Nigeria’s foreign reserves have climbed to $46.7 billion, the highest level in almost seven years, according to Central Bank of Nigeria (CBN) governor Olayemi Cardoso.

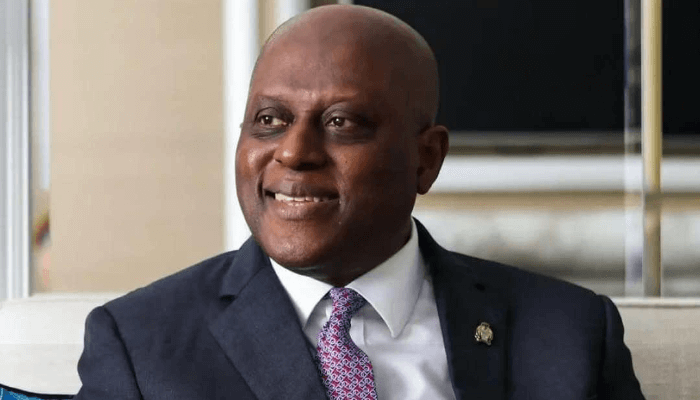

Cardoso disclosed the figures on Thursday during an engagement with the Senate committee on banking, insurance and other financial institutions, saying the reserve position now provides 10.3 months of import cover — a milestone he linked to renewed investor confidence and improved foreign exchange stability.

He told lawmakers that the spread between the official and parallel market exchange rates has narrowed sharply to below 2%, compared to more than 60% a year ago, reflecting what he described as a more orderly FX market.

Cardoso said the average exchange rate has strengthened to ₦1,442.92 per dollar as of November 26, improving from an average of ₦1,551.08 recorded in the first half of the year.

Read Also: Nigeria sets ambitious plan targeting almost 8% growth by 2028

The apex bank governor reported a sharp rise in diaspora inflows, noting that remittances have increased by 66.7%, up from roughly $200 million monthly to about $600 million in recent months.

“Another important outcome was the resolution of the $7 billion of verified FX backlog, restoring credibility and confidence in the Nigerian economy,” he said.

Cardoso also pointed to progress on inflation, which he said has declined for seven consecutive months to 16.05% in October, the lowest level in three years. Food inflation eased to 13.12%, according to him.

Nigeria’s real GDP expanded by 3.98% in the third quarter of 2025, driven by crop production, ICT, real estate and financial services.

Cardoso described the prospects for 2026 as “very positive”, adding that Nigeria is now one of Africa’s most advanced digital payments markets, powered by a fintech ecosystem that has produced eight of the continent’s nine unicorns.

Tokunbo Abiru, chairman of the committee, commended the central bank’s monetary policy framework, saying lawmakers have observed “remarkable macroeconomic improvements” since their last engagement with the bank in July.

“These positive indicators have not gone unnoticed globally,” he said.

Abiru also praised the CBN leadership for helping Nigeria secure favourable ratings from Fitch and S&P Global Ratings, which he said reflect improved investor sentiment, policy credibility and macroeconomic stability.