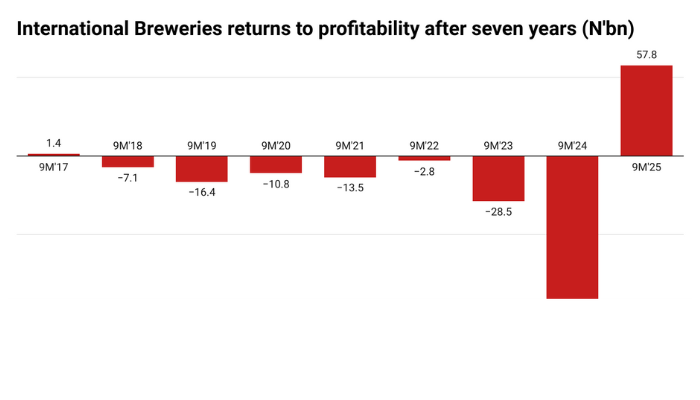

International Breweries (IBPLC), one of Nigeria’s top beer makers, has swung back to profitability in the nine months of 2025, after seven years of losses.

According to the company’s report, the Osun-based brewer saw its after-tax profit rise to N57 billion from a loss of N112.8 billion reported in the 9M of 2024.

The turnaround was driven by stronger revenue growth, reduced finance costs, and foreign exchange gains, signaling a recovery in the brewer’s financial performance after eight years of losses.

The company’s unaudited results show that revenue surged 38 percent to N472.57 billion from N343.45 billion in the prior year, buoyed by higher sales volumes and improved pricing in its beer and beverage segments. The cost of sales rose by a slower 25 percent to N311.64 billion, resulting in a gross profit of N160.92 billion, up from N94.86 billion the previous year.

Administrative, marketing, and distribution expenses increased 27 percent year-on-year to N92.09 billion, reflecting inflationary pressures, higher logistics costs, and intensified marketing campaigns across key brands. Despite this, the company’s operating profit stood at N67.01 billion for the nine months, a sharp rebound from the N125.40 billion operating loss in 2024.

Read also: International Breweries commits to increasing local input sourcing

A key driver of this recovery was the shift in other expenses, which declined significantly to a net expense of N1.78 billion, compared to N147.58 billion the previous year. The improvement was largely attributed to unrealised foreign exchange gains of N8.72 billion and reduced realised FX losses of N13.51 billion, well below the N159.15 billion FX losses recorded in 2024 when the naira depreciated steeply.

Finance costs also eased to N6.13 billion from N37.10 billion, reflecting lower interest expenses and the absence of major borrowings after the company cleared its bank loans. Meanwhile, finance income more than doubled to N13.33 billion, supported by interest on short-term investments and improved cash management, resulting in a net finance income of N7.20 billion, compared to a N29.15 billion net finance loss in the previous year.

Pre-tax profit stood at N74.21 billion, reversing a N154.55 billion loss in the prior year. After accounting for a tax charge of N16.39 billion, profit after tax closed at N57.83 billion, representing a net margin of 12 percent.

International Breweries generated N38.42 billion from operating activities, compared to a N10.90 billion outflow in the prior year. Capital expenditure rose sharply to N86.01 billion as the company expanded capacity and modernised production facilities. Despite these investments, net cash outflow from financing activities narrowed to N13.67 billion, thanks to lower lease and interest payments.

The brewer’s earnings per share turned positive at N0.34 for the nine months, against a loss per share of N0.67 in 2024, signaling renewed investor confidence after years of underperformance.