In nine months (9M) to September 30, 2025, Beta Glass Plc grew its pre-tax profit by 225 percent to N40.318billion from N12.415 billion in the same nine months period of 2024. The company recently announced its unaudited interim financial results for third-quarter (Q3) and the nine months period ended September 30, delivering record performance across key metrics.

Beta Glass Plc is a leading manufacturer of quality glass packaging solutions for beverage, pharmaceutical and food industries. Headquartered in Lagos, the company also exports to Central and West African markets such as Ghana, Burkina Faso, Ivory Coast, etc., serving both regional and international clients with a strong commitment to quality, innovation, and sustainability.

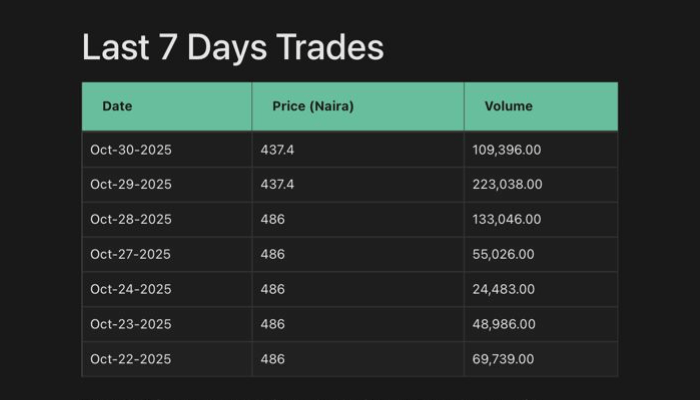

The company’s 9M’25 profit after tax (PAT) increased by 227 percent to N27.223billion from N8.318billion in 9M’24. The company’s share price at N437.4 as at October 30 shows it has risen this year by 573.96 percent. The stock had reached a 52-week high of N486 as against corresponding week low of N45.

Beta Glass net sales rose by 43 percent in 9M’25 to N114.381billion from N79.761billion in 9M’24. In Q3 2025, the company reported revenue of N36.148 billion, EBITDA of N16.42 billion, and an EBITDA margin of 39.8percent, reflecting strong year-on-year growth and sustained margin expansion.

The company said it continues to monitor external factors such as foreign exchange volatility and energy costs while advancing supply chain optimisation and sustainability initiatives to ensure business resilience.

In nine months to September 30, 2025, the company’s earnings per share (EPS) increased to N45.38 from N13.86 in 9M’24, representing an increase by 227 percent.

Read also: Beta Glass bets on world-record DF1 furnace rebuild to drive efficiency gains

On a last twelve months (September 2024–September 2025) basis, Beta Glass revenue reached N152.20 billion, with EBITDA of N53.38 billion and margin of 35percent, underscoring Beta Glass’s ongoing transformation and operational excellence. “This performance was driven by disciplined cost management, enhanced production efficiency, and strong demand across core markets,” the company said.

“Building on the performance from previous quarters, Q3 2025 performance showcases increased market demand, strategic market positioning, and focus on operational efficiency, cost discipline and value creation.

“The 9M 2025 performance reaffirms the Company’s resilience, underscored by operational excellence, innovative product offerings, and agile response to market opportunities,” Beta Glass noted further in a recent statement.

Speaking on the results, Alexander Gendis, CEO of Beta Glass, said: “This quarter and year-todate results reflect the powerful fundamentals of our business, that is innovation, sustainability and quality, and the compounding impact of our ongoing transformation journey. We are pleased to report another period of strong results, driven by our team’s disciplined execution and strategic focus on efficiency, innovation, and customer satisfaction.

“With the Delta plant furnace rebuild completed in record time and our new solar power plant now fully operational, we are building a more energy-efficient and future-ready manufacturing base to serve the growing demand of our domestic customers and continue our regional expansion. These strategic investments reinforce our ability to serve customers reliably while advancing our sustainability agenda by reducing our carbon footprint and long-term energy costs,” Gendis said.