Geofluids Plc is implementing a holistic growth strategy aimed at driving up value for its current and prospective investors.

The plan has three-lane paths: strengthened board, business line expansion, and stronger operational structure. All are aimed achieving a better value for investors and all stakeholders.

As the company looks forward to list its shares on multiple exchanges – local and offshore -its current move to re-envision and redefine goals with needle-point implementation is most timely.

According to Jacob Esan, chairman and chief executive officer of Geofluids Plc, the shares of the company are currently listed and actively traded on NASD board. He noted that the plan is to list the company on the NGX and on other offshore international stock exchanges.

According to a report of a market analyst, the stock, which trades around N5.50 on the OTC market, has the potential for upside in hidden-market value opportunities if Geo-Fluids succeeds in its new business direction and chooses to become a fully listed company on an alternative non-OTC market.

The report further noted that even if the company chooses to remain on an OTC trading platform, there are opportunities for investors to benefit from additional market value.

A review of the stock’s price performance in the course of the year shows that on the overall, excluding the outlier, Geo-Fluids’ price ranged from N1.62 to N5.00, characterised by high volatility, episodic liquidity, and event-driven swings typical of Nigerian small-cap energy stocks.

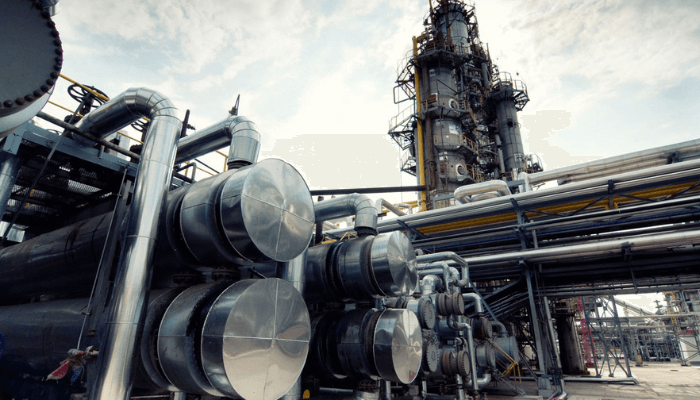

Geofluids is one of the players in the oil and gas sector. It was originally set up to supply drilling mud, barite, bentonite, and calcium carbonate. It also handled jobs on engineering, marketing, and project management services in the oil and gas industry, where it quickly built a strong reputation, attracting elite clients.

According to Esan, the firm is implementing a bold and ambitious turnaround strategy that will improve value and place it at the top of its industry of operation.

Esan, a corporate finance expert who initiated the strategic plans and oversees its successful implementation to date, stated that the decision of the company to expand its business lines by entering into bitumen, hydrocarbon exploration and extraction is aimed at positioning it for greater value delivery.

Read also: Hydrocarbon and the Niger Delta in perspective

“Geofluids holds significant interest in bitumen blocs, each capable of producing a significant commercial quantity of tar sand (bitumen) and other hydrocarbons. These blocs are located in Ondo State, and has the capacity to trigger strong corporate revival for the company’s fortunes,” he said.

He noted that the process, which started in 2012, has reached a stage where the company has now been completely stabilised with a new focus on growth and value creation for its shareholders and all other stakeholders.

According to Esan, it took this long to fully reestablish Geofluids for very many reasons.

“First, there were a lot of issues we needed to resolve, and that was successful. Secondly, we had to clearly redefine the strategic focus of the company,” he said, stressing that this was necessary to give the firm a direction.

“Thirdly, we needed to review operational systems and put in place structures that will complement the new driving force. This is aimed at achieving the overall goal that has been established. And, finally, we needed to put in place a financing structure that would give the company the necessary live blood that will keep it engines running.”

He further explained that Geofluids is now run by a new agile and versatile board, with deep and broad experience in various sectors.

“Our board shows regional spread, diverse expertise, and relevant experience,” he said. “The new board brings the needed experience across energy, finance, law, governance, and strategic investments,” he said.

“It is expected that this new board will provide Geo-Fluids with the sociopolitical and economic network, expertise, and governance support needed to drive the company’s subsequent evolution into one of Nigeria’s principal hydrocarbon businesses.”

The financials of Geofluids over the past 13 years, he said, shows a shift to a stable cash flow profile from a prior stream of operating losses.

The positive change is underlined by some investment and financing activities that have had significant impact on liquidity.

Operating cash flows were volatile but gradually improved, moving from negative figures in the early years to steady positive inflows from 2018 onwards, and peaking at N35.51m in 2022 and remaining robust at N34.34m in 2024. This indicates better earnings quality and improved working capital management, as accounted for by the new operational structure of the organisation.

Though there were spot cash inflows of N3.81 billion inflow in 2013 and N1.13 billion in 2024, the end of period cash levels remained modest, fluctuating between N1.34 million and N7.96 million, ending FY 2024 at N7.27 million. This underscores tight liquidity and a tendency to reinvest rather than hoard cash.