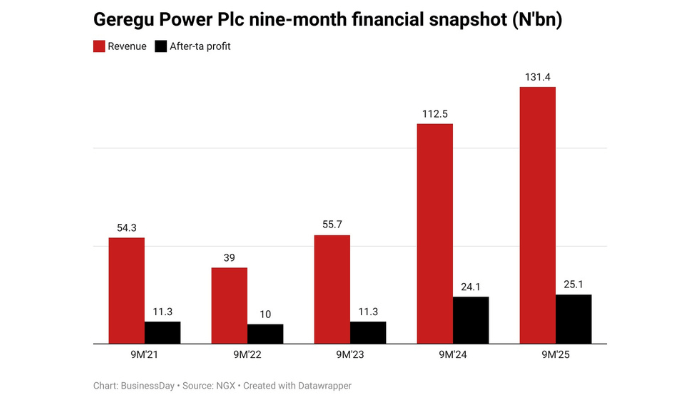

Geregu Power Plc, Nigeria’s first listed power generation company, recorded its highest net profit in more than five years buoyed by a stronger revenue, despite widening finance costs.

The company’s revenue surged to N131.4 billion in 9M’25, up from N112 billion reported in the same period last year, with 65 percent of the total amount from energy sales.

A breakdown of the total revenue made during the period revealed that energy sold rose to N85.5 billion, up from N71.4 billion, while the capacity charge rose to N45.9 billion.

The increase impacted the power-generating firm’s after-tax profit by 4.1 percent, to N25.1 billion from N24.1 billion.

Read also: Geregu eyes record N44bn profit in 2025 as revenue soars

A further analysis of Geregu’s report revealed that administrative expenses amounted to N7.3 billion in the period under review from N7 billion recorded in the same period of 2024.

Of the administrative expenses, personnel cost gulped N2.04 billion of the total amount, followed by repair and maintenance of machinery and plant with N1.02 billion, compared to N1.2 billion a year ago.

The company’s other income increased to N1.3 billion as a result of the firm’s ability to generate proceeds from insurance claims.

Finance costs during the period rose by 38.5 percent to N10.1 billion from N7.3 billion in the same period in the previous year. The statement disclosed that the increase in finance cost was on the back of a 108.6 percent increase in the cost of borrowed funds.

The power-generating firm’s total assets rose to N273.1 billion, up from N221 billion, while total liabilities rose to N216 billion, up from N171 billion.

Read also: Geregu Power reports 85% rise in revenue on energy demand

Its shareholders’ fund during the reviewed period also rose to N56.4 billion from N48 billion, indicating that the firm has a healthy financial health and can pay its short-term obligations as at when due.

The company’s cash flows for the nine months of 2025 were as follows: Net cash from operating activities amounted to N24.3 billion, down from N38.7 billion; net cash generated from investing activities rebounded to N3.14 billion, from a N25.2 billion recorded.

Net cash used in financing activities amounted to a negative N39.2 billion from N35.6 billion generated in the corresponding period of 2023.

Cash and cash equivalents for the period increased to N28.1 billion from N40.4 billion.