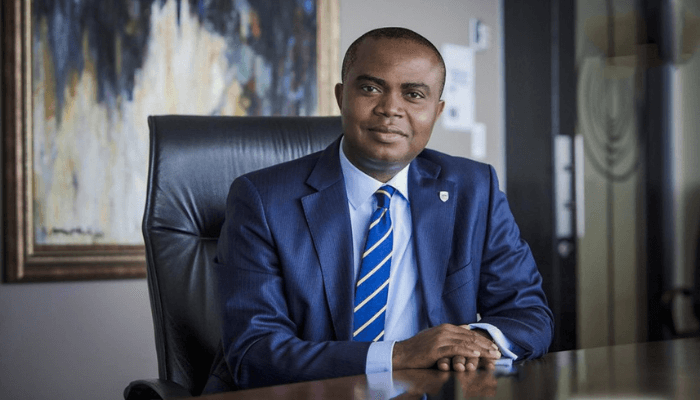

Stanbic IBTC Holdings has named Chuma Nwokocha as its new Group Managing Director. His appointment brings an end to Adekunle Adedeji’s interim stewardship at the helm of the financial services giant.

Adedeji had held the acting role since October 2024. He stepped in following the retirement of Demola Sogunle, a stalwart of the Stanbic IBTC group. Sogunle bowed out after an illustrious 34-year career with the institution.

The appointment places Nwokocha at the head of one of Nigeria’s largest and most diversified financial services groups. The group’s operations span banking, pensions, asset management, insurance, and investment banking.

His elevation is seen as a strategic move to steady the organisation at a delicate time. It also draws on his vast experience across African markets, where regulatory oversight and competitive pressures have repeatedly tested financial leaders.

Nwokocha’s appointment is not without intrigue. Before taking the Stanbic role, he served as Regional Managing Director for Southern Africa at Access Bank Plc. In that position, he oversaw the bank’s subsidiaries in Mozambique, South Africa, Zambia, Botswana, and Angola.

It was, however, his years in Mozambique that defined his reputation. He emerged as both a resilient executive and a survivor of regulatory storms.

Read Also: Stanbic IBTC Bank turns disciplined saving into unforgettable experiences – Businessday NG

In July 2021, while leading Standard Bank Mozambique, the country’s central bank accused him of misconduct. Alongside the director of the Corporate and Investment division, Carlos Madeira, he was alleged to have fraudulently manipulated the exchange rate. The Bank of Mozambique imposed a fine, casting a long shadow over the institution’s standing.

For many executives, such a confrontation could have ended a career. Yet just six months later, in January 2022, a Mozambican court acquitted him of any wrongdoing. The ruling cleared his name and allowed him to resume his career trajectory.

The episode, far from derailing him, seemed to harden his ability to manage crises. Soon after, he transitioned to Access Bank Plc. There, he was tasked with leading its Southern African division.

By the end of FY 2024, the five subsidiaries under his supervision had swung back to profitability. They posted a combined net income of $23.4 million, compared to a net loss of $1.2 million in the previous year. Their total assets also surged, rising from $1.96 billion in 2023 to $2.53 billion in 2024. The turnaround underscored his ability to stabilise and grow regional operations.

It is unknown when Nwokocha’s career with Standard Bank Mozambique started. However, in May 2014, he joined the bank’s board as Executive Director in charge of finance. He had previously served as the bank’s director for individuals, small businesses, and SME banking. By January 2015, he was elevated to Chief Executive Officer of Standard Bank Mozambique, a position in which he delivered measurable results.

Under his leadership, the bank’s total assets expanded from $1.47 billion at the end of FY 2014 to $2.24 billion by FY 2021. Its loan book grew by 56 percent over the period, rising to $1.54 billion from $985 million. Customer deposits also jumped by 49 percent, reaching $1.70 billion compared to $1.14 billion at the start of his tenure. These figures cemented his reputation as a leader capable of driving growth even in a challenging and highly competitive banking environment.

Yet Nwokocha assumes the leadership of Stanbic IBTC Holdings at a time when the group is locked in a major regulatory crosswind. In September, the Securities and Exchange Commission (SEC) imposed a fine of N50.15 billion on Stanbic IBTC Capital Limited, the group’s investment banking arm.

The sanction arose from Stanbic IBTC Capital’s role as lead issuing house in the Guaranty Trust Holding Company (GTCO) public offer. The firm was found to have used internet banking platforms and mobile applications to collect share applications without first obtaining the SEC’s mandatory “No Objection” approval.

The penalty, one of the largest ever imposed by Nigeria’s capital market regulator, has sparked concerns about the group’s compliance culture and governance standards.

Read Also: Stanbic IBTC Holdings surpasses N100 per share as investor confidence soars – Businessday NG

For Nwokocha, the timing of this crisis could hardly be more consequential. His first challenge as Group Managing Director will be steering Stanbic IBTC through the regulatory quagmire. He must also restore confidence among shareholders, regulators, and the investing public.

His past brushes with regulators, especially his acquittal in Mozambique, may prove invaluable in guiding the group through this storm.

Observers argue that his mix of African banking experience, resilience under regulatory pressure, and a proven track record of growth in difficult markets makes him a unique fit for the role. The financial community will be watching closely to see how his leadership translates from the Maputo courts to the Lagos boardrooms. Stanbic IBTC now faces a defining moment in its bid to reinforce its reputation as one of Nigeria’s premier financial services groups.