…UBA remains the outlier with YOY growth

Nigeria’s biggest lenders reported a 14.9 percent decline in nine-month profit as the one-off currency revaluation windfall that inflated 2024 earnings vanished, signaling that banks may struggle to sustain returns without stronger loan growth and fee income.

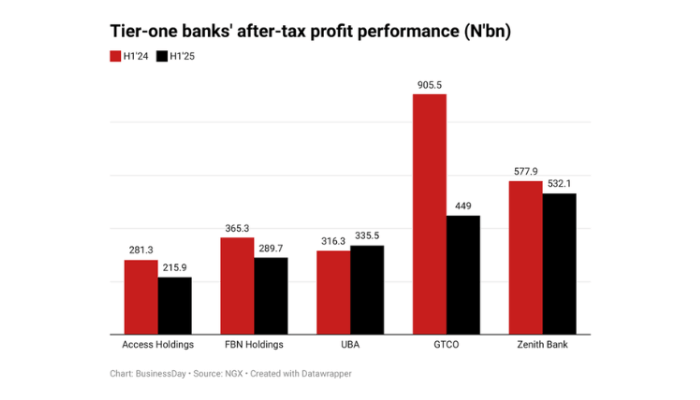

Nigeria’s tier 1 banks, including First Bank of Nigeria Holding, United Bank for Africa, Guaranty Holding Company, Access Holdings, and Zenith Bank, posted a combined profit after tax of N2.91 trillion for the first nine months of 2025, compared to N3.42 trillion in the same period last year.

Among the big banks, UBA was the only lender to record year-on-year growth, posting N537.5 billion in profit, a 3 percent increase compared to the same period in 2024.

The bank’s steady performance contrasts sharply with Nigeria’s biggest bank by market value, GTCO, which recorded the largest decline, posting N699.6 billion, down 35.5 percent from last year.

FirstBank’s profit fell to N458.1 billion, marking a 13 percent decline from the first nine months of 2024. Access Holdings, Nigeria’s biggest bank by assets, reported N447.5 billion in profit, a 2.2 percent decrease, reflecting relative stability in its earnings despite broader sector pressures.

Read also: Big banks’ customer lending jumps to N42trn on rate cut

Zenith Bank, Nigeria’s second most valuable bank, also saw its earnings slip by about 8 percent to N764.2 billion in the months to September 2025.

Lenders in Africa’s top crude producer have been the most beneficiaries of the country’s unification of the exchange rate and the subsequent floating of the naira to be more market-determined, as eight leading banks cupped N754.8 billion in FX revaluation gains in 2023, up 472.3 percent from N132 billion recorded in the prior year.

But the rare calmness of the naira that has suffered more than 70 percent devaluation means lower revaluation gains and an overall decline in earnings for the lenders.

“We expect a 19.2 percent decline in profit before taxation with the pre-tax return on average equity plummeting to 27.3 percent (FY 2024: 48.2 percent) in FY 2025,” Augsto&Co, a Lagos-based credit rating agency, said in its banking industry report.

The research and consultancy firm, however, sees a rebound in 2026, supported by the ongoing recapitalisation exercise and the impact of the uptick in the impairment charge.

Analysts say the variation in performance points out differences in business models, operational efficiency, and cost management among the banks. Analysts further note that the decline in overall profit is partly attributable to “the moderation of extraordinary gains that had boosted earnings in prior periods.”

Banks with larger exposure to high-growth segments or more disciplined cost structures fared better, while those with higher risk-weighted assets or rising loan impairments experienced more pronounced declines.

Read also: Banks to face N3m penalty for failing to verify customer status

Banks’ stocks, which used to be the ‘darling’ of the Nigerian Exchange, are witnessing their steepest declines in recent months, driven by slowing earnings and a drop in dividend payout.

GTCO has lost approximately 9 percent of its value over the past four weeks, reflecting the market’s reaction to its unimpressive performance, despite the stock’s year-to-date gain of 48.3 percent.

That same fate is meted out on Access Holdings, with its stock down 18 percent in about a month, compounding shareholders’ worries. The stock, which began the year with a share price of N23.85, has since lost 14.1 percent off that price valuation, ranking it 132nd on the NGX in terms of year-to-date performance.

Though Zenith is still up 31.3 percent year-to-date, it’s lost 11 percent of its value in the past four weeks. It closed trading on Friday at N59.75 per share on the NGX, recording a 0.2 percent drop from its previous closing price.

The story is the same with FirstHoldCo and UBA. The former is down 4.23 percent in the past four weeks, while the latter has also seen a downward trend in its value by as much as 12 percent, outpacing its 8 percent year-to-date gain.