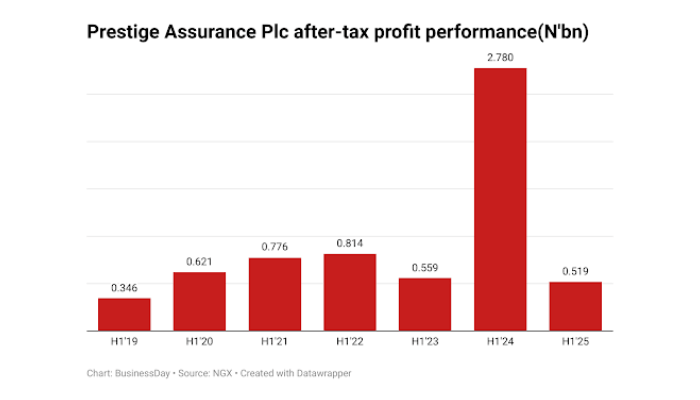

Prestige Assurance Plc, a non-life insurer, posted its weakest first-half after-tax profit in six years as cost pressures and lower investment income hit its bottom line

According to the insurer’s financial statement on the Nigerian Exchange Group, its after-tax profit for H1’2025 came in at N519 million, an 81 percent fall compared to N2.78 billion in the prior period.

The drop came despite a solid 32 percent rise in gross written premium to N15.32 billion and a 39 percent increase in insurance revenue to N12.3 billion, driven by improved marketing and prompt claims settlement.

However, insurance service expenses surged 86 percent to N10.9 billion, leading to a sharp contraction in insurance service results to just N18.3 million, a 97 percent drop from last year.

Reinsurance recoveries provided some relief, cutting net expenses by 41 percent, but were not enough to offset the higher claims and acquisition costs.

Read also: Berger Paints H1 profit rises 600% on strong revenue growth, cost efficiencies

On the investment side, Prestige saw a 47 percent slump in investment income to N1.63 billion, mainly due to lower foreign exchange gains and muted fair-value gains on financial assets

Operating expenses further squeezed margins, with management expenses rising 53 percent to N947.96 million, reflecting higher staff costs, professional fees, and office expenses

As a result, profit before tax dropped 82 percent to N577.3 million, while earnings per share fell to 4 kobo, down from 21 kobo a year ago

The insurer with over seventy years’ experience in Nigeria has its core areas of business, including motor, marine, bond, engineering, fire, aviation, oil and gas, and general accident.

The company is known for providing expertise, especially in high-risk businesses such as aviation, marine, and oil and gas.

Prestige Assurance was incorporated on 6 January 1970. The company is a subsidiary of New India Assurance Limited, which was established on 18 August 1918.

Read also: United Capital to pay N5.4bn interim dividend as H1 profit soars to N11.89bn

New India Assurance Company owns a majority 78.3% stake in Prestige Assurance.

Prestige’s total assets grew 12 percent year-on-year to N42.7 billion, supported by higher reinsurance assets and debt instruments, while shareholders’ funds rose 3 percent to N19.9 billion

A new insurance reform bill signed into law by President Bola Tinubu proposes that the minimum capital required for life, non-life, and reinsurance businesses be raised to N10 billion, N15 billion, and N35 billion, respectively.

The company ended the second quarter of 2025 with a strong liquidity position, as net cash generated from operations and investment activities drove a N2.4 billion boost in cash and cash equivalents, despite an 81 percent drop in profit after tax.

Operating activities produced N809 million net cash inflow, though this was 30 percent lower than the N1.16 billion recorded in the same period of 2024

Premium receipts from policyholders rose to N14.79 billion, but higher reinsurance premiums (N7.69 billion) and claims payments (N6.08 billion) absorbed much of the inflow, leaving a relatively modest net operating surplus.

Read also: BUA Foods hits N10.3trn market cap after record H1 profit

Investing activities were the major source of cash. Prestige posted a N1.59 billion net inflow, reversing a N1.54 billion outflow in 2024. This was supported by N2.40 billion in proceeds from the redemption of debt instruments, robust interest income of N996.1 million, and N265.3 million in dividends.

Financing activities were neutral, with only N0.85 million spent on lease interest repayment and no dividends paid during the period

As a result, cash and cash equivalents closed at N4.16 billion, more than double the N1.76 billion at the start of the year, providing Prestige with a stronger buffer to meet claims and investment opportunities going into the second half of 2025.

Prestige Assurance stock listed on the NGX is up 73 percent year-to-date and has a market capitalisaton of N25.04 billion.