PZ Cussons Nigeria Plc delivered its strongest half-year performance in at least five years, swinging back to profitability as price increases, foreign-exchange gains, and asset disposals helped the consumer-goods maker weather the still-volatile environment of Africa’s largest consumer market.

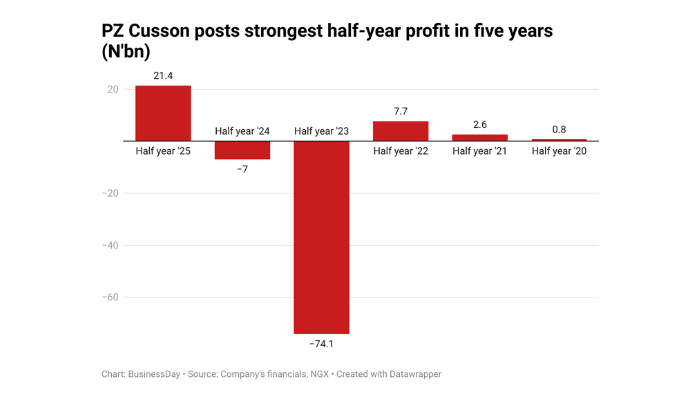

The Lagos-based company reported a N21.4 billion profit after tax for the six months ended November 30, reversing a N7.0 billion loss a year earlier, according to its recently filed unaudited results with the Nigerian Exchange.

Revenue rose 33 percent to N127.9 billion, reflecting higher product pricing and improved sales volumes across soaps, detergents, and personal-care brands.

Read also: PZ Cussons halts African exit plan as Nigeria’s economic outlook brightens

Operating profit climbed to N38.0 billion, from a N3.3 billion loss a year earlier, buoyed by an N8.6 billion foreign-exchange gain and a sharp increase in other income, which reached N14.8 billion, largely from property disposals and rental income.

The sharp upturn in PZ Cusson Nigeria’s growth trajectory came on the back of the company’s recent suspension to exit the African market, citing renewed prospects in the continent, specifically, its Nigerian subsidiaries.

That recommitment of its business operations has seen its share price rise 18 percent over the past four weeks, placing it as the 20th best performer on the local bourse, according to data analytics platform African Exchange.

The more than 120-year-old company began its profit comeback at the end of the 2025 financial period, which ended May 31, 2025, reporting a net income of N5.5 billion. That marks a sharp reversal from the N76 billion net loss recorded in FY 2024, a 107 percent turnaround.

It extended that profit streak in the first quarter of 2026 as the consumer goods maker, a subsidiary of the UK-listed PZ Cussons Group, reported a net profit of N13.49 billion for the three months ended August 31, reversing a loss of N4.65 billion in the same period last year.

Read also: PZ Cussons halts plan to sell Nigerian, other African subsidiaries

The earnings reboundin the reviewed period translated into a stronger balance sheet, with shareholders’ equity returning to positive territory at N4.1 billion, from negative equity at the end of the last financial year.

The shift is expected to boost prospects for a dividend payout after the company endured the steep devaluation of the naira and sky-high inflation. Earnings per share rose to N5.17, compared with a loss of N1.67 a year earlier.

Cash flow, however, painted a more nuanced picture. Net cash used in operating activities stood at N1.47 billion, compared with a N40.7 billion inflow in the prior year, reflecting higher working-capital absorption as inventories and receivables expanded amid rising input costs.

That pressure was partly offset by investing activities, which generated N13.9 billion in net cash, largely driven by proceeds from the sale of fixed assets. Financing cash outflows totaled N11.7 billion, as the company continued to reduce borrowings, including repayments to related parties.

Overall, cash and cash equivalents increased to N45.5 billion, up from N40.7 billion at the start of the period, supported by foreign-exchange gains on cash balances and asset sales.

Read also: PZ Cussons Nigeria swings to N13.5bn profit on 139% FX gains

While the results mark a clear turnaround after years of currency-driven losses, analysts say sustainability will hinge on the company’s ability to convert accounting profits into operating cash, manage elevated payables of N109.9 billion, and maintain margins as Nigerian consumers remain under pressure from inflation despite easing for the eighth straight month to 14.45 percent in November 2025.

PZ closed its last trading day, Wednesday, December 24, 2025, at N47.10 per share on the NGX, recording a 0.2 percent gain over its previous closing price. PZ Cussons has gained 93.8 percent since January, ranking it 52nd on the Exchange in terms of year-to-date performance.