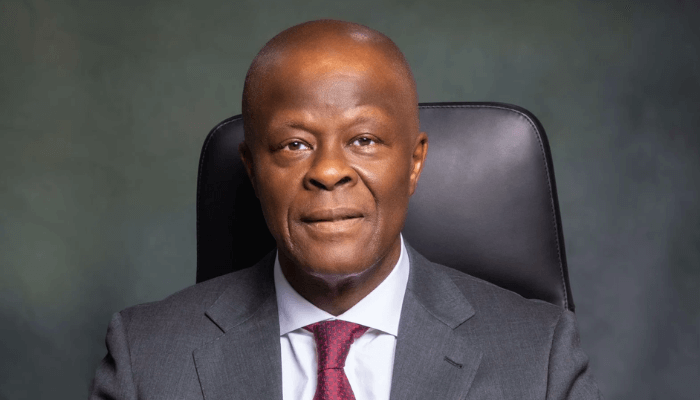

Wale Edun, minister of finance & coordinating minister of the economy, has said Nigeria is entering a critical phase of economic consolidation as recent reforms begin to restore macroeconomic stability and create the conditions for an investment-led growth push.

Speaking at the launch of the 2026 macroeconomic outlook by the Nigerian Economic Summit Group (NESG), Edun said the country has reached the threshold of stabilisation and consolidation after years of economic distortions, adding that policy discipline and consistency will now determine whether recent gains translate into sustained growth, job creation, and poverty reduction.

“Nigeria cannot afford to pause, cannot afford to retreat, and cannot afford reform fatigue,” Edun said. “Success at this stage will determine whether stability becomes sustained growth, whether growth delivers productive jobs, and whether poverty is reduced at scale.”

Read also: NESG sees Nigeria’s inflation hitting single-digit by 2029

According to Edun, data presented by the Nigerian Economic Summit Group (NESG) indicate a downward trend in poverty, which he interprets as a target to lift 100 million Nigerians out of poverty before the end of the decade.

He said achieving this ambition requires positioning Nigeria as a competitive regional and global economy capable of feeding itself, meeting its housing needs, and powering industrial activity.

The finance minister said Nigeria’s economy has shifted away from a system defined by distortions, arbitrage opportunities, and rent-seeking, particularly in the foreign exchange market, towards a more transparent and competitive environment.

“For a long time, young people felt the best option was to look for distortions to exploit,” Edun said. “Access to cheap foreign exchange or value-chain arbitrage was the game. That is no longer the case.”

With exchange rate reforms narrowing arbitrage opportunities, Edun said incentives are now aligned toward productivity, entrepreneurship, and investment, especially in technology and services that can be exported digitally.

He highlighted ongoing investments in digital infrastructure, including plans to roll out about 90,000 kilometres of fiber-optic cables in partnership with development institutions, as part of efforts to integrate Nigeria’s youthful population into global value chains.

Edun said Nigeria’s reform efforts are beginning to improve the country’s standing with international partners and investors. He noted improved engagement with institutions such as the World Bank and confirmed that Nigeria has recently exited a high-risk classification in Europe, a move expected to ease cross-border business and capital flows.

“These are signals that Nigeria is being taken seriously again as a market,” he said.

Read also: NESG projects naira to trade at N1,480 with $52bn reserves

According to Edun, real GDP growth has exceeded 3 percent, despite tight monetary conditions driven by the fight against inflation. While higher interest rates have increased borrowing costs for businesses and government, he said they are a necessary part of restoring price stability and investor confidence.

On fiscal performance, Edun acknowledged ongoing challenges, including debt servicing pressures and revenue shortfalls—particularly from oil and gas—but said discipline and transparency have improved.

He said Nigeria’s debt profile has been clarified following the recognition of previously unreported “ways and means” financing, noting that much of the recent increase in debt stock reflects exchange rate adjustments rather than new borrowing.

Read also: World Bank sees Nigeria’s economy growing at fastest pace in over a decade

At the subnational level, Edun said reforms to fiscal federalism and transparency have strengthened state finances, with several states now running budget surpluses of around 3 percent, enabling higher spending on health, education, and social services.

Capital expenditure performance in 2024 reached about 85 percent, driven by the completion of priority projects after the budget was extended, he added.

2026 Outlook

Looking ahead, Edun said the government is targeting medium-term growth of about 7 percent per annum, more than double population growth, to support meaningful poverty reduction and build a $1 trillion economy by the end of the decade.

For 2026, the economy is projected to grow by 4.68 percent, with inflation averaging 16.5 percent and the exchange rate stabilising around N1,400 to the dollar, based on assumptions in the Medium-Term Expenditure Framework approved by the National Assembly.

Olusegun Omisakin, NESG’s chief economist and director of research and development, during his keynote address, said the country was no longer in an emergency phase, creating an opportunity to maximise the benefits of recent reforms.

“The challenge now is that we are no longer in a state of crisis, as referenced by the chairman. The present situation allows us to look critically at how we optimise the gains we’ve seen so far,” Omisakin said.