Nigeria’s biggest companies are riding on stronger macroeconomic fundamentals, including easing inflation and firmer naira to deliver bumper earnings in the first six months of 2025, an analysis of 80 percent of listed firms by BusinessDay has shown.

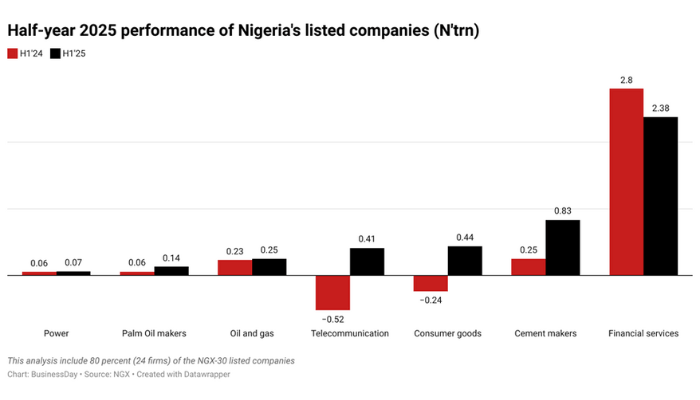

Combined after-tax profits of the listed companies in the consumer goods, financial services, cement makers, palm oil makers, oil and gas, telecommunications, and the power sectors jumped by 70.5 percent in the first six months of 2025 compared with the previous year, when reform policies almost muted their earnings.

With the Nigerian economy showing stability as naira pressure eases, business activities rise, and the Nigerian GDP reaches 4.23 percent in the second quarter of the year, the country’s biggest companies leveraged a combination of factors, including strong unit volume growth, pricing, and favourable base effects, to post bumper results in the first six months of 2025.

Analysis of the half-year performance of the country’s biggest companies show that their profits hit N4.51 trillion, up from the N2.64 trillion reported in the corresponding period of 2024.

A breakdown of the listed companies’ financial results for the first half of 2025 reveals how individual sectors/companies performed.

Read also: These women are leading Nigeria’s biggest companies by market capitalisation

Oil and gas

Listed oil and gas firms on the Nigerian Exchange Limited (NGX) reported growth in profit and revenue on the back of the hike in the price of petrol following the rise in global crude prices.

The NGX-30 oil and gas companies that have released their half-year results for the period ended June 30, 2025, include Oando Plc, Aradel Holdings, and Seplat Energy. Reported profit for the period jumped to N251 billion in H1’25, up from N234 billion reported in H1’24. The companies also grew their revenue to N4.24 trillion in the review period

Financial Services

Nine companies surveyed under the NGX-30 firms fall under the financial services sector with the combined profits reaching N2.37 trillion, down from N2.80 trillion.

According to half-year earnings reports released on the NGX, Guaranty Trust Holding Company (GTCO) had a notable after-tax profit decline of N449 billion in H1 2025 compared to N905 billion in the same period of 2024. Zenith Bank followed with N532 billion, slightly below the N577 billion reported a year earlier.

United Bank for Africa (UBA) recorded a modest uptick in profit, rising from N316 billion in H1 2024 to N335 billion in 2025. Similarly, Stanbic IBTC Holdings delivered strong growth, with profit increasing from N116 billion to N173 billion, reflecting the firm’s consistent earnings momentum.

Among the tier-two lenders, Wema Bank showed one of the most impressive gains, tripling its profit from N26 billion to N87 billion, while FCMB Group also improved from N59 billion to N73 billion.

Ecobank Transnational Incorporated (ETI) maintained steady performance, with profit inching up slightly from N431 billion in H1 2024 to N434 billion in 2025. However, First Bank Holdings saw a decline, as profit dipped from N365 billion to N283 billion over the same period.

On the investment side, United Capital Plc posted a modest gain, increasing profit from N7 billion in H1 2024 to N11 billion in H1 2025, highlighting resilience in Nigeria’s investment and asset management segment.

Consumer Goods

Consumer goods companies saw their profits rebound in the first half of 2021, a sign that an economic recovery is on for Africa’s most populous nation.

Analysis of their results show that BUA Foods, Nigerian Breweries, International Breweries, and Nestlé Nigeria recorded a combined profit turnaround of N440 billion in the first half of 2025, compared with a N236 billion loss recorded in the same period last year.

Read also: Nigeria’s biggest firms reap N2.47trn as FX relief power earnings

Palm oil

Nigeria’s oil palm sector has witnessed its most significant growth in the first six months of 2025, supported by surging crude palm oil prices, easing inflation, and a stable naira.

These factors have boosted the profitability of the sector’s two leading listed companies on the Nigerian Stock Exchange and handed shareholders more value, even as projections see the run “not ending soon”.

Presco and Okomu’s combined H1 2025 profit of N136.2 billion is 15.8 percent higher than their entire 2024 full-year profit of N117.7 billion and 131 percent above the N59.1 billion posted in the first half of last year, underscoring the firms’ fundamentals and operational performance.

Cement Makers

Nigeria’s cement makers recorded their best half-year performance ever in 2025 as price adjustments, operational efficiency, and a more stable naira drove earnings to new highs.

Dangote Cement, BUA Cement, and Lafarge Africa saw their combined net income rise to N834.01 billion in the first six months of 2025. That’s more than triple the figures they earned in the same period last year.

Cement makers in Nigeria are benefiting from high demand as the government builds the 700-kilometer Lagos-Calabar coastal highway and rural roads. Real estate projects are also surging, with the sector now accounting for a third of the nation’s gross domestic product.

While the demand for cement is high, Nigerians are paying more, which has led to a profit jump of more than 200 percent in six months.

Power sector