Chemical and Allied Products Plc (CAP), one of Nigeria’s paint manufacturers, reported stronger earnings from its main business operations, as reflected in its latest financial results for the half year ended June 30, 2025.

The company’s focus on improving operational efficiency, expanding market reach, and deepening its product penetration is paying off, and the numbers tell the story.

According to CAP’s unaudited financial statement, the company’s revenue grew by 29 percent to N20.09 billion in the first half of 2025, from N15.61 billion in the same period of 2024. This growth was driven almost entirely by sales of paint products, which contributed N20.05 billion, reaffirming that CAP’s core business remains its most profitable engine.

Operating profit nearly doubled to N3.18 billion, representing a 95 percent year-on-year increase, while profit before tax rose 41 percent to N3.78 billion. Profit after tax followed a similar trajectory, increasing to N2.53 billion from N1.79 billion the previous year. Earnings per share improved from 220 kobo to 311 kobo, signaling stronger returns to shareholders.

Read also: CAP Plc’s half-year profit jumps 41% on increased sales, cost efficiency

Over the past year, CAP has intensified its focus on paint production, streamlining non-core activities while optimising its manufacturing and distribution processes.

The company’s paints segment, which includes decorative coatings and industrial finishes, remains its main revenue contributor. This strategic focus has helped it navigate a challenging operating environment marked by high input costs and inflationary pressures.

By emphasising local production and efficient sourcing of raw materials, CAP has managed to keep its cost of sales in check. The company’s cost of sales rose 13 percent to N11.37 billion, much lower than its 29 percent revenue growth, indicating improved cost efficiency and better pricing power. As a result, gross profit surged 57 percent to N8.72 billion from N5.56 billion in H1 2024.

While finance income declined 43 percent to N601 million due to lower foreign exchange gains compared with the prior year, CAP maintained minimal finance costs of N726,000 during the period, reflecting its low-debt position. The company continues to rely on internally generated funds rather than borrowings, maintaining financial stability in a volatile economic environment.

Read also: CAP PLC bets on retail innovation to deepen market share

A key part of CAP’s success lies in its expanding distribution network and brand visibility. The company continues to invest in marketing and sales initiatives that drive consumer engagement, dealer incentives, and retail expansion across Nigeria. Selling and marketing expenses grew to N2.12 billion from N1.52 billion, reflecting sustained investments in brand activation and customer loyalty programmes.

Through its long-standing relationship with distributors and franchise owners of its flagship brands, Dulux and Caplux, CAP has maintained a strong market presence across the decorative paints segment. Its network of color centers and retail outlets has been instrumental in deepening market penetration and driving higher volumes.

Administrative expenses increased by 37 percent to N3.65 billion, a rise attributed to higher personnel costs and inflation-driven expenses such as energy, logistics, and professional services. However, the company’s ability to expand revenue faster than expenses indicates effective cost control.

Notably, CAP’s operating profit margin improved to 15.8 percent, up from 10.4 percent a year earlier, showing enhanced profitability from its core activities. This improvement comes amid disciplined management of working capital, better inventory control, and stronger cash flow generation.

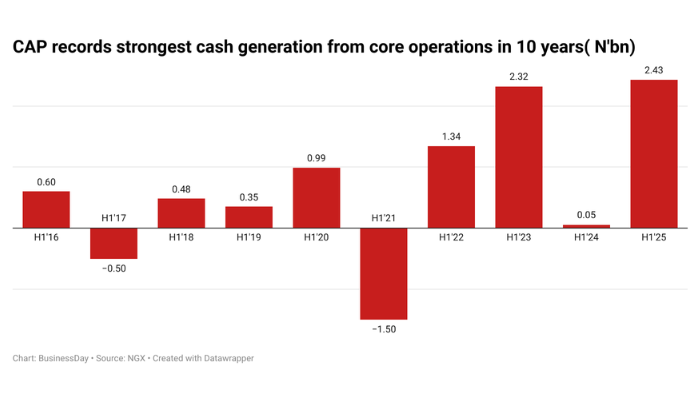

The company’s cash from operating activities rose sharply to N2.43 billion from just N53.8 million in the same period last year. Its cash and cash equivalents nearly doubled to N7.59 billion, strengthening liquidity and supporting dividend payouts and reinvestment in business operations.

Read also: We’re addressing a critical need while empowering homeowners – CAP Plc

CAP’s balance sheet also reflects a company in solid financial health. Total equity rose 5 percent to N11.21 billion, while total assets increased to N20.42 billion, up from N16.76 billion in June 2024. The company’s net asset per share climbed 32 percent to N13.76, compared to N10.43 last year, evidence of growing shareholder value.

Additions to property, plant, and equipment were modest at N652.9 million, as the company shifted focus from expansion to maximizing existing capacity and improving asset utilisation. This capital discipline supports sustainable profitability without overextending resources.