Nigeria’s publicly listed hospitality companies recorded a strong rebound in earnings, with combined revenues surging by nearly per cent year-on-year, driven by higher room occupancy and food and beverage consumption during the period.

An analysis of financial statements from major hotel groups such as Transcorp Hotels Plc and Ikeja Hotel Plc shows that revenue growth was largely supported by sustained demand from corporate clients, conferences, and tourism-related activities amid an improving macroeconomic environment.

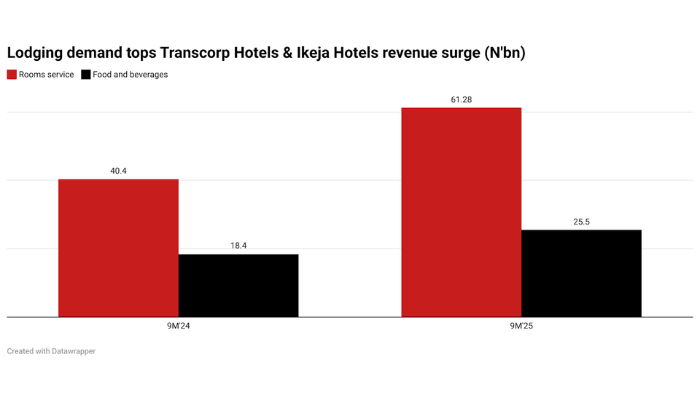

Transcorp Hotels Plc, operators of Transcorp Hilton Abuja and Transcorp Hilton Ikoyi, posted cent9 per cent increase in revenue to N72.31 billion in the nine months of 2025 from N48.49 billion in the same period of 2024, driven largely by its flagship Transcorp Hilton Abuja, which saw strong growth in room occupancy, food and beverage sales, and event hosting. Room revenue jumped to N48.05 billion from N31.87 billion, while food and beverage income surged to N21.02 billion.

After-tax profit also grew by per cent year-on-year to N14.82 billion in the first nine months of 2025, compared with N10.24 billion a year earlier.

Similarly, Ikeja Hotel Plc, owners of Sheraton Lagos Hotel, reported an 8 per cent revenue increase to N18.6 billion, buoyed by a rise in room occupancy and food and beverages.

Read also: Nigeria’s hospitality needs policy support to thrive – Experts

The company said its leisure segment benefited from the inflow of expatriates and domestic tourists, especially during the second and third quarters of the year. After-tax profit climbed to N4.85 billion from N2 billion during the reviewed period.

Analysts attribute the sector’s growth to Nigeria’s gradual economic recovery, increased corporate spending, and the post-pandemic resurgence of conferences, exhibitions, and entertainment events. The government’s efforts to promote domestic tourism and hospitality investment also supported the upturn.

According to reports, in Lagos and Abuja, hotel room rates surged by 40 per cent, as hotels battled higher costs from generator fuel, imported goods, and maintenance, all of which trickled down to guests.

According to the National Bureau of Statistics (NBS), Nigeria’s consumer price index has slowed by per cent in September, from per cent reported a year ago, as the rebasing takes effect.

Read also: Transcorp Hotels’ profit rises to a record on hospitality boom

Further analysis revealed that balance sheet analysis shows that total assets across the listed hospitality firms rose by an average oper centpercent, underscoring renewed investment in hotel upgrades, renovations, and digital platforms. Meanwhile, cash flow from operations improved substantially, as stronger revenues enhanced liquidity positions and reduced reliance on debt.

A report compiled by the Lagos-based W Hospitality Group using data from 50 international and regional hotel chains shows that Africa is seeing strong momentum in hotel construction, with 577 hotels and a total of 104,444 rooms under development in Q1 2025. This marks a percentage increase from a year earlier.

The region posted a 3 per cent year-on-year jump, with 230 hotels and 49,260 rooms currently under development. Growth was also recorded in Sub-Saharan Africa, but at a slower pace of 6 per cent, totalling 347 hotels and 55,184 rooms.