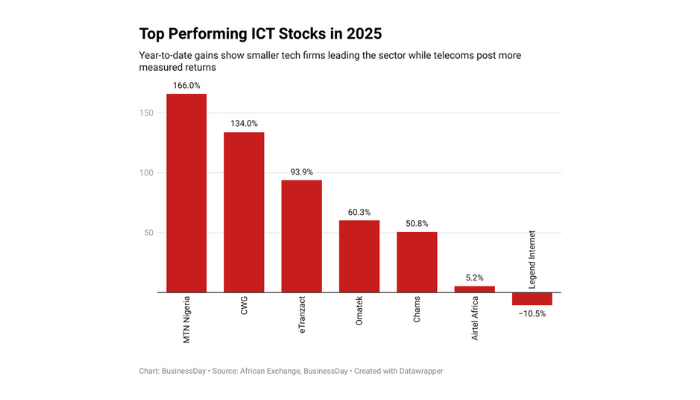

ICT stocks emerged as some of the most dynamic performers on the Nigerian Exchange in 2025, producing a wide range of returns across the sector. Year-to-date share price data show that smaller technology and mid-cap firms dominated the top of the performance table, while large telecom operators posted more measured gains. Investors have rewarded specific stocks with strong fundamentals or market interest, rather than the sector as a whole.

NCR Nigeria

NCR Nigeria emerged as the best-performing ICT stock on the NGX in 2025, posting a year-to-date gain of 1,354 percent. The stock opened the year at N5 and surged throughout 2025, recording the highest price appreciation among all ICT stocks and ranking first on the exchange overall. Despite a relatively small market capitalisation of N7.85 billion, the stock captured investor attention, highlighting the outsized returns possible within smaller technology firms.

MTN Nigeria

MTN Nigeria was the strongest-performing large-cap ICT stock in 2025, gaining 166 percent year-to-date. The telecom operator rose from N200 to N531.70 per share over the period. With a market capitalisation of N11.2 trillion, MTN ranked among the strongest gainers on the NGX, demonstrating sustained investor appetite despite its size. Its performance placed it well ahead of most other telecom peers in the sector.

CWG

CWG recorded a 134 percent year-to-date gain, rising from N7.70 to N18 per share. The stock ranked among the top-performing mid-cap ICT names on the exchange, reflecting steady investor demand throughout 2025. The company’s share price growth demonstrates that mid-sized ICT firms can achieve substantial returns when market interest is strong.

Read also: Forty stocks that more than doubled investors’ wealth in 2025

eTranzact International

eTranzact International posted a 93.9 percent year-to-date gain. The stock began the year at N6.50 and rose steadily over the months, placing it among the better-performing ICT equities on the NGX in 2025. Its strong performance highlights investor confidence in the payments and transaction processing segment, which continues to attract attention for its growth potential.

Omatek Ventures

Omatek Ventures delivered a 60.3 percent gain year to date, moving from N0.73 to N1.16 per share. The stock’s performance placed it solidly in the mid-range of ICT performers on the exchange. Its price appreciation reflects a combination of investor optimism and market activity, contributing to the overall strength of the ICT segment in 2025.

Chams Plc

Chams Plc gained 50.8 percent year to date, rising from N1.99 to N3 per share. While the stock recorded positive momentum during 2025, it trailed the sector’s top performers. Chams’ gains nonetheless highlight consistent investor support for smaller ICT companies on the NGX, which have become key drivers of year-to-date sector performance.

Airtel Africa

Airtel Africa posted a 5.24 percent year-to-date gain. The stock opened the year at N2,156.90 and rose to N2,270. Despite being the fourth most valuable company on the NGX with a market capitalisation of N8.53 trillion, Airtel’s share price performance was modest compared with other ICT stocks. The performance indicates that while large-cap telecoms remain important market drivers, they are less likely to produce extreme year-to-date gains.

Legend Internet

Legend Internet recorded a 10.5 percent year-to-date decline. The stock closed its IPO day in April at N6.20 but fell to N5.55. This placed it at the bottom of the ICT performance table for 2025. As a newly listed firm, the decline reflects the challenges faced by IPOs during their first year on the exchange, particularly in a sector marked by high variance in returns.

Overall, 2025 has been a year of wide divergence in ICT stock performance. Small and mid-cap firms, led by NCR Nigeria, recorded the most striking gains, while larger operators such as Airtel Africa and MTN posted more moderate growth. The performance data illustrates how investor attention and market dynamics have disproportionately benefited certain stocks, making ICT one of the most uneven yet headline-grabbing sectors on the NGX this year.