…Inflows top outflows for first time since 2023

Foreign investors have turned net buyers of Nigerian equities for the first time in three years, marking a decisive shift in sentiment toward Africa’s most populous nation.

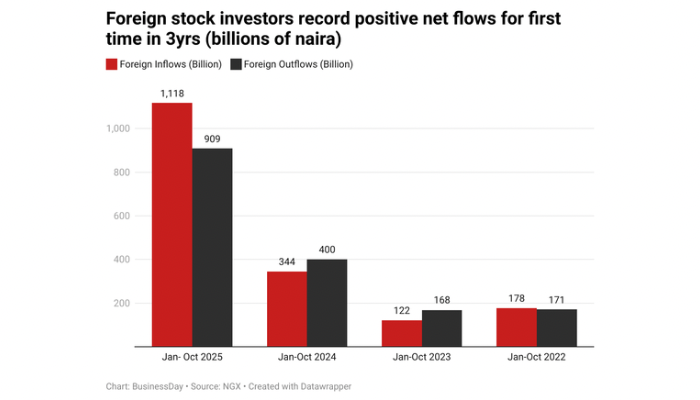

Offshore funds injected N1.1 trillion into the market in the first 10 months of 2025, outpacing outflows of N909 billion and delivering the strongest positive net position since pre-foreign exchange-crisis days, according to data from the Nigerian Exchange Group (NGX).

The turnaround caps a three-year stretch of persistent net sales, from N344 billion inflows against N400 billion outflows in 2024, to even deeper deficits in 2023, and signals confidence in Nigeria’s currency reforms and improving liquidity conditions that had long kept foreign money on the sidelines.

Stakeholders say 2025 has emerged as a net positive year for the Nigerian equities market, with foreign portfolio inflows exceeding outflows – a sharp reversal from when more funds exited than entered.

Temi Popoola, group managing director/CEO of NGX Group, said: “Foreign portfolio inflows into Nigerian equities signal a clear resurgence of global confidence in our market.”

Read also: Foreign investors show confidence in Nigeria at World Bank/IMF meetings

He said the momentum reflects the impact of ongoing reforms, digital innovations, and the concerted engagement efforts of stakeholders across the financial ecosystem, which have broadened access, enhanced efficiency, and reinforced transparency.

He noted that Investor participation is now deeper and more diversified, with domestic and international players engaging across multiple sectors and instruments.

“Our priority is to translate this renewed activity into sustained capital formation, ensuring a market that is inclusive, resilient, and positioned for long-term growth,” Popoola told BusinessDay.

Abiola Rasaq, former head, investor relations and portfolio investments at United Bank for Africa Plc, told BusinessDay that recent growth of Nigeria’s market capitalisation to about $67billion, far ahead of those of Egypt and Morocco, reinforces the significance of “our market on the continent and highlights the capacity of Nigeria’s capital market to attract and absorb global capital.”

“Interestingly, market liquidity also improved significantly at a time when goods news such as the FTSE Russell possible reclassification of Nigeria into its Frontier Market basket and the country’s exit of the FATF Grey list, highlighting the progress of reforms in the economy and financial market,” he said.

Read also: Nigeria woos foreign investors ahead $2.3bn Eurobond issue

Rasaq added that the market capitalisation growth of over N90 trillion is commendable. He said both macroeconomic reforms and capital market initiatives, such as the shortening of settlement cycles to T+2 by the CSCS and planned reforms in digital asset trading, should deepen domestic investor participation and attract more foreign capital.

Emomotimi Agama, director-general, Securities and Exchange Commission (SEC), at the second Capital Market Committee (CMC) meeting for 2025, said Nigeria’s sovereign credit rating and the country’s removal from the FATF grey list have boosted investor confidence and improved prospects for capital inflows.

Agama noted strong capital-raising activities in the market between April and October 2025, with significant transactions approved across debt, equity, and commercial paper markets.

Nigeria’s inflation has also moderated, with the headline rate easing to 16.05 percent year-on-year in October, the lowest level since March 2025.

The positive net position seen in Nigeria’s equities market indicates that foreign investors are returning to the Nigerian market in 2025, reversing the net outflow seen in 2024. Foreign participation has increased significantly in 2025—both inflows and outflows rose, experts say.