The federal ministry of finance said it will assume the development finance quasi-fiscal responsibilities previously held by the Central Bank of Nigeria (CBN), a development which marks a significant shift in the country’s approach to mobilising investment and financing priority sectors.

The move comes nearly two years after the central bank halted its direct funding of development programs, a decision that had left a gap in long-term financing for infrastructure, energy, and other strategic sectors.

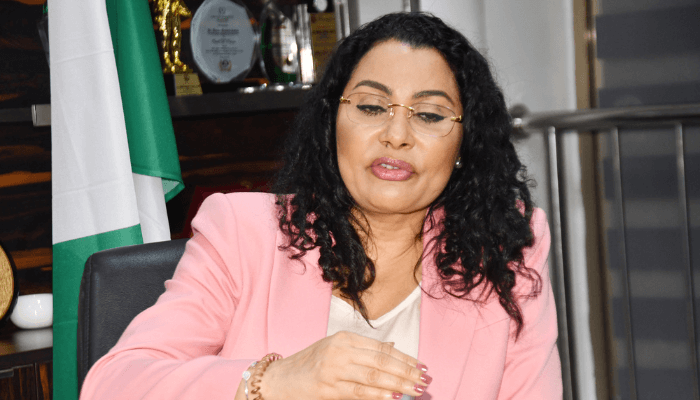

In a statement on Thursday, Doris Uzoka-Anite, minister of state for finance, said the ministry will develop a comprehensive guideline to implement a “go-forward” development finance strategy.

She emphasised that Development Finance Institutions (DFIs), will be central to Nigeria’s growth and investment objectives. “Given the scale of Nigeria’s growth ambition and the need to crowd in long-term, patient capital estimated at ₦246 trillion through 2036, the Federal Government recognises DFIs as essential partners in de-risking priority sectors, anchoring private sector investor confidence, and mobilising large volumes of private capital at scale,” Uzoka-Anite said.

DFIs, including the Bank of Industry (BOI) and the Nigerian Export-Import (NEXIM) Bank, will provide long-tenor financing, concessional instruments, technical expertise, and risk-sharing capacity to sectors where private capital has been hesitant to engage despite strong fundamentals, the minister said.

Read also: Naira extends rally in first trading day of 2026

These sectors include infrastructure, energy transition, agribusiness value chains, healthcare, climate-resilient industries, and digital public infrastructure.

The minister outlined a four-pronged strategy to strengthen domestic DFIs, beginning with improved capitalization and balance sheet strength to allow them to underwrite larger transactions over longer tenors. Governance reforms will ensure “stronger boards and performance-linked key performance indicators,” she said.

The strategy also focuses on enhanced risk-sharing and credit enhancement powers, and closer alignment with the finance ministry to provide treasury support, sovereign guarantees, and policy-backed lending.

The ministry intends to leverage both domestic and international partnerships to mobilise capital and shorten project timelines. “Strengthen institutional and delivery capacity across ministries, departments, agencies, and sub-national governments, and align financing with climate resilience, financial inclusion, and sustainability objectives, consistent with global development standards,” Uzoka-Anite said.

She added, “Nigeria’s reform momentum, policy clarity, and execution discipline provides a credible platform for DFIs to deploy capital at scale, with confidence, and measurable impact.”

The finance ministry’s assumption of development finance responsibilities follows the CBN’s decision to withdraw from direct interventions.

Shortly after his appointment, Olayemi Cardoso, CBN Governor announced the regulator would stop funding development programs. In December 2023, the apex bank formally suspended the application of new loans under all existing development intervention schemes, while committing to recover funds disbursed under earlier intervention programs.

Uzoka-Anite said the federal government remains committed to supporting DFI-led initiatives aligned with national priorities, while maintaining policy consistency, institutional coordination, and the implementation focus required for successful delivery.