The ongoing reforms in Nigeria’s financial sector have contributed to a notable Balance of Payments (BOP) surplus, sustained growth in diaspora remittances, and consistent inflows into the country’s external reserves.

Nigeria recorded a BOP surplus of $4.60 billion in the third quarter of 2025, marking a turnaround from the deficit recorded in the preceding quarter. This performance reflects strengthening external sector fundamentals, firmer investor confidence, and the continued impact of reforms in the foreign exchange market, monetary policy, and the domestic energy sector.

Monetary and fiscal authorities have made significant progress in restoring macroeconomic stability, reducing inflation, improving data analytics, ending monetary financing of deficits, and narrowing the FX market gap to under 2 per cent.

Read also: Here are 21 banks that have met the new CBN capital rules

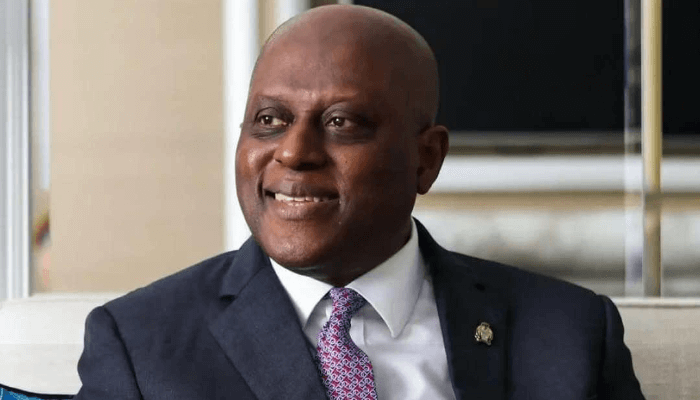

The reforms instituted by the Central Bank of Nigeria (CBN), under the leadership of Olayemi Cardoso, governor of the CBN, have helped rebuild FX reserves organically through stronger non-oil exports and improved market functioning. These policies have also supported foreign capital inflows and contributed to growth in key sectors of the economy.

According to the CBN, the BOP surplus in Q3 2025 was supported by a current account surplus of $3.42 billion, driven by stronger trade performance, resilient remittance inflows, increased financial flows, and continued accretion to external reserves. The goods account remained in surplus at $4.94 billion, reflecting higher export earnings during the period.

“Exports increased to $15.24 billion in Q3 2025, from $14.90 billion in Q2 2025, on account of higher crude oil and refined petroleum product exports. Nigeria is gradually transitioning from a net importer of refined petroleum products to a net exporter. Imports of petroleum products decreased by 12.7 per cent to $1.65 billion,” the CBN stated.

Net out-payments in the services account increased to $4.07 billion in Q3 2025, from $3.74 billion in Q2 2025, mainly due to higher net imports of transport, travel, insurance, computer and information, other business, and government services. Meanwhile, the primary income account debit balance rose significantly to $2.95 billion in Q3 2025, from $1.25 billion in Q2 2025, largely reflecting repatriation of reinvested earnings by domestic banks on foreign investments.

The secondary income account balance decreased slightly to $5.50 billion in Q3 2025, from $5.51 billion in Q2 2025, with workers’ remittances from Nigerians in the diaspora at $5.24 billion, down slightly from $5.30 billion.

Crude oil exports rose to $8.45 billion, while exports of refined petroleum products grew by 44 per cent to $2.29 billion, indicating progress in domestic refining capacity. The total goods exports of $15.24 billion, combined with a decline in imports of refined petroleum products by 12.7 per cent, contributed to an improved trade balance.

The financial account also supported the overall BOP outcome, with a net lending position of $0.32 billion. Foreign direct investment (FDI) inflows rose to $0.72 billion, while portfolio investment inflows remained robust at $2.51 billion, reflecting improved investor sentiment and continued non-resident participation in domestic financial instruments.

External reserves increased to $42.77 billion at end-September 2025, up from $37.81 billion at end-June, strengthening Nigeria’s external buffers and providing a cushion against external shocks.

According to Cardoso, the Q3 2025 BOP outcome underscores the strengthening of external sector fundamentals, higher investor confidence, and the sustained impact of reforms in monetary policy, the FX market, and the domestic energy sector.

At the 60th Annual Bankers’ Dinner, Cardoso reaffirmed that the banking system remains resilient, with continued vigilance on emerging risks. He outlined the CBN’s 2026 priorities, which include strengthening the banking system, ensuring price stability, modernising payments, deepening financial inclusion, and supporting responsible fintech innovation.

He also highlighted growth in digital payments, expansion of contactless card usage, improved agent-banking controls, and Nigeria’s exit from the FATF grey list as major confidence boosters. Cardoso reiterated the bank’s commitment to disciplined, transparent, and forward-looking policies to maintain stability and foster sustainable economic growth.

Read also: CBN sees capital market extending bullish streak on bank recapitalisation

The CBN embarked on a series of bold reforms aimed at attracting foreign capital and achieving price and exchange rate stability. In 2023, the new administration and the CBN liberalised the foreign exchange market, ended Central Bank financing of fiscal deficits, reformed fuel subsidies, and strengthened revenue collection. These steps were complemented by strategic measures to reduce inflation.

Since implementation, international reserves have increased, and access to foreign exchange in the official market has improved. Nigeria returned to international capital markets in December and received upgrades from rating agencies. The establishment of new domestic private refineries is positioning Nigeria up the value chain in a deregulated market.

CBN policies, including currency reforms, have boosted investment inflows and reduced interventions in the domestic FX market. The unification of exchange rates and clearance of over $7 billion in FX backlog improved the country’s investment outlook, with multilateral organizations like the World Bank describing it as a bold step for long-term economic sustainability.

Sovereign risk spreads have fallen to the lowest level since January 2020, reflecting improved investor confidence and a reduction in the premium accumulated during the pandemic and economic strain.

In its effort to control inflation, the CBN recently hosted the Monetary Policy Forum 2025, with participation from fiscal authorities, legislators, private sector leaders, development partners, and scholars. The forum focused on “Managing the Disinflation Process” and enhancing collaboration on monetary policy implementation.

Cardoso emphasised that sustaining price stability requires coordination between fiscal and monetary authorities to anchor expectations, restore purchasing power, and ease economic hardship. He reiterated that monetary policy remains forward-looking, adaptive, and resilient.

The CBN has also strengthened the banking sector, introducing new minimum capital requirements for banks effective March 2026, to ensure resilience and position Nigeria for a $1 trillion economy. These reforms reflect a commitment to creating an enabling environment for inclusive economic growth.

As the apex bank shifts from unorthodox to orthodox monetary policy, Cardoso confirmed its focus on restoring confidence, strengthening policy credibility, and maintaining price stability. Monetary policy easing, he explained, was necessary following a review of macroeconomic developments and projections of declining inflation to support economic recovery.

The CBN under Cardoso has developed multiple channels to increase dollar inflows and support access for manufacturers and retail end users. These include improving diaspora remittances through new product development, licensing new International Money Transfer Operators (IMTOs), implementing a willing buyer-willing seller FX model, and enabling timely naira liquidity for IMTOs. These measures have strengthened gross FX reserves and supported naira stability.

Diaspora remittances, estimated at $23 billion annually, remain a reliable source of foreign exchange. The CBN continues to explore additional policies to sustain inflows, with an objective to double formal remittance receipts within a year.

Charlie Bird, director of Trading at Verto, noted during a Cordros Asset Management seminar titled “The Naira Playbook” that dollar liquidity is now more balanced, with foreign investors and airlines able to repatriate funds. He said Nigeria is now a preferred destination for foreign investment due to improved FX liquidity following CBN reforms.

Read also: 2025 in review: How CBN policies impacted Nigeria’s economy and financial system

Over the past 12 months, Nigeria’s economy has transitioned from crisis management to laying the foundation for sustainable recovery. Cardoso said: “After nearly a decade in which real GDP growth averaged about 2 per cent, reforms have restored momentum and confidence in our macroeconomic environment. Our economy grew by 4.23 per cent in Q2 2025, the strongest pace in four years, driven by telecommunications, financial services, and oil production.”

He noted that inflation has moderated consistently, from a peak of 34.6 per cent in November 2024 to 16.05 per cent in October 2025, marking seven consecutive months of disinflation. Food inflation fell to 13.12 per cent in October, down from 21.87 per cent in August. This decline restores real purchasing power and demonstrates disciplined execution under orthodox monetary policy.