Nigeria’s cement sector is projected to post another strong performance in FY’26, supported by government infrastructure spending, a shift toward concrete road construction, and sustained pricing that has strengthened operator margins over the past two years.

Analysts at CardinalStone Research believe these forces will maintain solid industry fundamentals despite continued weakness in private-sector demand.

“The government’s infrastructure push is the single biggest catalyst for cement consumption going into 2026,” the Lagos-based analysts said. “Even with sluggish private construction, public sector projects are more than filling the gap.”

The federal government has proposed N7.5 trillion for infrastructure in the 2025 budget, up from N4.5 trillion in 2024, signalling a renewed commitment to closing Nigeria’s infrastructure deficit. The administration has also secured a $747 million loan from Deutsche Bank for the first phase of the Lagos–Calabar coastal highway, underscoring its resolve to accelerate big-ticket projects.

Read also: Lafarge Africa’s profit rises 4-fold on cement sales growth

The analysts reported that major schemes such as the Lagos–Calabar coastal highway and the Sokoto–Badagry superhighway are expected to anchor cement demand into 2026.

The policy shift toward concrete roads, after years of asphalt failures in flood-prone corridors, is also seen as a significant driver.

According to CardinalStone, “The concrete-road policy is a structural win for the cement industry. It lifts demand in a way asphalt projects simply could not.”

In addition to roads, housing is emerging as a major demand centre. With Nigeria’s estimated 28 million-unit housing deficit, the government is pursuing large-scale PPP-led housing programmes and innovative financing schemes to stimulate delivery.

Analysts say these initiatives are creating a stable, multi-year pipeline for cement producers.

“Private demand, however, remains subdued. High inflation, weak purchasing power, and expensive mortgages have slowed construction activity, particularly in Lagos and Port Harcourt.”

Developers have postponed or scaled down projects, limiting consumption. Still, analysts expect an eventual rebound. “Once inflation cools and the currency stabilises further, private construction should begin to recover,” they added.

Nigeria’s role as a regional cement hub is also strengthening. Under AfCFTA, producers, especially Dangote Cement, continue to push clinker and cement exports into West and Central Africa.

CardinalStone noted that ongoing corridor upgrades and port development, including the Bakassi Deep Seaport, are expected to cut logistics costs and widen export routes.

Read also: BUA Cement sees profit climbing to N250bn on lower FX losses

Sustained pricing tailwinds have helped cement companies navigate cost pressures. Average revenue per tonne climbed to N161,459 in 9M’25, up 34.7 percent year-on-year, after a steep 56.4 percent rise in FY’24. Retail prices across regions remained between N8,500 and N10,000 per 50 kg bag.

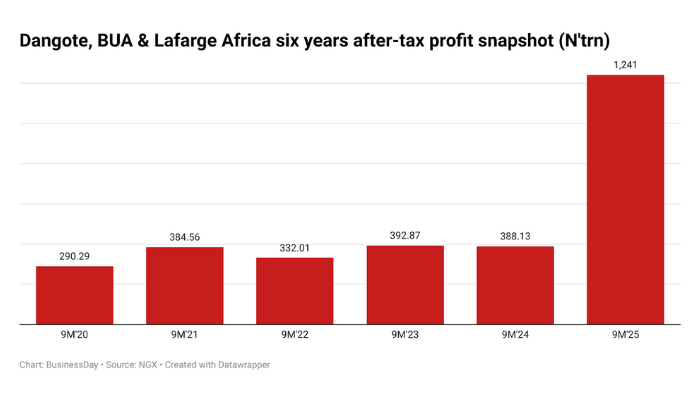

According to the nine-month financial statements of Dangote Cement, BUA Cement, and Lafarge Africa combined, after-tax profit rose to N1.2 trillion, from N386 billion reported in the same period of last year.

The trio disclosed that the rise in profit can be attributed to price increases across operating segments during the period.

CardinalStone said operators have also strengthened margins through the adoption of alternative fuels, logistics optimisation, and deleveraging efforts, supported by cooling inflation and a more stable naira.

According to the National Bureau of Statistics, Nigeria’s inflation rate fell again for the seventh consecutive month to 16.1 percent from 18.02 percent in September, well below many economists’ projections, making leeway for a sizable reduction in the benchmark rate.

However, CardinalStone analysts expect the pace of price increases to slow sharply in 2026 and potentially reverse as producers prioritise market share gains in anticipation of additional capacity coming onstream over the next few years.