Against the backdrop of lending rates that have climbed into the 30 percent range, Nigerian listed firms are increasingly warming up to equity capital as an alternative source of funding.

Beyond the trillions of naira raised by banks in their race to meet new paid-up share capital requirements, non-bank corporates have also developed a strong appetite for what they consider non-pressuring finance. Equity, unlike debt, offers breathing room in an era of expensive credit.

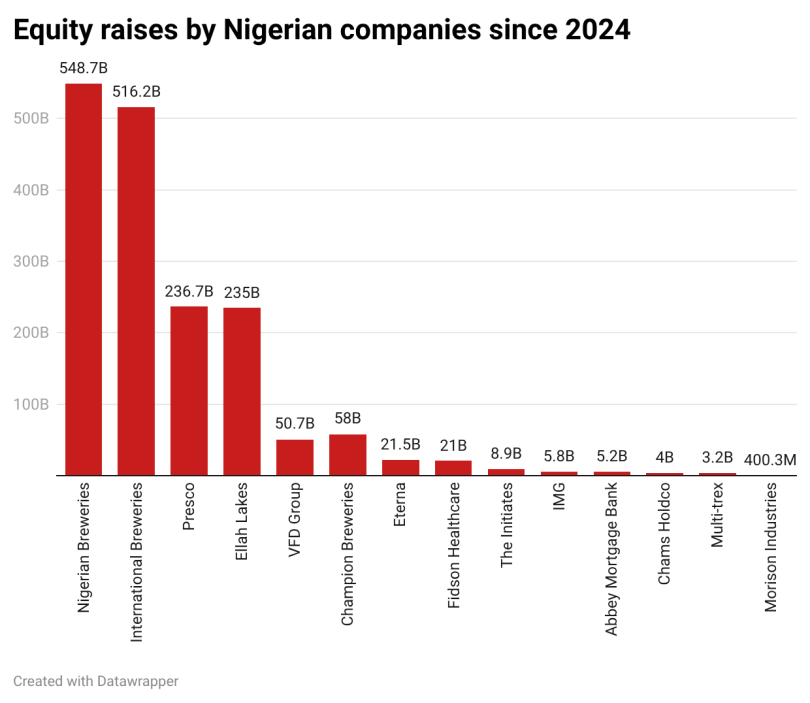

Since June 2024, non-banks have tapped the Nigerian Exchange (NGX) for a combined N1.72 trillion. The breweries, International Breweries and Nigerian Breweries, have led the charge, setting the pace for others to follow.

From the start of 2024 to date, the NGX’s total market capitalisation has surged by about N65.3 trillion, rising from N40.9 trillion to N106.2 trillion as of January 13. Only around N5.2 trillion of this expansion can be attributed to new listings, as the market has recorded just six new listings in the past two years. This figure pales in comparison with the scale of fresh capital raised by banks, which have collectively pulled in about N2.55 trillion in new equity.

Read More: N100trn market cap: NGX Group expanding definition of value – Businessday NG

When share price appreciation is factored into this context, the contribution of banks’ new capital raises far outweighs that of new listings. This largely underscores how capital formation has been driven largely by existing players rather than new entrants.

According to an analysis by BusinessDay, 15 non-banking firms have raised growth capital from the NGX through public offers, rights issues, or private placements within the period under review. Leading the charge is Nigerian Breweries, which raised N548.7 billion from its 2024 rights issue. The brewer initially sought to raise N599 billion; however, the offer was 91.6 percent subscribed.

International Breweries also approached the market with a sizeable rights issue, seeking to raise N588 billion in 2024. The offer was 87.8 percent subscribed, allowing the company to raise N516.2 billion.

Combined, the N1.06 trillion raised by these two brewers accounts for about 62 percent of all equity capital raised by non-banks during the period under consideration. Notably, they were the only non-bank equity raisers in 2024. In contrast, 2025 marked a sharp acceleration, with the number of raisers jumping by over 550 percent to 13, led by agro-industrial giant Presco Plc.

The palm oil producer, in what is arguably the largest equity raise by an African agribusiness, raised N237 billion ($163 million) through a rights issue that concluded in December 2025. Another agribusiness player, Ellah Lakes, is looking to raise a comparable amount, with a N235 billion public offer concluded already.

At the heart of this equity fundraising wave is Nigeria’s persistently high-interest-rate environment. The surge in rates has been driven by inflationary pressures that intensified from 2023, even though the economy saw some relief in 2025. With the benchmark monetary policy rate standing at 27 percent, commercial lending rates have climbed as high as 36 percent at some banks. This has made traditional borrowing increasingly unattractive for corporates.

As a result, companies seeking to expand operations or finance acquisitions have begun to think beyond the framework of conventional bank lending. Presco offers a clear example. In a landmark transaction, the company acquired one of Ghana’s largest oil palm producers. Rather than entering an expensive lending arrangement with a bank, Presco chose to finance the deal by offering additional rights to its shareholders, effectively raising long-term capital without the burden of high interest costs.

Adebayo Adebanjo, an investment associate at Cardinalstone, noted that “equity is better long-term capital, as it is devoid of the risk of immediate interest repayment.”

Similarly, Ellah Lakes has completed its N235 billion public offer, aimed at financing its most recent acquisition. ARPN, which holds a 22,000-hectare plantation in Edo State and includes an integrated palm oil mill and a cassava processing facility. The scale of the asset highlights why equity was considered a more suitable funding option.

Champion Breweries, another player in the brewing space, is also seeking to raise N58 billion, comprising N16 billion from a rights issue and N42 billion from a public offer. The proceeds are expected to fund its acquisition of the Bullet energy drink brand from Sun Mark International. This contrasts with a similar deal in the food and beverages sector in 2025, when UACN acquired Chi Limited but opted against an equity raise, instead financing the transaction through internal cash flows and a bank lending arrangement.

For VFD Group, its N50 billion rights issue is intended to “strengthen the Group’s capital base to accelerate strategic expansion.” However, market signals suggest that part of the proceeds may be directed toward the recapitalisation of Abbey Mortgage Bank, as it transitions into a commercial banking licence.

Fidson Healthcare’s N21 billion rights issue, on the other hand, is squarely focused on expanding the pharmaceutical company’s manufacturing capacity to support future growth.

The pattern is similar at Industrial and Medical Gases, which raised N5.8 billion to finance its expansion plans and improve production capacity.

For many of these companies, equity capital provides strategic clarity. “Equity allows management to focus on the actual purpose of the capital raise as opposed to chasing short-term gains to meet interest rate expectations,” Adebanjo explained.

Beyond expansion and acquisitions, equity raises have also been deployed as a tool for balance sheet repair.

By 2024, many Nigerian manufacturers were under intense financial pressure after enduring several years of losses. Debt levels continued to rise, particularly for companies dependent on imported raw materials that were severely affected by sharp currency depreciation. Breweries were among the hardest hit, given their exposure to foreign inputs and foreign-currency liabilities.

To address these challenges, the major brewers adopted a different approach from the conventional playbook. Rather than pursuing a straightforward debt-to-equity conversion, as Cadbury did, Nigerian Breweries and International Breweries implemented a more structured, two-step strategy.

First, shareholders approved plans that allowed the companies to convert loans owed to their foreign parent companies into equity. This move laid out the groundwork for reclassifying what had previously been recorded as liabilities into shareholders’ funds.

Next, the companies launched rights issues. While rights issues typically aim to raise fresh cash by increasing the number of shares in circulation, that was not the primary objective in this case.

In reality, the rights issues did not result in significant cash inflows. Instead, they created the necessary capital structure for the debt conversion to occur smoothly. With expanded share capital in place, International Breweries was able to eliminate its $379.9 million loan owed to AB InBev, while Nigerian Breweries cleared its outstanding debt to Heineken.

In simple terms, the brewers did not suddenly become cash-rich. Rather, they restructured their finances by shifting a substantial portion of their obligations from liabilities into ownership capital. This move eased debt pressure, strengthened their balance sheets, and improved their financial optics, without relying on a large injection of new cash.