The rate of growth of Nigeria’s money supply slowed to a four-year low of 12.83 percent in November 2025, following aggressive liquidity mop-up by the Central Bank of Nigeria (CBN) aimed at reining in inflationary pressures.

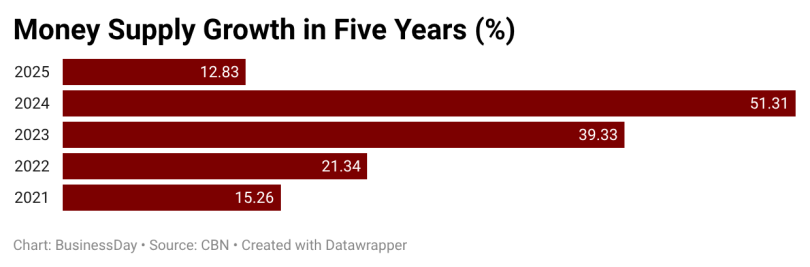

Data from the CBN showed that broad money supply growth moderated sharply over the period, slowing from 15.26 percent in 2021 to 21.34 percent in 2022, rising to 39.33 percent in 2023 and peaking at 51.31 percent in 2024, before decelerating to its lowest level of 12.83 percent in 2025.

Read also: Food, fuel break Rwanda’s six-month inflation slowdown

Adebowale Funmi, head of Research at Parthian Securities, said from an economic standpoint, slower money supply growth is positive for inflation control as it helps to reduce excess demand pressures and supports the ongoing moderation in price increases.

Nigeria’s headline inflation rate continued its downward trajectory in November 2025, easing to 14.45 percent from 16.05 percent in October, reflecting the impact of tighter monetary conditions. The CBN mopped up about N33.12 trillion from the system in 2025 through Open Market Operations and other liquidity management tools.

Despite the slowdown in growth, the stock of money in the system remained elevated. Broad money supply (M3), which measures the total amount of money in the economy, climbed to an all-time high of N122.9 trillion in November 2025, compared with N108.97 trillion in November 2024, representing a 12.83 percent increase, albeit at a significantly reduced pace.

The CBN data showed that M3 increased by N3.9 trillion, or 3.3 percent, from N119.03 trillion in October 2025 to its November level, suggesting a continued build-up of liquidity toward the end of the year.

Ayokunle Olubunmi, head of Financial Institutions Ratings at Agusto & Co., said the sharp slowdown in money supply growth reflects the CBN’s tight and contractionary monetary stance throughout most of 2025. He noted that for a large part of the year, the apex bank maintained aggressive tightening measures, including raising the Cash Reserve Ratio (CRR) to 50 percent and keeping the Monetary Policy Rate (MPR) elevated, alongside frequent Open Market Operations to mop up excess liquidity.

According to him, these measures, many of which were also designed to stabilise the foreign exchange market, have significantly constrained liquidity in the financial system. “The decline in headline money supply is a direct outcome of the CBN’s contractionary monetary actions,” he said, adding that economic activity has increasingly been shaped by restricted liquidity conditions.

Read also: IMF to release January 2026 World Economic Outlook update on Monday

Olubunmi explained that money supply is a key driver of inflation, noting that moderation in liquidity should translate into easing inflationary pressures. “As money supply continues to slow, we expect inflation to decelerate further, which should help restore price stability,” he said.

He added that the current environment supports a gradual return to real and sustainable economic growth. “With excess liquidity curtailed, inflationary distortions reduce, allowing real economic activities to drive growth rather than speculative money flows,” he said.

Funmi also said the slowdown in money supply growth to 12.83 percent, the lowest level in five years, reflects the CBN’s sustained tight monetary policy and deliberate efforts to withdraw excess liquidity from the system. He attributed the trend to high interest rates, aggressive liquidity mop-up through OMO and Treasury bill issuances, stricter cash reserve management, reduced direct financing of fiscal deficits through ways and means advances, and elevated borrowing costs that have moderated credit expansion.

In November 2025, by a majority vote, the Monetary Policy Committee resolved to maintain the current monetary policy stance, while adjusting the standing facility corridor around the policy rate. The decision reflected the Committee’s assessment of prevailing macroeconomic conditions and its commitment to sustaining tight monetary conditions in pursuit of price and financial stability.

Under the decision, the MPC retained the Monetary Policy Rate at 27.0 percent and adjusted the standing facility corridor to +50/–450 basis points around the MPR. It also maintained the Cash Reserve Requirement at 45.0 percent for Deposit Money Banks, 16.0 percent for Merchant Banks, and 75.0 percent for non-TSA public sector deposits, while keeping the Liquidity Ratio unchanged at 30.0 percent.