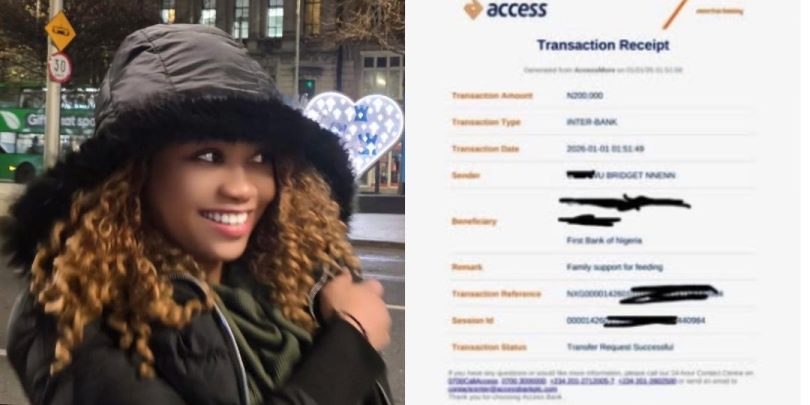

A Nigerian lady based in Dublin, Ireland, has revealed how much Access bank charged her for sending money home, sparking discussions online about Nigeria’s new tax laws.

The lady identified as Barrister Bridget Nnenna shared her experience publicly, highlighting both the bank charges and her views on the country’s taxation system.

Lawyer Reveals Bank Charges

Bridget, a Nigerian legal practitioner residing in Ireland, posted on Facebook the exact amounts Access Bank debited her for two separate transfers to Nigeria.

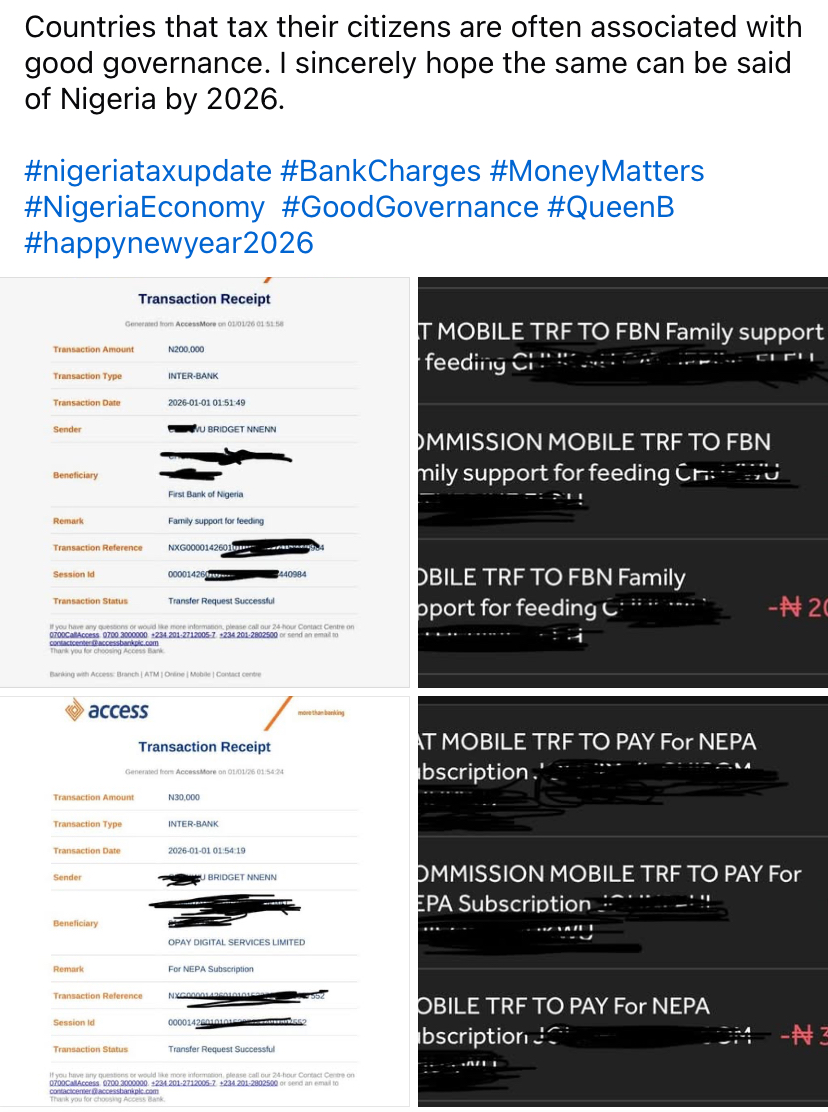

On Thursday, January 1, she sent N200,000 and N30,000 home and documented the charges placed on each transaction.

For the N200,000 transfer, Bridget was charged N50 and N3.75, while the N30,000 transfer attracted N25 and N1.88.

She also shared screenshots of the transaction receipts to show the deductions.

Purpose of Transfers

In her post, Bridget explained the reasons behind the transfers. The N200,000 was sent as family support for feeding, while the N30,000 was meant for NEPA subscription.

She added that Access Bank had previously informed her that charges would now fall mainly on the sender rather than the receiver, in line with the new banking policy.

Views on Nigeria’s New Tax Laws

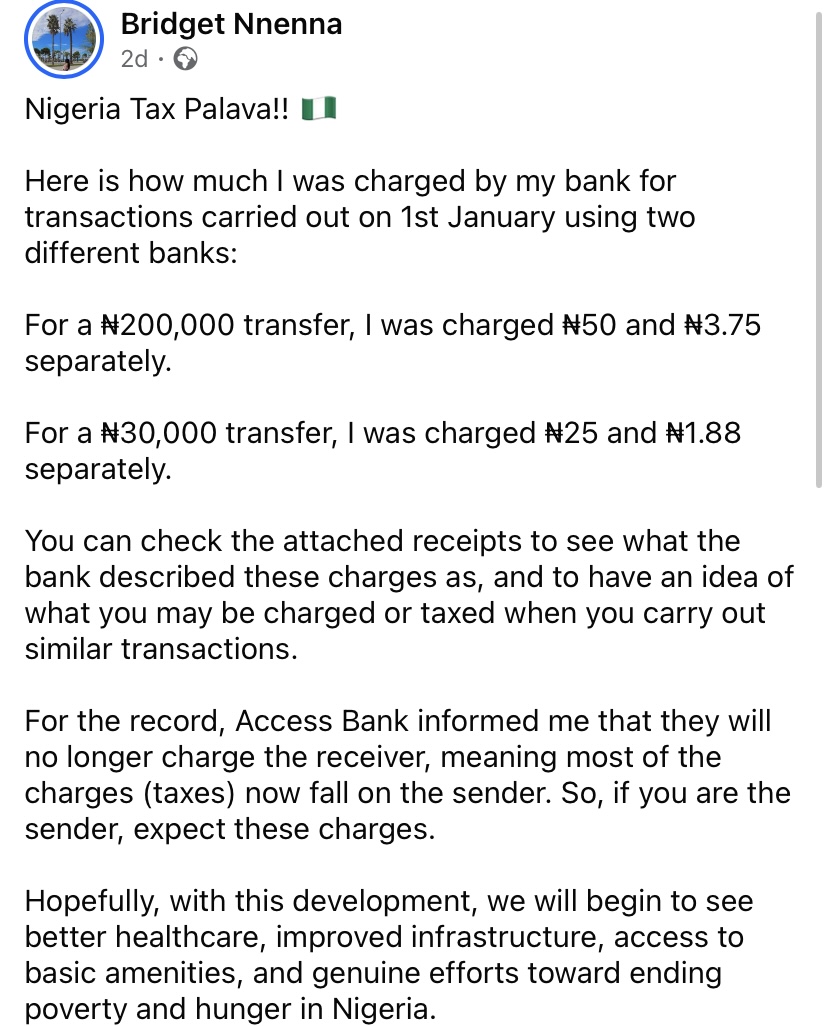

Bridget also used the post to speak about Nigeria’s new tax regulations.

She expressed hope that the policy would result in better healthcare, improved infrastructure, access to basic amenities, and real efforts to reduce poverty and hunger in the country.

In her words:

“Nigeria Tax Palava!!

Here is how much I was charged by my bank for transactions carried out on 1st January using two different banks:

For a ₦200,000 transfer, I was charged ₦50 and ₦3.75 separately.

For a ₦30,000 transfer, I was charged ₦25 and ₦1.88 separately.

You can check the attached receipts to see what the bank described these charges as, and to have an idea of what you may be charged or taxed when you carry out similar transactions.

For the record, Access Bank informed me that they will no longer charge the receiver, meaning most of the charges (taxes) now fall on the sender. So, if you are the sender, expect these charges.

Hopefully, with this development, we will begin to see better healthcare, improved infrastructure, access to basic amenities, and genuine efforts toward ending poverty and hunger in Nigeria.

Countries that tax their citizens are often associated with good governance. I sincerely hope the same can be said of Nigeria by 2026.”

Social Media Reactions

Her post quickly gained attention online, with many Nigerians discussing the charges and the effect of the new tax law.

See below;