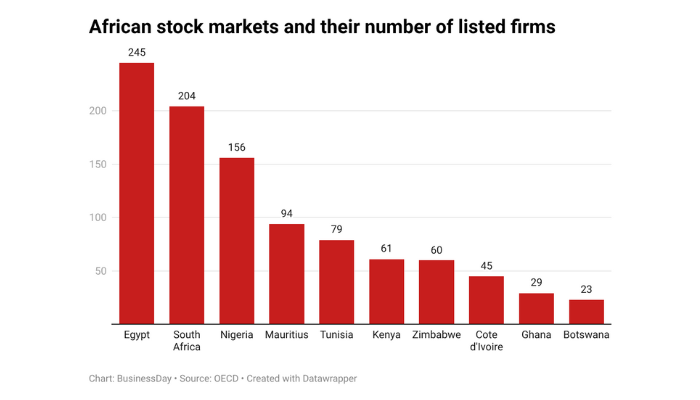

Nigeria’s stock market has been ranked as the third-highest in Africa by the number of listed companies, according to the Organisation of Economic Co-operation and Development (OECD).

The Nigerian Exchange (NGX) hosts 156 listed firms, trailing behind Egypt’s Egyptian Stock Exchange (245) and South Africa’s Johannesburg Stock Exchange (204), and has a market capitalisation of $33 billion, per OECD’s Africa Markets Report 2025.

“South Africa has the most developed public equity market, accounting for 60% of the region’s market capitalisation. Its market capitalisation to GDP ratio (84%) is not only significantly higher than that of other African countries but also exceeds that of EMs, which stands at 61%,” OECD said.

“At the country level, only a few markets stand out in terms of size and activity. In addition, the median size of South African listed companies is markedly larger compared to the figure for EMs and globally, with a median market capitalisation of USD 195 million. Morocco, Egypt, and Nigeria also have relatively large markets, together accounting for 15% of the region’s market capitalisation. Together, these three markets represent almost half of all listed companies in Africa,” the Paris-based think tank added.

Read also: NGX Group: Steering market to world-beating 51.19% rally in 2025

Other countries in the top ten include Mauritius (94), Tunisia (79), Kenya (61), Zimbabwe (60), Cote d’Ivoire (45), Ghana (29), and Botswana (23).

“In contrast, stock exchanges in Tanzania, Ghana, Botswana, Uganda, Zambia, and Namibia remain very small, each listing between 12 and 29 companies. Their market capitalisation is also modest, ranging from 5% to 20% of their respective GDPs.”

The data is both broad and strategically significant. Home to sector giants such as banking, telecommunications, manufacturing, and energy, NGX also provides a platform for blue-chip companies, including MTN Nigeria and BUA Foods, becoming a critical vehicle for domestic wealth creation and institutional investment.

As of 2026, the bulls are still running. Nigeria surpassed N100 trillion market capitalisation, closing at N101.8 on 5 January 2026. Temi Poopola, group managing director/CEO, Nigerian Exchange Group (NGX), said the milestone “reflects the market’s growing depth, resilience, and capacity to respond positively to improving macroeconomic conditions and structural reforms.”

Popoola has said the Group intends to sustain the momentum by deepening market infrastructure, leveraging partnerships and technology, as they position Nigeria’s capital market as a leading destination for long-term investment in Africa.

Analysts expect a continuous momentum. In a recent report, the Central Bank of Nigeria said, “The capital market is expected to remain bullish in 2026, supported by recapitalisation exercise, rising investor confidence, and other policy measures aimed at fostering growth.”

Read also: NGX reveals results of Full-Year review of Market Indices

According to the report, some of the key measures that are expected to spur new entrants into the capital market include the technology strategy and collaborations between the NGX and Federal Ministry of Industry, Trade & Investment, the zero per cent capital gains tax (CGT) for small businesses, and the N150 million exemption for retail investors. The increase in trading activities attracted more foreign portfolio inflows, reflecting growing confidence in the market, while improved foreign exchange (FX) liquidity and regulatory clarity continued to bolster foreign investor appetite.

Coronation Research analysts concurred in their January 5 notes to investors, “We expect positive sentiment to persist in the near term as the new year opens, supported by portfolio rebalancing, bargain hunting in fundamentally strong names, and continued positioning ahead of full-year earnings releases and dividend announcements.”

United Capital research analysts expect the market to be more selective. “The equity market is expected to remain positive but selective, supported by improving confidence and strong momentum in consumer goods, banking, and insurance stocks.” Still, gains are likely to be moderate as investors take profits after recent advances and as they await fresh catalysts.