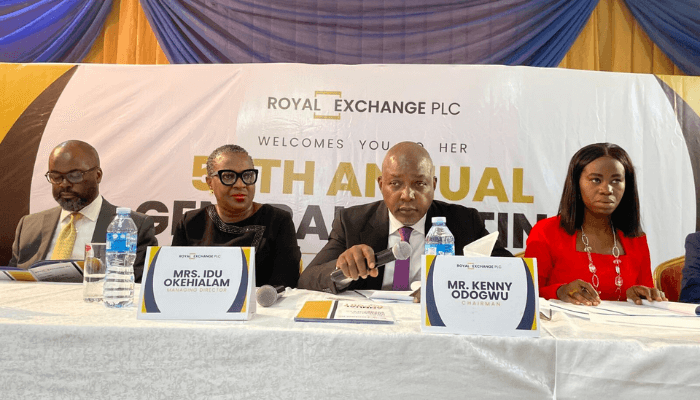

Kenny Ezenwani Odogwu, chairman of the company speaking at its 56th Annual General Meeting held in Lagos said the group delivered positive earnings performance at the end of 2024 financial year, attributing it to increased revenue from investment and share of profit in associate companies contributing to the groups overall top line.

He disclosed that Royal Exchange recorded N1.614 billion in earned revenue at the end of 2024, as against N767.4 million in 2023, a 110 percent increase.

According to him, the Company’s Profit Before Tax (PBT) was N1.029 billion, indicating a 609 percent growth from a loss position of N201.988 million in 2023, while the Profit After Tax (PAT) was N1.005 billion, as against a loss position of N206.218 million in 2023, a 588 percent increase.

Odogwu said, “Royal Exchange remains focused on two key objectives – Consolidating our asset management expertise through driving growth and profitability across our investee companies, and leveraging on our diversified portfolio which we have repositioned strategically for long-term value creation.

He said with the appointment of a female chief executive officer, Idu Okeahialam, the Company has taken a bold step to drive its growth agenda, noting that Idu has a wealth of experience across the financial services sector and expressed optimism in her capacity to lead the company to great heights, with support of all the board members.

Speaking further on its performance he said: “Royal Exchange boasts a robust liquidity position and healthy cash flow, providing flexibility for future investment opportunities.

“We remain dedicated to capitalizing on market opportunities and ultimately generating value for shareholders. This turn around was achieved despite significant global and local economic headwinds, including macroeconomic turbulence, financial market volatility, and domestic challenges-like fuel subsidy removal and foreign exchange fluctuations.

Overall, he said Royal Exchange Plc’s FY 2024 performance demonstrates a successful turnaround strategy and strong fundamentals that position the company for continued growth.

This strategic shift according to him is reflected in the positive trend of our financial performance.

He thanked other members of the board and the entire management team for their unwavering cooperation and contributions in 2024, noting that their dedication has been instrumental in achieving our goals.

To the shareholders, he appreciated their continued faith in Royal Exchange, and promised to deliver long-term value and exceeding expectations.