Mauritius Commercial Bank Ltd. has arranged a $400 million syndicated loan for Sea World Energy Holdings Ltd., the African operations arm of Turkey’s Karpowership Group, marking the lender’s latest push into large-scale power and infrastructure financing across emerging markets.

MCB acted as the sole mandated lead arranger and account bank for the facility, which was fully subscribed, the Port Louis–based lender said in a statement. The five-year deal consolidates Karpowership’s activities in several African markets where its floating power plants supply emergency electricity to governments and utilities.

Read also: FG’s fresh N1.15 trillion loan exposes Tinubu’s debt addiction – ADC

The financing was structured as a portfolio facility backed by the company’s power purchase agreements in Africa, giving the group flexibility to deploy its Powership fleet across multiple countries. Proceeds will support liquidity management and strengthen the company’s capital structure, according to the statement.

“This bespoke transaction stands as a testament to the capabilities of MCB in understanding and supporting its clients’ strategy,” said Mathieu Delteil, the bank’s global head of structured finance. “We thank the Karpowership team for their trust and the close relationship we have built over the past years.”

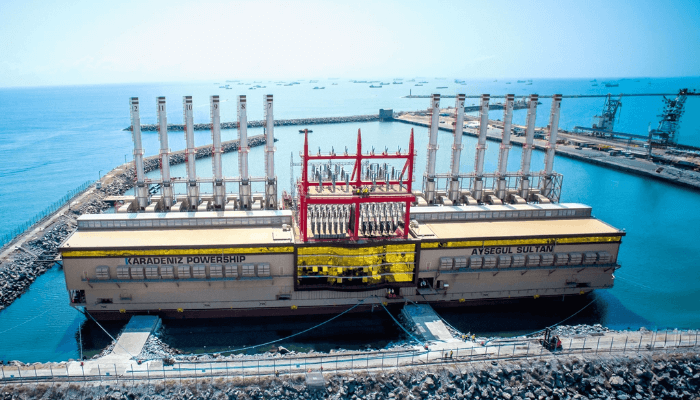

Karpowership, a unit of the Karadeniz Energy Group, operates a fleet of 40 floating power barges with a combined capacity of 8,000 megawatts. The company supplies electricity to 14 countries across Africa, South America and Asia, and has become a major provider of temporary power in markets facing persistent grid shortfalls.

Youri Harel, head of specialised finance at MCB, said the transaction underscores the bank’s growing capabilities in large power and infrastructure deals. “This achievement will further support Karpowership’s ambitious growth strategy while showcasing the continued buildup of MCB’s capabilities,” he said.

The deal helps Karpowership diversify funding sources and create a framework for future borrowing, said N.K. Naginlal Modi, team leader for MCB’s power and infrastructure desk. The lender has been expanding its project finance portfolio across the region as it deepens its international footprint.

Tuğrul Öz, Karpowership’s finance executive director, said the structure enhances the group’s balance sheet flexibility. “The successful closing of this $400 million syndicated facility represents a significant step in strengthening Karpowership’s capital structure,” he said. “This solution provides the flexibility required to support our growing portfolio across Africa.”

Read also: FG commends Tamrose for repaying $10m NCI loan, expanding marine logistics operations

MCB, Mauritius’s largest bank with more than 188 years of operations, has expanded across the Indian Ocean islands and parts of Africa, with representative offices in Kenya, South Africa, Dubai and Nigeria.