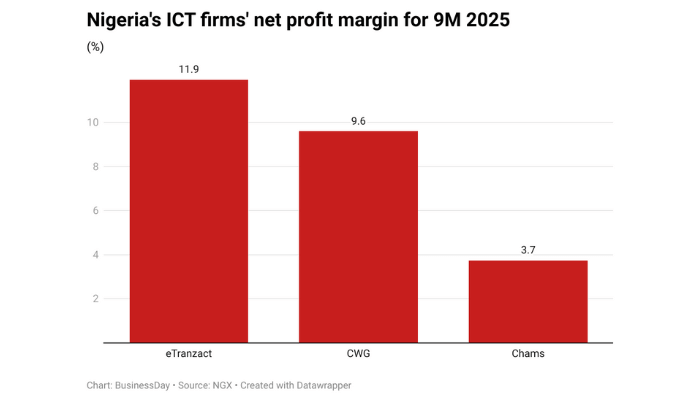

Nigeria’s listed ICT companies recorded significantly different net profit margins in the first nine months of 2025, with eTranzact leading the pack according to a new analysis by BusinessDay.

The data shows that while eTranzact, CWG, and Chams generated revenue, their ability to convert that topline into net earnings diverges sharply, offering investors and market watchers a clear view of which firms are most efficient and resilient.

eTranzact Plc emerged as the most profitable relative to revenue, posting a net profit margin of 11.9 percent. With revenue of N20.1 billion and net profit of N2.4 billion, the company retains nearly 12 kobo for every naira earned, signalling effective cost management and operational discipline.

This margin positions eTranzact as the most efficient of the three firms, suggesting it is better able to translate its revenue into sustainable earnings.

Read also: Nigerian tech firms’ multi-million dollar haul in 2025 fuels innovation across sectors

CWG Plc, in contrast, recorded a net margin of 9.6 percent. The company generated N48.9 billion in revenue and N4.7 billion in profit. While CWG achieved the highest absolute profit among the trio, the lower net margin indicates that the company is less efficient in generating earnings from revenue.

This demonstrates that higher revenue does not automatically lead to higher profitability per unit of sales. Analysts and investors examining the data would note that CWG’s broader service mix and potentially higher operating costs may contribute to the relative gap in net margin compared with eTranzact.

Chams Plc recorded the lowest net profit margin at 3.7 percent, with revenue of N13.4 billion and net profit of N500.7 million. The company retains only a small portion of each Naira earned as profit, indicating that costs and operational inefficiencies are limiting its ability to convert revenue into earnings.

The thin margin highlights the challenges smaller ICT firms face in scaling operations efficiently and maintaining profitability in a competitive market.

From an investor’s perspective, these margins reveal both efficiency and potential risk. Etranzact’s leading margin signals strong cost discipline and scalability, which could make it more attractive to investors seeking consistent profitability.

Read also: Top 10 Venture Capital firms powering Nigeria’s $520m startup ecosystem

CWG’s moderate margin reflects solid earnings but suggests room for improvement in efficiency. Chams’ low margin, meanwhile, points to operational pressures that may need to be addressed to enhance profitability and competitiveness.

The data also highlights broader sector dynamics. Nigeria’s ICT industry continues to benefit from increasing adoption of digital services, enterprise software, and payment processing technologies.

However, the ability to monetise these trends effectively varies by firm. Etranzact’s performance suggests that operational focus and effective cost management enable companies to maximize the benefits of revenue growth. At the same time, CWG and Chams demonstrate that size and revenue do not always equate to higher efficiency.

Overall, the nine-month data paints a clear picture of the profitability hierarchy in Nigeria’s ICT sector. Etranzact leads in efficiency, CWG achieves moderate profitability relative to revenue, and Chams faces margin pressures that could limit its capacity to convert sales into earnings. For market observers, these net margins provide a concise measure of financial health, operational discipline, and relative investment appeal.