South Africa’s billionaire class has always been shaped by a plethora of the country’s traditional engines of wealth, such as mining, finance, and telecommunications.

The arrival of Paul Van Zuydam as the country’s newest dollar billionaire is a quiet but significant departure from an established pathway and well-treaded path.

Van Zuydam’s $1.7 billion fortune was not built on commodities or capital markets, but on the foresight and reinvention of a French foundry on the verge of bankruptcy.

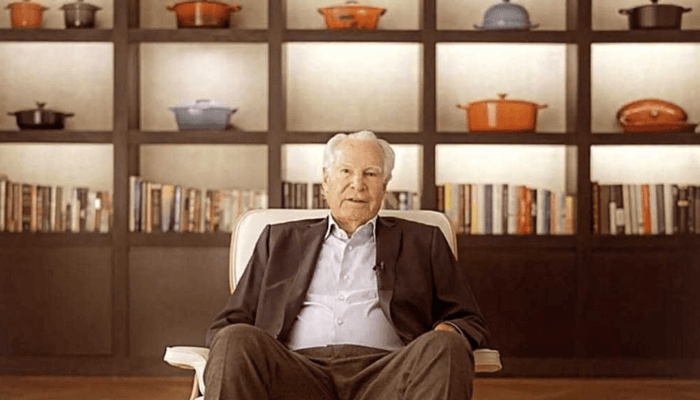

As the owner and president of Le Creuset, the 87-year-old became South Africa’s newest and oldest dollar billionaire. His inclusion on the Forbes Real-Time Billionaires Index is the result of a 37-year turnaround that transformed Le Creuset from an industrial relic into a global brand premium.

His journey to becoming a billionaire began in 1988 when he was the chairman and chief executive of the homeware group, Prestige. Struggling with debts, the once illustrious Le Creuset was put up for sale. Prestige initially sought to buy the floundering foundry, but the deal collapsed after a French labour strike against Prestige’s American ownership.

Determined to buy the company, Van Zuydam resigned from his role and pursued the acquisition personally. At that time, market watchers were baffled at such a contrarian move made at a time when institutional capital was retreating from heavy manufacturing in Europe.

Van Zuydam’s strategy was rooted in factory work. Closing secondary facilities to focus on Le Creuset’s original foundry, there was a sharp improvement in productivity. Even as labour costs fell, quality consistency improved, and daily output more than doubled. He also left the “Made in France” tagline, fully turning what had been a cost burden into a pillar of premium pricing power.

This manufacturing discipline laid the foundation for the French-based foundry that repositioned it as a global status symbol. Seasonal colour releases, limited editions, and a carefully managed retail presence allowed the brand to tap into “drop” culture, particularly in the United States and Asia.

A trademark of van Zuydam’s strategy was his aversion to debt. Since 2001, Le Creuset has expanded into more than 60 countries without relying on external financing. Apart from boosting profitability—Le Creuset is estimated to generate around $850 million in annual revenue—this conservatism has protected the company from the interest rate shocks that have strained many consumer goods rivals.

Joining such South African billionaires as Johann Rupert, Nicky Oppenheimer, and Patrice Motsepe, Paul Van Zuydam has carved a path through the steady grind of a factory floor with the patience to let compounding do its work for nearly four decades.