At a statutory rate of 30 percent, Nigeria’s Company Income Tax (CIT) hovers significantly above the global average combined statutory corporate tax rate, which currently sits at around 23.5 percent.

According to the Nigeria Tax Act, 2025, Companies Income Tax (CIT), also known as corporate tax, is a tax levied on a company’s income. The tax is charged at 30 percent of a company’s profit.

For a country aggressively seeking Foreign Direct Investment (FDI) to stimulate growth, this headline figure presents a critical, two-pronged question: Is Nigeria’s tax policy a competitive burden, or are its tiered rates and incentives enough to soften the blow for investors?

However, Taiwo Oyedele, chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, has said that there are plans to drop the corporate income tax rate to 25 percent, from 30 percent currently stated in the new tax act.

“ We had written the CIT review for 25 percent into the law, but the governors refused it, so we found a way to add it to the law with a condition to get approval of the governors under the National Economic Council (NEC),”

“ We have written to NEC, and are hoping we can put all of this behind us by the time we finalise the tax law before the end of December, or by early 2026, before people have to start paying this tax,” Oyedele said.

He said this means that companies that are listed will become more profitable, even the unlisted ones as well.

Read also: FDI into Nigeria plunges 70% in Q1 as investors favour short-term bets

The African Peer Review

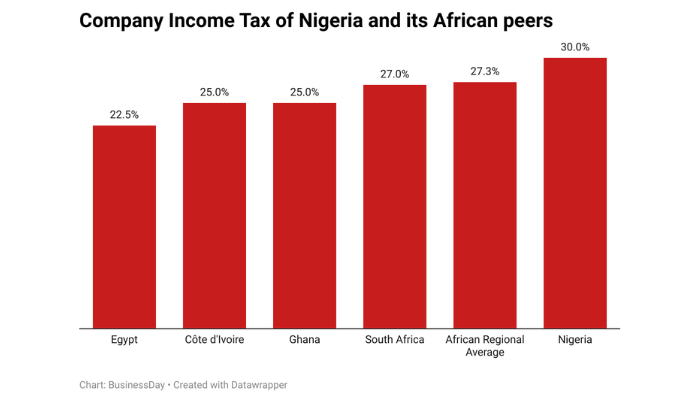

Nigeria’s 30 percent corporate tax rate places it among the higher corporate tax jurisdictions on the continent, matching peers like Kenya (30 percent) and Zambia (30 percent) and surpassing regional economic rivals like Ghana (25 percent), South Africa (27percent), and Egypt (22.5 percent).

While Nigeria’s headline rate is high, its overall effective tax burden is further magnified by additional levies. Companies are to pay the 30 percent CIT on their assessable profits, and an additional 4 percent development tax.

This stacked burden effectively pushes the tax drag on large, profitable enterprises well over the 30 percent mark, directly impacting investor sentiment and the immediate profitability of large-scale projects compared to nations with fewer secondary taxes.

The Global Trend and Nigeria’s Resistance

Globally, the long-term trend has been a consistent decline in statutory corporate tax rates as countries compete for mobile capital. The average statutory CIT rate has dropped dramatically from over 40 percent in 1980 to approximately 23.5 percent today, according to the Tax Foundation organisation, an international research think tank based in Washington. This shift by countries was to attract foreign direct investment, to retain corporate headquarters, and signal business-friendliness.

At the 30 percent mark, Nigeria runs counter to this global push, and even more significantly, it positions the country in an uncertain space regarding the OECD’s 15 percent Global Minimum Tax (GMT) framework.

For Medium and Small Enterprises (SMEs), this structure makes Nigeria remarkably tax-friendly, especially the 0 percent rate for small companies. This policy is a clear strategic attempt to foster local entrepreneurship and formalize the massive informal sector.

The Fiscal Necessity: Why the Rate Must Stay High (For Now)

Policy analysts argue that the high headline CIT is a symptom of a larger fiscal ailment: Nigeria’s chronically low tax-to-GDP ratio.

Despite recent re-computations, Nigeria’s tax-to-GDP ratio sits around 10.86 percent (2021 data), significantly lagging the African average of 15.6 percent.

Revenue from Company Income Tax (CIT) grew by 37.9 percent year-on-year (YoY), reaching N4.76 trillion in the first half of 2025 (H1’25), up from N3.45 trillion in H1’24, according to the National Bureau of Statistics (NBS).

The N4.76 trillion collected from CIT in the first half of 2025 already accounts for 11.36 percent of the entire N41.91 trillion revenue target for the fiscal year. If the revenue trend continues in the second half of the year (H2’25) at the same rate, the projected annual CIT revenue would be approximately N9.52 trillion. This alone would cover about 22.7 percent of the total budgeted revenue

“The government is fiscally constrained and must rely heavily on the few large, formal businesses that are already within the tax net,” notes a tax partner at a Lagos-based consulting firm. “Lowering the 30% rate now, without successfully broadening the tax base to include more of the informal economy, would simply exacerbate the revenue crisis.”

Nigeria’s 30 percent CIT rate is a direct trade-off between the immediate need for government revenue and the long-term goal of attracting competitive FDI.

Foreign Direct Investment (FDI) into Nigeria fell sharply by 70.06 percent in the first quarter of 2025, dropping to $126.29million from $421.88million in the previous quarter, according to new data from the National Bureau of Statistics (NBS). Equity investment, the largest component of FDI, fell 70.36 percent to $124.31 million.

For large multinational corporations, the high headline rate, coupled with the development levy, makes Nigeria less attractive than competitors like South Africa, Ghana, and Egypt.

Global companies often choose South Africa as their regional base. Around 50 percent of the 400 foreign multinationals in Africa are headquartered here.

The reliance on Pioneer Status Incentives (PSI)—which grant temporary tax holidays—is often seen by investors as a discretionary and complex substitute for a globally competitive, stable statutory rate.