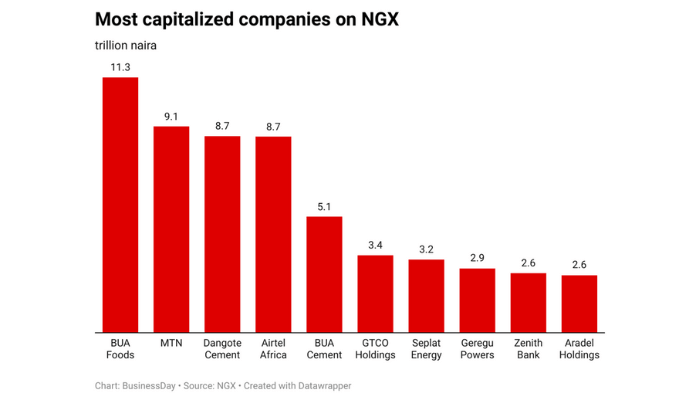

Nigeria’s equities market has become more concentrated than ever, with ten companies controlling N56.3 trillion in value, or 63 percent of the Nigerian Exchange’s total market capitalization of N89.8 trillion, data from NGX has shown.

Leading the charge is BUA Foods Plc, which has overtaken cement and telecom rivals to become the NGX’s most valuable company at N11.3 trillion.

In an economy where inflation remains above 20 percent, investors are leaning into consumer staples as a defensive hedge. Food demand has proven inelastic, and BUA’s regional expansion has kept revenues resilient, giving it premium valuations.

Close behind are MTN Nigeria at N9.13 trillion, Dangote Cement at N8.71 trillion, and Airtel Africa at N8.68 trillion. Together with BUA Foods, these four stocks make up over 40 percent of the market’s value. BUA Cement, worth N5.14 trillion, rounds out the top five, cementing the Rabiu-led conglomerate’s combined market weight at more than N16 trillion, rivaling the entire banking sector.

Banks, once the heart of the market, have lost ground. GTCO Holdings at N3.42 trillion and Zenith Bank at N2.63 trillion remain popular dividend plays but no longer carry the heft of telecoms or consumer goods. Tight monetary policy, high funding costs, and currency volatility have dampened their growth narrative, leaving investors to treat them as stable but unspectacular holdings.

Read also: The 10 most valuable companies in the world in 2025

Energy names have surged into the top tier. Seplat Energy at N3.23 trillion, Geregu Power at N2.85 trillion, and Aradel Holdings at N2.55 trillion together account for nearly N8.6 trillion. Deregulation in the power sector and oil reforms have strengthened valuations, and investors see these firms as early winners in Nigeria’s evolving energy landscape.

This concentration is the product of three forces: inflation, which has pushed investors into defensive sectors; liquidity, with institutional funds crowding into the few stocks large enough to absorb big trades; and policy shifts, particularly in energy and cement, which have amplified the value of the biggest players. The result is a market deep in a few industries but thin elsewhere. Technology, healthcare, and services remain underrepresented, leaving investors with limited options for diversification.

The implications are two-faced. On one hand, Nigeria’s blue-chip firms provide resilience and attract capital. On the other hand, day-to-day swings in a handful of names now dictate market direction. The backdrop makes this tilt even riskier. Inflation, while easing, is still high; the naira remains fragile despite forex reforms; and monetary policy at 27.5 percent continues to squeeze liquidity. Against this, large liquid stocks have become safe havens, leaving smaller firms struggling for visibility and depressing the pipeline of new listings.

Analysts argue that broadening the market is critical. Fintechs, renewable energy firms, and infrastructure players are often cited as candidates to balance the dominance of consumer goods, cement, and telecoms. Until such listings materialise, the future of the NGX will remain closely tied to its ten giants, with BUA Foods now standing at the very top.