Levene Energy Development Limited’s acquisition of a 30 percent stake in Axxela Limited marks a strategic pivot in how local energy firms are deploying capital, moving from trading-driven earnings toward infrastructure-backed cash flows. The transaction also reflects growing lender confidence in Nigeria’s midstream gas sector, even amid macroeconomic and foreign exchange volatility.

The deal was executed through Bluecore Gas InfraCo Limited and financed with a $64 million acquisition facility from the African Export-Import Bank (Afreximbank). It forms part of a broader $285 million debt and equity package used to acquire Axxela from Helios Investment Partners and minority shareholder Sojitz Corporation.

Read also: Afreximbank provides $64m to support Levene Energy’s acquisition of Axxela

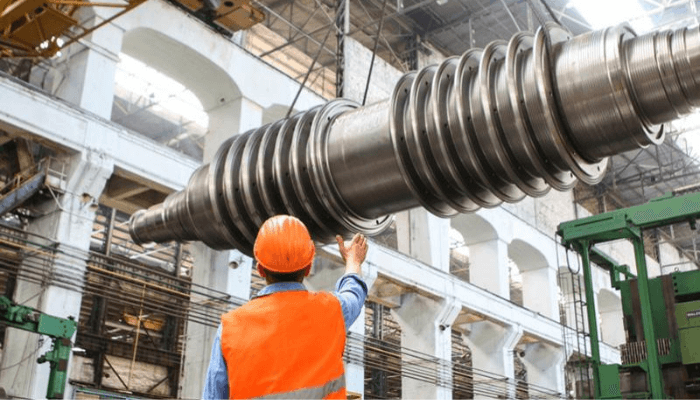

Axxela operates more than 360 kilometres of gas pipeline infrastructure with a throughput capacity of 211 million standard cubic feet per day, supplying over 200 industrial and commercial customers. Its scale and mature operations position it as a yield-oriented platform suitable for leveraged acquisition financing and predictable cash flows.

Afreximbank’s Executive Vice President for Global Trade Bank, Haytham Elmaayergi, said the financing reflects the bank’s focus on strategic partnerships with African champions. “By backing Levene Energy’s strategic move into gas infrastructure, we are supporting the critical transition to cleaner energy sources, enhancing regional energy security, and strengthening intra-African value chains.”

For Levene Energy, the acquisition represents a deliberate move away from trading into infrastructure. Sam Aofolaju, Head of Corporate Development, said: “The financing from Afreximbank not only validates our vision but underscores our shared belief that resilient, locally-owned infrastructure is the foundation for lasting economic development across Africa.”

Read also: Levene Energy Holdings Group CEO Wins SERAS 2025 Sustainability Man of the Year Award for Advancing Nigeria’s First Fully Automated Solar Panel Facility

The structure of the deal highlights growing lender confidence in Nigeria’s midstream sector. Acquisition finance rather than project-specific funding indicates that Axxela’s cash flows and operating history are sufficient to support balance-sheet-backed investment. The transaction also reflects a broader trend among local energy firms seeking stable, asset-backed income streams to smooth earnings and strengthen credit profiles amid macroeconomic and foreign exchange pressures.

While Helios’ exit closes a private equity chapter at Axxela, Levene Energy’s entry signals the increasing sophistication of domestic capital in Nigeria’s energy sector and the growing appetite for yield-focused infrastructure deals.