…As industry, agric shine

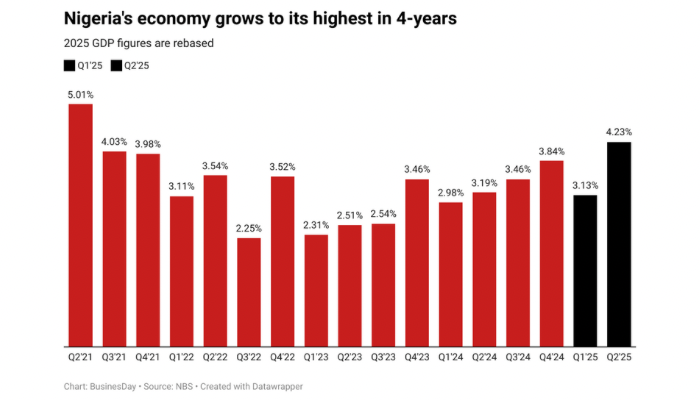

Nigeria’s economy expanded at its quickest pace in four years in the second quarter (Q2) of 2025, powered by a strong rebound in oil output.

The gross domestic product (GDP) grew by 4.23 percent in real terms from a year earlier, the National Bureau of Statistics (NBS) said in its quarterly report Monday. That compares with 3.48 percent in the same period of 2024 and marks the fastest growth since mid-2022 (Q2 of 2022).

The turnaround was anchored by the oil sector, which surged 20.46 percent year-on-year, more than double the growth recorded a year earlier.

Nigeria pumped an average of 1.68 million barrels per day (mbpd) during the quarter, up from 1.41 mbpd a year ago and 1.62 mbpd in the first quarter (Q1) of 2025.

According to the NBS report, the oil sector contributed 4.05 percent to the GDP, higher than 3.51 percent in Q2 of 2024.

The broader industry sector, which includes oil, manufacturing and construction, expanded by 7.45 percent, compared with 3.72 percent a year earlier. That lifted its share of GDP to 17.31 percent from 16.79 percent.

Agriculture grew by 2.82 percent, slightly stronger than the 2.60 percent posted in the same quarter of 2024, while services rose 3.94 percent, broadly steady from 3.83 percent a year earlier.

The improved performance reflects momentum in Nigeria’s key revenue source after years of underproduction caused by theft, pipeline vandalism, and operational bottlenecks. A clampdown on illegal tapping, coupled with improved security in oil-producing regions, has boosted supply and supported government revenue.

Despite the headline growth, economic conditions remain tough for households and businesses. Inflation is still over 20 percent, even though it has eased for the fifth consecutive month, and borrowing costs are elevated after a series of interest-rate hikes.

President Bola Tinubu’s administration has made the restoration of oil output a priority as part of broader reforms, which also included fuel subsidy removal and exchange-rate unification.

Higher crude volumes are expected to ease fiscal pressures, though analysts caution that non-oil sectors will need to do more heavy lifting for long-term resilience.

The latest report underscores Nigeria’s dependence on crude oil, which continues to shape its economic trajectory, even as policymakers press ahead with diversification, analysts say.

The non-oil sector remained the top contributor to the GDP, contributing 95.95 percent in real terms in Q2.

Trade’s year-on-year growth stood at 1.29 percent in real terms, which was 0.53 percent points lower than the rate recorded in the previous year at 1.82 percent, and 0.49 percent points lower than in the preceding quarter at 1.78 percent growth rate.

“Trade’s contribution to GDP was 18.28 percent, lower than the 18.81 percent it represented in the previous year, and higher than the 18.21 percent recorded in the first quarter of 2025,” NBS said.

Read also: Nigeria’s oil GDP slows to 6% in Q2 2025

Positive effects of FG policies

Tajudeen Ibrahim, head of research at Chapel Hill Denham, said the growth was a result of deliberate government policies aimed at boosting output.

“Oil sector growth was driven by the deliberate efforts of the government to ensure that our output improves. That improvement came from two main factors: changes in the leadership of the NNPC and an improvement in the security of oil installations,” he said.

Ibrahim also pointed to the progress in oil refining, which is technically classified as part of the manufacturing sector.

“The oil refining sub-sector also saw an improvement largely because of an increase in local production, and local production is being led largely by the Dangote Refinery,” he explained.

Oluwambepelumi Olanubi, executive director of Kingsgate Advisors Institute, noted that the growth in the industrial sector is tied to the stability of supply.

“Another important reason I think the industrial sector is being reported as the main driver is the relatively stable supply environment. Stability in supply reduces the pressure on industries, manufacturers, and companies. It makes it easier to plan whether in the short, medium-, or long term,” Olanubi said.

“It also improves access to raw materials, which is critical for sectors like pharmaceuticals and manufacturing generally. This stability supports production activities and helps sustain economic growth.”

Harvest season boosts agric GDP

Experts have attributed the 2.82 percent growth in agric growth to the current harvest season, which has increased food supply.

The sector’s growth in Q2 2025 was three percentage points higher than the 0.07 percent recorded in Q1 and 0.2 percentage points above the 2.6 percent posted a year earlier.

Abiodun Olorundero, an agribusiness expert and managing partner at Prasinos Farms, told BusinessDay that food prices have begun easing, with farmers in food-producing states harvesting.