Nigeria emerged as Africa’s trade surplus leader in the first six months of 2025, posting a positive balance of $8.4 billion. This stands as the largest surplus recorded on the continent during the period and underlines the country’s resilience in foreign trade despite persistent structural challenges.

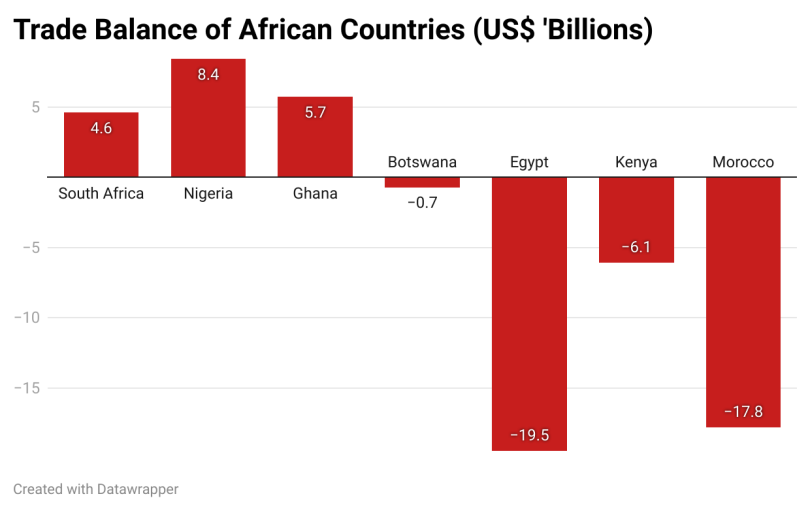

Between January and June, Nigeria exported products worth N43.3 trillion, or about $28.9 billion, while importing goods valued at N30.7 trillion, or $20.5 billion. The result was a net trade advantage unmatched by other African peers. Ghana followed in second place with a surplus of $5.7 billion, while South Africa came in third with $4.6 billion.

Ghana’s exports during the period totalled $13.97 billion, with imports amounting to $8.2 billion. South Africa, though posting a smaller surplus, recorded far larger trade volumes, exporting goods worth $57 billion and importing $52.4 billion.

Not all of Africa’s top economies fared positively. Egypt ended the half-year with a substantial deficit of $19.48 billion, while Morocco followed with a $17.81 billion deficit. Kenya also reported a negative balance of $6.1 billion. Algeria, with incomplete data for the second quarter, still reported a $710 million deficit in the first half. This means that among Africa’s ten largest economies, only Nigeria, Ghana, South Africa, and Angola managed to maintain a trade surplus. Ethiopia, on the other hand, did not publish trade statistics for the period.

Despite outperforming South Africa in terms of trade balance, Nigeria’s total trade volume of $49.4 billion was just 45 percent of South Africa’s. It also trailed the activity of Egypt and Morocco, which both recorded trade volumes of about $70 billion in the same period. This gap highlights Nigeria’s narrower export base and limited economic complexity compared to some of its peers.

Crude oil remained the backbone of Nigeria’s trade. At $16.6 billion, oil accounted for nearly 58 percent of total exports. However, the country also showed progress in diversifying its exports. Agricultural goods brought in about $1.97 billion, up 33 percent from $1.49 billion in the first half of 2024.

Non-oil exports reached $4.14 billion, representing about 14 percent of total export earnings. The standout products included urea, which generated $410.5 million, and cashew nuts, which earned $235 million.

On the import side, petroleum products continued to weigh heavily. Premium Motor Spirit and related refined fuels accounted for $2.7 billion, about 26 percent of all imports. Durum wheat also featured prominently, with imports valued at N503 billion in the six months under review.

South Africa’s export strength rests largely on its mineral wealth and manufacturing base. In the first half of 2025, mineral products such as aluminium, platinum, and gold contributed about $14.2 billion to exports, while precious metals added another $10.7 billion. The country also exported $7.9 billion worth of vehicles, aircraft, vessels, and other transport equipment, alongside about $4 billion in heavy machinery.

On the import side, mineral products also dominated, with South Africa purchasing nearly $9.8 billion worth during the same period.