Malawi, one of the world’s least developed and poorest countries, recorded Africa’s best-performing stock market in 2025, defying deep macroeconomic stress marked by high inflation, currency instability, and an International Monetary Fund (IMF) programme suspension.

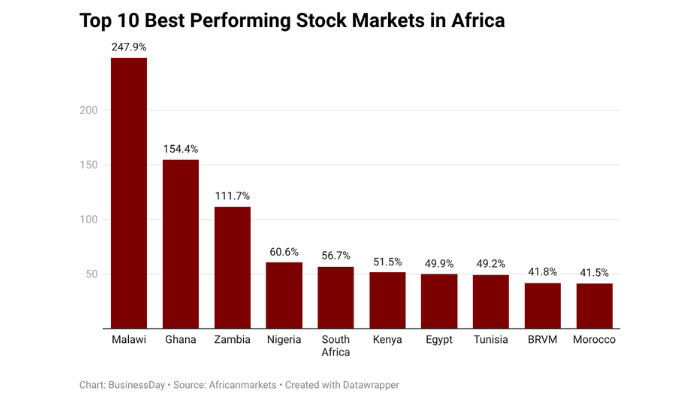

Data from African Markets, a pan-African capital markets portal, shows that the Southeastern country’s All Share Index (MASI) surged by 247.6 percent in local currency and 247.9 percent in US-dollar terms year-on-year as of December 31, 2025, overtaking Ghana, which led the continent in 2024.

The rally has nearly doubled market capitalisation, pushing the market-cap-to-GDP ratio above 120 percent — a rare level for African exchanges, particularly one as small as Malawi’s.

Read also: Here are top 10 best-performing stocks in the NGX for H1 2025

A small market with outsized gains

Malawi operates one of Africa’s smallest stock exchanges, with a total market capitalisation of MWK 32.6 trillion ($18.8 billion) as of January 5, 2026. With just 16 listed companies and a limited free float, modest demand increases can trigger outsized price movements.

“The Malawi Stock Exchange stands out as the best-performing market on the continent, driven by a spectacular surge in banking stocks — a performance rarely seen even by global standards,” African Markets said in a LinkedIn post on Monday.

Another similar firm, Daba Finance, added that the rally was unusually broad-based, with all listed sectors and stocks posting gains. “The surge in trading activity, combined with a 127 percent market-cap-to-GDP ratio, highlights deepening market participation and the growing role of equities in domestic wealth creation,” the firm said.

How Malawi ranked against Africa’s top markets

Ghana, which posted the continent’s strongest currency performance last year, came second with a 79.3 percent equity gain in local currency, followed by Zambia at 67.7 percent. Larger and more liquid markets also posted strong returns, including Nigeria at 51.2 percent and Kenya at 51.1 percent.

In US-dollar terms, Ghana delivered 154.4 percent, Zambia (111.7 percent), Nigeria (60.3 percent), and Kenya (51.5 percent).

African Markets noted that nearly all African stock exchanges ended the year in positive territory in both local currency and dollar terms. The Stock Exchange of Mauritius was the only exception, weighed down by weak flagship stocks and currency effects.

Banking stocks power the rally

Further analysis by the Kenya Wallstreet shows that National Investment Trust was the single largest driver of Malawi’s rally. Its share price closed 2025 at MK 3,938.5 ($2.27) up nearly 800 percent year-on-year, despite trading just 2,693 shares in the final session — highlighting the market’s thin liquidity.

Banks were central to the surge. National Bank of Malawi closed the year at MK 11,995.63 ($6.92), giving it a market value of MK 5.6 trillion ($3.23 billion), supported by nominal earnings of MK 102.3 billion ($59 million) and a dividend yield of 1.05 percent.

NBS Bank ended the year at MK 913.7 ($0.53) after rising more than 420 percent, while FDH Bank closed at MK 599.89 ($0.35), with a market capitalisation exceeding MK 4.1 trillion ($2.37 billion).

Inflation hedge, not economic boom

Analysts say the rally was less about economic expansion and more about capital preservation. Persistently high inflation and sustained pressure on the Malawi kwacha pushed domestic investors toward equities as a store of nominal value.

Last July, the World Bank downgraded the country’s 2025 GDP growth forecast to 2.0 percent from 4.2 percent projected at the end of 2024, citing a weaker-than-expected agricultural season.

“In the past four years, Malawi’s economy has been marked by negative per-capita growth, persistent trade imbalances, elevated inflation, and chronic foreign-exchange distortions,” the Bank noted.

Despite the stock market surge, inflation averaged between 25 and 30 percent in 2025 — far above the Reserve Bank of Malawi’s (RBM) three to six percent target. Food and fuel shocks continued to keep prices elevated, according to Veri Group, a Mauritius-based investment platform.

Foreign exchange shortages push investors into equities

The kwacha remained volatile on the official market, trading around MK 1,730–1,800 per US dollar, while a parallel market rate above MK 4,500 emerged amid acute FX shortages.

The IMF’s $175 million programme was suspended due to stalled reforms, prompting capital controls and limiting imports. In this environment, equities became one of the few viable inflation hedges available to domestic investors.

“With bank deposit rates capped and cash rapidly losing purchasing power, stocks became an attractive store of value,” Veri Group said.

According to the National Statistical Office of Malawi, the country’s inflation rate eased slightly to a four-month low of 27.9 percent in November 2025, down from 29.1 percent in October, but still ranks among the 10 highest in Africa.

Read also: Stocks cross N100trn valuation as investors eye earnings season

Structural factors amplify price movements

Kondwani Makwakwa, an equity and money-market dealer at Stockbrokers Malawi Limited, said in a recent article that with inflation averaging about 28 percent, limited real returns in fixed-income markets, and continued currency pressure, drove funds into equities despite weak macro fundamentals.

“Malawi’s market is relatively small, which means that when demand rises, share prices can increase significantly,” Makwakwa said.