NASD Securities Exchange recorded a strong performance in 2025, as its market diversification strategy translated into increased listings, higher market capitalisation, and growing activity across its alternative trading platforms.

Market capitalisation on the NASD Exchange rose by 106 percent to N2.12 trillion in 2025, from N1.029 trillion in 2024, reflecting both new listings and price appreciation. The NASD Pension Index (NPI) also recorded significant growth, climbing 215 percent to 3,002.68 points, compared with 954.33 points in the previous year.

The Exchange said the year marked a shift from strategy to execution, with diversification efforts producing measurable results across equities, fixed-income instruments, and digital securities.

Read also: NASD lists Jilnas Nigeria’s N3bn series 1 commercial paper

While activity on the flagship Over-the-Counter (OTC) market was moderate, it was supported by new company admissions and improved stability among established securities.

Listing activity remained a major growth driver during the year. NASD admitted Infrastructure Credit Guarantee Company Plc (InfraCredit), Paintcom Investment Nigeria Plc, and MRS Plc, alongside the listing of Access Bank Plc’s Rights Issue. Combined, these transactions contributed approximately N1.121 trillion in new listings on the Exchange in 2025.

Beyond equities, NASD recorded strong traction in alternative funding instruments. Commercial Paper admissions on the platform exceeded N34.32 billion, signalling increased issuer and investor participation.

The Exchange also announced plans for a N5 billion maiden tokenised Commercial Paper issuance on its Digital Securities Platform, aimed at expanding access to structured financing options.

Read also: Norrenberger acquires GTI’s 4.35% stake in NASD for N1.305bn

“The performance reinforces its positioning as Nigeria’s leading alternative securities exchange, providing flexible capital-raising and investment platforms outside the traditional exchange framework. Looking ahead, we are optimistic about the macroeconomic outlook for 2026, economic conditions and anticipated gains from ongoing structural reforms, including the implementation of Nigeria’s new tax law.

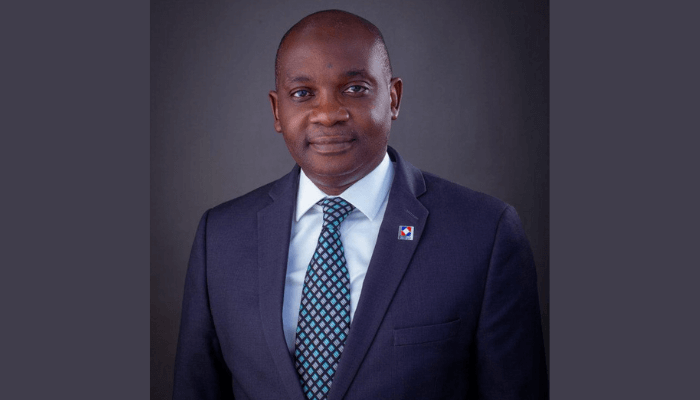

“NASD will continue to work with stakeholders across the capital market to expand economic opportunities, support entrepreneurship, and promote inclusive growth through innovation, market diversification, and improved access to capital,” said Eguarekhide Longe, Managing Director and Chief Executive Officer, NASD.