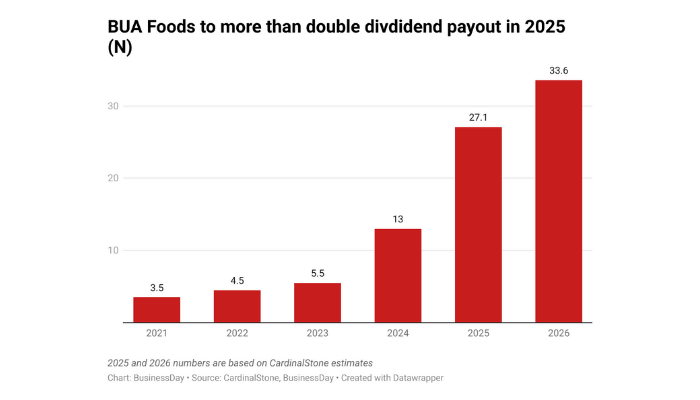

BUA Foods, Nigeria’s most valuable listed company, is expected to more than double its dividend payment this year, helped by a robust profit growth and improving cash flow, according to analysts at Lagos-based research, advisory, and consultancy firm CardinalStone.

That will mark the continuity of the consumer goods dividend policy that it has maintained for the past four years, despite economic headwinds that have held many firms from paying dividends to their shareholders.

BUA Foods declared N5.50 and N13 in the full year of 2023 and 2024, respectively, driven by an average growth in Earnings Per Share (EPS) of 80 percent across both years. That run is projected to be maintained this year and in 2026.

Read also: BUA rewards 510 long-serving staff with N30bn

“For FY’25 and FY’26, we maintain a positive outlook, with forecast Dividend Per Share (DPS) of N27.09 and N33.56, respectively. This outlook is supported by robust profit-after-tax growth, solid operating cash-flow generation, and the maintenance of a high dividend payout ratio of 88.0%,” CardinalStone said in a recent report on the company.

BUA Foods, which started the year at N7.52 trillion market capitalisation, has gone on to overtake MTN Nigeria and Dangote Cement, with its valuation currently at N13.2 trillion, placing the food giant as the most capitalised firm on the Nigerian Exchange.

This 77 percent leap in valuation was driven by strong profit and investors’ confidence in the company’s fundamentals. Net profit at AbdulSamad Rabiu’s BUA Foods more than doubled to N405.3 billion in the nine months to September 2o25.

The company is expecting its profitability run to extend through the end of the year as the consumer goods giant doubles down on its expansion strategy to hold a larger slice of the growing food market, according to its managing director, Ayodele Abioye, who told investors during a call in November.

CardinalStone sees the company more than doubling its full-year net profit to N554.13 billion, buoyed by a stabilizing naira and easing inflation, which has now slowed for the eighth consecutive month to 14.45 percent in November.

Read also: BUA Foods nears completion of Nigeria’s largest sugar plant

Revenue is also projected to surge to N1.9 trillion compared with N1.8 trillion last year, reflecting price increases and higher volumes in the company’s various product lines.

“For FY’26, we see room for a continued revenue uptick (+20.8% YoY to N2.3 trillion), aided by improving macroeconomic conditions, which is positive for customers’ purchasing power,” CardinalStone said.

“Additionally, we expect ongoing capacity expansions, improving utilisation rates, and deepening market penetration (particularly in the rice segment) to support volume growth further and, by extension, topline.”