Kano State Internal Revenue Service (KIRS) has set an ambitious target to generate ₦15 billion in monthly revenue starting in 2026. The projection is part of Governor Abba Kabiru Yusuf’s ongoing efforts to strengthen the state’s Internally Generated Revenue (IGR) capacity.

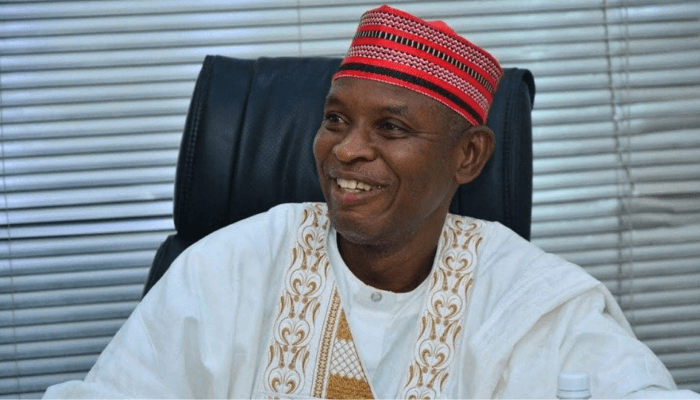

Mohammed Abba Aliyu, executive director, compliance and enforcement of KIRS, made this disclosure, during a two-day multisector stakeholders’ engagement, currently holding in the commercial city of Kano.

The new IGR target is coming against the backdrop of the recent information issued by National Bureau of Statistics (NBS) which indicates that Kano State doubled its IGR in the 2024 financial circle.

According to NBS, the state is said to have doubled its total IGR collection in the outgone year, to N74.77 billion, which represents a 100 percent increase, as against the N37.39 billion collected in the 2023 financial year.

Addressing participants at the stakeholders’ engagement organised by the agency in collaboration with Partnership for Agile Governance and Climate Engagement (PACE), Mohammed said that the projection is anchored in a new tax framework being implemented in the state that is structured on fairness and efficiency.

Read also: Edo IGR hits N79bn in nine months, adopt TSA to block leakages

He said under the revised system that is expected to become operational in 2026, only individuals earning above N800,000 per year will be taxed on the surplus, as a way of ensuring that lower-income earners are shielded from undue financial pressure.

Mohammed clarified that the new tax structure being implemented in the state, rests on three key pillars: Income tax from employment or business activities, Service charges for accessing public amenities like education and Penalties for legal infractions.

He further clarified that the new approach to tax collection is designed to streamline revenue collection, while reinforcing the social contract between citizens and the state in the payment of tax.

Also, in his presentation, Alhassan Usman, PACE representative, emphasized the transformative power of digital tax systems, urging the residents of the state, to move away from cash-based interactions with revenue officers, and advocated for secure, traceable digital payments.

Usman disclosed that the new revenue policy of the state is geared at not only reducing corruption, but also to improve access to government grants and financial support for compliant individuals and businesses.

Read also:Nigeria’s faulty education system, others fuel youth unemployment— NESG

He noted that beyond revenue generation, the campaign embarked upon by the agency, seeks to educate citizens on the long-term benefits of tax compliance, and the need for accurate tax records keeping, charging tax payees to monitor their financial health and position themselves for growth opportunities in the new tax reform.

It would be recalled that Northern states have recorded low performance in IGR collection compared to other regions, with the North-West and North-East zones recording low figures in 2023.

Although some states like Kaduna, Bauchi, and lately Kano, have stepped up their performance in latest data released by NBS, within their zones. The total IGR collection among states in the North-West in 2023 is put at N206.23 billion, which was less than the total collection by Federal Capital Territory (FCT) alone, highlighting the lower overall revenue generating capacity of the region.