Nigeria’s new tax reform now enforces compliance on Value Added Tax (VAT) payment on digital payments, SaaS and online services – which will significantly boost tax revenue.

The new system mandates e-invoicing and real time VAT reporting in assessment of taxes.

“These tax provisions represent a digital fiscalisation milestone,” said Paulinus Iyika, assistant director, Federal Inland Revenue Service (FIRS) in a linkedIn post.

In Q2 2025, about 22.3 percent of all VAT came from foreign sources from digital services to foreign companies selling to Nigerians and cross-border transactions, which means this could be an untapped potential for more revenue for the government and that’s what this tax reform is hoping to drive.

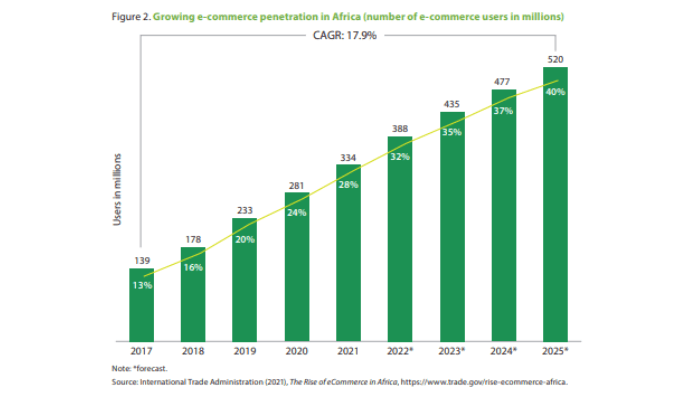

The opportunity is large as the OECD data shows that the number of African consumers shopping online grew by an annual average of 18 percent between 2014 and 2018 outpacing the global average of 12 percent. The report projects that the continent’s online shoppers will almost double between 2020 and 2025 to reach over 500 million consumers, with 40 percent of Africans expected to shop online by 2025, up from 13 percent in 2017.

This means that if VAT compliance is enforced, there will be an increase in VAT remitted to the FIRS, “expanding VAT to digital payments, SaaS, and online services will significantly boost tax revenue.

Read also: Is the withholding tax on fixed-income a new law?

The digital economy has grown rapidly while remaining largely untaxed; this reform closes that gap and captures a fast-expanding revenue base without raising rates on traditional sectors”, said Onyinye Afolabi, a principal consultant at Techpoint finance.

Earlier this year, the FIRS disclosed that Nigeria collected N600billion in VAT from foreign service providers, evidence of rising digital consumption and improved compliance among NRCs. The surge underscores the increasing importance of digital services in Nigeria’s economy and the government’s push to ensure that both local and foreign operators contribute fairly to tax revenues

What this means for companies based in Nigeria is that they must charge VAT on SaaS subscriptions, digital tools, and online services and they must remit VAT to FIRS monthly and for foreign companies with significant economic presence such as Netflix, Meta and Google must charge VAT to its Nigerian users or the local intermediary remits the VAT, for digital payments any fee on digital transactions is now vatable(applicable to only service fee), marketplaces must also charge VAT on commissions, service fees, delivery charges, ads, promotions.

The reform is expected to boost government revenue and raise compliance levels among digital-facing businesses. “This period calls for structured adaptation, ethical practice, agile thinking, and proactive capacity building, not reactive desperation” said Mutiat Abiola, founder, Elevate Insight Partners, in a recent article titled ‘How agile strategy, compliance, and ethical finance will define 2026’

The reform may also increase prices for consumers as platforms adjust to VAT obligations. Failure to file VAT returns now attracts a penalty of N100,000 for the first month and N50,000 for each subsequent month.