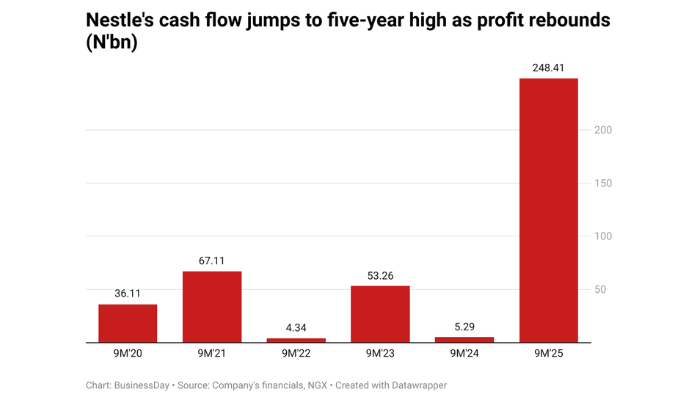

Nestlé Nigeria Plc recorded its strongest operating cash flow in at least five years, as operational recovery and tighter working capital control helped push the company back to profitability after a steep loss the previous year.

Net cash generated from operations surged to N248.41 billion in the nine months to 2025, from N5.29 billion in the same period of 2024, reflecting stronger collections from distributors, inventory optimisation, and higher naira revenues following repeated price adjustments across key product lines.

The rebound coincided with a sharp turnaround in earnings. Profit for the period rose to N72.48 billion, compared with a loss of N184.27 billion a year earlier, supported by improved operating performance and reduced pressure from foreign-exchange losses.

The return to profitability was supported by a stronger-than-expected FX gain, which jumped to N34.83 billion from N3.76 billion in the corresponding period last year, as the naira’s appreciation within the reviewed period cushioned earnings pressure.

The Swiss-headquartered food manufacturer had been squeezed by the steep devaluation of the naira that drove up costs for imported raw materials and triggered sizable FX revaluation losses. While currency volatility continues to weigh on margins, the latest results suggest the company’s core business has begun to stabilise.

Operating cash flow — a measure of the cash generated from day-to-day business — often provides a clearer picture of corporate health than net income during periods of high FX turbulence, when non-cash accounting charges can obscure operational gains.

Analysts say the cash rebound enhances Nestlé’s financial flexibility, strengthening its ability to reduce debt, fund capital expenditure internally, and sustain shareholder payouts.

The improvement in cash flow helped the food maker repay an additional $20 million of its inter-company foreign currency (FCY) loan in the third quarter, bringing total repayments to $40 million year-to-date.

Read also: Nestle hits N72.5 billion profit in nine months as higher prices boost revenue

This deleveraging strengthened the company’s FCY position and improved its overall leverage profile. The combination of these repayments and the Naira’s appreciation during the quarter resulted in a significant FX gain of N20.8 billion, marking a sharp reversal from prior translation losses and reflecting the positive impact of reduced foreign currency exposure amid a stronger domestic currency on earnings and balance sheet resilience.

“The sharp improvement in free cash generation shows that Nestlé has regained control of its operating cycle,” a Lagos-based consumer-goods analyst told BusinessDay. “That resilience is crucial in a sector still grappling with imported inflation and currency risk.”

The financial statement reveals that revenue grew by 33 percent to N884.5 billion from N665.4 billion in 2024, while operating profit rose by 63.6 percent to N181.3 billion, up from N110.8 billion.

Dividend payouts unlikely despite return to profitability

Despite returning to profitability, Nestle may likely not declare dividend payouts next year as it reported a negative shareholders’ equity balance of N19.7 billion, primarily reflecting accumulated FX losses from previous periods.

Analysts at CardinalStone, however, expect this position to turn positive by year-end, closing FY’25 at an estimated N13.8 billion, supported by sustained profitability and FX gains recorded during the year.

“However, despite this anticipated improvement, retained earnings are projected to remain negative, which, in our view, limits the company’s capacity to declare dividends in FY’26.”