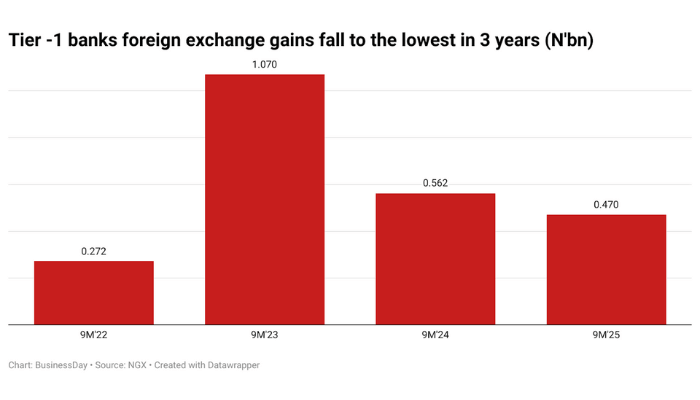

The foreign exchange gains of Nigeria’s biggest banks, once a key driver of profitability, fell to their lowest level in three years and is expected to shrink further as interest rate cuts boost corporate borrowing.

For the first nine months of the year, lenders have reported weaker foreign-exchange gains of N470.1 billion, down from N562.5 billion reported in the same period last year.

This is a 55.9 percent decline from the N1.07 trillion reported in 2023.

Across Nigeria’s biggest banks by market value, Access Holdings and UBA saw major declines of 53.4 percent and 77.4 percent in their FX gains during the period.

In contrast, First Holdco posted N71.6 billion in FX gains, up 131.7 percent, followed by Zenith Bank, which swung from a loss last year to N24.2 billion, marking a 1,517 percent increase, and GTCO reported N77.2 billion in FX gains, up 28.1 percent.

Read also: Big banks’ profits drop 15% in 9 months as revaluation gains fade

Samuel Oyekanmi, research and insights lead at Abuja-based consultancy Norreberger, said the pattern reflects differences in how banks manage FX exposure.

“Foreign exchange revaluation gains remained uneven across the sector, underscoring the varied FX risk management strategies and balance-sheet positioning of Nigerian banks,” he said.

“Zenith Bank and First Bank delivered strong FX income, reflecting more favourable foreign currency exposures and active treasury positioning during the period. In contrast, UBA, Access Bank, and GTCO posted more modest or sharply lower gains, highlighting a more conservative or hedged exposure stance.”

According to Oyekanmi, while the magnitude of gains is largely driven by short-term market conditions, particularly currency adjustments and rate liberalisation, the results also reinforce the growing importance of sophisticated treasury operations as a key competitive advantage within the banking industry.

It is worth noting that this shift became apparent after the Central Bank of Nigeria (CBN) began cutting benchmark interest rates to support economic activity amid cooling inflation, which stood at 16.1 percent in October, down from 18.02 percent in the previous month, as reported by the National Bureau of Statistics (NBS).

At the end of the two-day Monetary Policy Committee (MPC) meeting, the apex bank retained its interest rate at 27 percent, a stance aimed at sustaining the gains already achieved in the fight against inflation and ensuring continued stability.

Lower yields across money markets and government securities have reduced the extraordinary income banks previously earned from high-rate environments.

Read also: Big banks incur N442bn in AMCON expenses amid falling profit

In July 2024, Nigerian President Bola Ahmed Tinubu introduced a one-time windfall tax of 50 percent on the profits realised from all FX transactions conducted by banks in 2023.

The levy wiped out a substantial portion of those FX profits. Some banks that had declared exceptional FX gains were forced to revise tax provisions, absorb one-off charges, or report net FX losses after settling their tax liabilities.

According to Moody, a global rating agency, the windfall levy on Nigerian banks’ foreign exchange revaluation gains is credit negative for banks.

“The windfall tax will have a particularly negative effect on banks whose capital adequacy is close to regulatory thresholds. The tax follows record profits declared by banks in 2023, largely because of foreign-currency revaluation gains related to the naira’s massive devaluation of 37 percent in June 2023,” the report said.

By 2025, that era had faded. With the FX market stabilising and interest rates falling, banks can no longer rely on the extraordinary gains that once lifted their bottom lines.

The big lenders are now shifting their strategic focus toward rebuilding core banking operations.

BusinessDay reported that across the tier one banks, aggregate customer loans rose 2 percent from the N41.3 trillion recorded in the same period of 2024 and 5 percent above the full-year 2024 lending position.

The shift in monetary conditions is occurring against the backdrop of a more stable currency market. The naira, which opened the year at N1,660 per dollar, traded within a tighter band through 2025, closing December 5th at N1,450.42 at the Nigerian Foreign Exchange Market (NFEM). The narrower volatility drastically reduced opportunities for valuation gains, which had inflated banks’ 2024 profit bases.

Read also: Big banks face profit squeeze as rate cuts weigh on earnings

During the MPC meeting, the apex bank adjusted the asymmetric corridor around the Monetary Policy Rate (MPR) to +50 and –450 basis points, from the previous +250/–250 basis points maintained since September 2025.

This move significantly reduces the incentive for banks to simply lodge surplus cash with the CBN, rather than channel funds into productive lending to businesses and households.

Ayodeji Ebo, managing director and chief business officer at Optimus by Afrinvest, said keeping the MPR unchanged at 27 percent signals the CBN’s sustained caution around short-term inflation risks, particularly following the rise in October’s month-on-month inflation.

He said the shift from a symmetric corridor (+250bps/–250bps) to a more asymmetric structure (+50bps/–450bps) sends a strong policy message. By widening the lower band to –450bps, the CBN lowers the effective return on idle funds placed at its deposit window (now 22.5 percent), discouraging banks from relying on passive income from the CBN.

At the same time, raising the upper band to +50bps increases the cost of borrowing from the CBN’s lending window (now 27 percent). This encourages banks to seek liquidity through the interbank market or deploy funds into the real economy, rather than depend on the CBN for short-term funding.

Lukman Otunuga, market analyst at FXTM, added that further signs of moderating price pressures could encourage the CBN to begin interest rate cuts in 2026. The latest policy stance, he said, reinforces the bank’s focus on managing inflation while simultaneously nudging the financial system toward stronger credit expansion and real-sector growth.

According to Meristem Securities in their monthly Banking Sector Highlights for November 2025, as the massive foreign exchange gains that banks enjoyed in the wake of the harmonisation of the FX market dry up, lenders are actively seeking ways to open up other non-interest channels.