Nigeria’s oil sector expanded 5.84 percent in the third quarter of 2025, driven by higher crude production that pushed output to an 11-month high as Africa’s largest oil producer works to reverse years of decline and infrastructure neglect.

The oil sector growth, while below the 20.46 percent surge recorded in the second quarter, helped lift Nigeria’s overall gross domestic product by 3.98 percent year-on-year in the three months through September, according to data released Monday by the National Bureau of Statistics. The economy grew 3.86 percent in the same period last year.

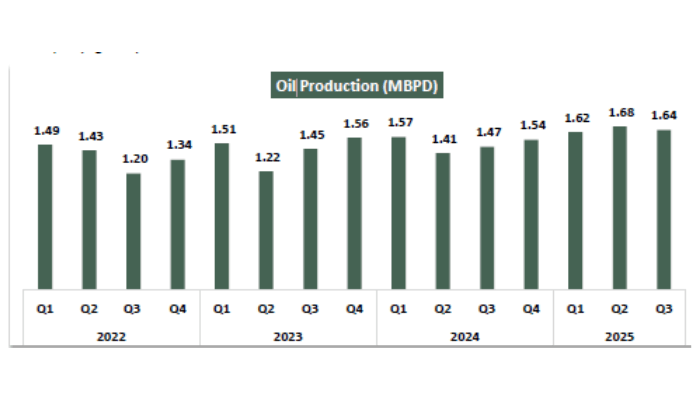

Aggregate crude oil production averaged 1.64 million barrels per day during the quarter, marking an 11.6 percent increase from 1.47 million barrels per day in the third quarter of 2024, the statistics office reported. However, output remained below the 1.68 million barrels per day achieved in the previous quarter, signaling ongoing challenges in sustaining production gains.

Read also: Oil sector drives Nigeria’s GDP growth to 4-year high

“The oil sector’s contribution to real GDP increased marginally to 3.44 percent from 3.38 percent in the same period of 2024,” the NBS said in its quarterly GDP report. The sector’s modest share underscores Nigeria’s heavy dependence on non-oil activities, which contributed 96.56 percent to total output and grew 3.91 percent during the period.

The improved oil performance comes amid President Bola Tinubu’s efforts to restore Nigeria’s position as a major global oil supplier after years of production setbacks from pipeline vandalism, theft, and chronic underinvestment. The government has set an ambitious target of reaching 3 million barrels per day, though experts say that goal remains distant given persistent infrastructure constraints.

Nigeria’s oil sector has struggled with decades of mismanagement and neglect of key infrastructure, particularly its state-owned refineries. The Port Harcourt refinery complex, which received $1.5 billion for rehabilitation, was shut down for maintenance in May 2025, just months after claims it had resumed operations. The facility, along with refineries in Warri and Kaduna, has consumed more than $18 billion over two decades without achieving sustained production, according to parliamentary investigations.

The non-oil sector remained the engine of Nigeria’s economy, with agriculture posting its strongest quarterly growth in over a year at 3.79 percent, up from 2.55 percent in the third quarter of 2024.

The statistics bureau attributed the improvement to better harvests and more stable weather conditions. Services, which account for 53.02 percent of GDP, expanded 4.15 percent, while industry grew 3.77 percent.

In nominal terms, Nigeria’s GDP jumped 18.12 percent year-on-year to N113.6 trillion, reflecting elevated inflation that continues to pressure household incomes despite economic expansion. Real GDP stood at 57.03 trillion naira, up from 54.85 trillion naira a year earlier.

Read also: Nigeria’s oil GDP slows to 6% in Q2 2025

The International Monetary Fund revised Nigeria’s 2025 growth outlook upward in October, projecting 3.9 percent GDP expansion based on expectations of higher oil production and stronger investor confidence. The fund cited a more supportive fiscal stance as a key driver of the improved forecast, which represents a 0.5 percentage point increase from earlier projections.

Quarter-on-quarter, the oil sector contracted 5.53 percent, suggesting volatility in production levels remains a concern. Mining and quarrying activities saw a nominal decline of 41.08 percent year-on-year due to fluctuations in crude petroleum and natural gas output, though metal ores and other minerals recorded strong gains.

Analysts say the third-quarter data reflect broad-based improvements across the economy, though sustaining momentum will require addressing persistent challenges in the energy sector and curbing inflation that erodes purchasing power.

The private-sector Dangote refinery, which has been ramping up operations, has provided some relief from Nigeria’s dependence on imported petroleum products. With a capacity of 650,000 barrels per day, the facility has helped stabilise fuel markets and reduce foreign exchange pressures, compensating for the continued dysfunction of state-owned refineries.