The major individual shareholders of banks in Nigeria, GTCO, Stanbic IBTC, Zenith, and UBA, are set to pocket a combined N9.3 billion in interim dividends for the first half of 2025.

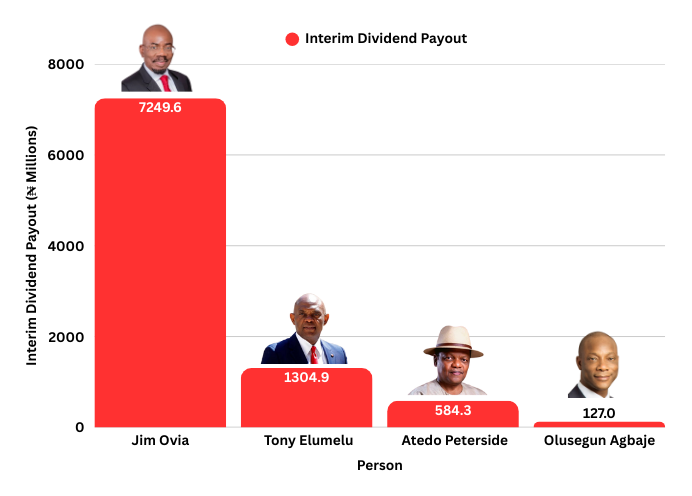

BusinessDay’s computations show that Jim Ovia, the chairman of Zenith Bank Plc, will take home the largest share at N7.25 billion. He is followed by Tony Elumelu, the chairman of United Bank for Africa (UBA), with N1.3 billion. Atedo Peterside, through his family trusts, will receive N584.3 million, while Segun Agbaje, the managing director of GTCO Holdings, is set to earn N127 million.

So far, these four banks remain the only institutions to announce interim dividends in H1 2025, despite Sterling Holdco and Wema Bank’s also reporting profits within the period.

UBA reported a net income of N335.5 billion, declaring an interim dividend of N10.3 billion. This amounts to a modest payout ratio of 3.1 percent. For context, in H1 2024, the bank distributed N68.4 billion, of which Elumelu earned N4.7 billion. The latest figures represent a 72 percent drop in the dividend payout accruing to Elumelu from his stake in UBA. This suggests the bank is prioritizing earnings retention to strengthen its balance sheet and meet capital adequacy expectations.

Zenith Bank, meanwhile, announced an interim dividend of N51.3 billion for H1 2025, a 64 percent increase compared to the N31.4 billion declared in H1 2024. For Jim Ovia, the payout translates to a personal dividend of N7.25 billion, up by N2.17 billion from the N5.08 billion he received in the prior period. The jump highlights Zenith’s strategy of sustaining shareholder returns, even as many banks tread cautiously amid Nigeria’s fluid policy and currency landscape.

At GTCO Holdings, Segun Agbaje, who is also the largest individual shareholder, will receive N127 million. While the group’s N36.4 billion interim dividend marks a 23.8 percent rise from the N29.4 billion declared in H1 2024, Agbaje’s personal earnings remain unchanged year-on-year. This is because his shareholding position stayed constant. GTCO’s decision to increase its payout points to steady earnings momentum.

For Stanbic IBTC Holdings, where Atedo Peterside is the largest individual shareholder through The First ANAP Domestic Trust and the MCA Peterside Memorial Trust, the interim dividend payout is significantly higher. Peterside is set to earn N584.3 million in H1 2025. The bank declared N39.8 billion in interim dividends, representing a payout ratio of 22.9 percent. This marks a 53 percent jump from the N25.9 billion paid in H1 2024. For Peterside, the gain is even more pronounced, with his dividend haul rising 94 percent from N300 million in the previous year.