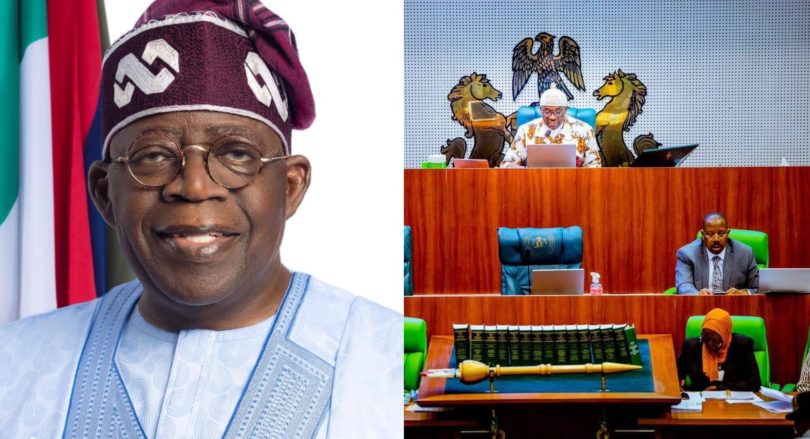

The House of Representatives has approved President Bola Tinubu’s request to borrow $2.35 billion to finance part of Nigeria’s 2025 budget deficit.

The lawmakers also endorsed the president’s proposal to issue a $500 million debut sovereign sukuk in the international capital market to fund infrastructure projects and diversify the country’s sources of financing.

Loan Approval and Budget Financing

The approval came after the House considered the report of the Committee on Aids, Loans and Debt Management.

The chamber also authorised the implementation of a new external borrowing of ₦1.84 trillion (approximately $1.23 billion) at the 2025 budget exchange rate of $1 = ₦1,500.

This loan is expected to partly fund the ₦9.27 trillion budget deficit.

Earlier this month, Tinubu wrote to the National Assembly seeking approval for the loans, citing provisions of the Debt Management Office (Establishment) Act, 2003, which requires legislative consent for all new borrowings.

Funding Sources and Market Conditions

The president explained that the funds would be raised through one or a combination of Eurobonds, loan syndications, or bridge financing facilities, depending on market conditions.

He added that the new Eurobond pricing would align with Nigeria’s existing international bonds, currently yielding between 6.8% and 9.3%, depending on maturity.

Sovereign Sukuk and Infrastructure Development

On the proposed $500 million sovereign sukuk, Tinubu stated that the initiative would help attract diverse investors and strengthen the government securities market.

He noted that proceeds would fund critical infrastructure projects across the country.

According to the president, over ₦1.39 trillion has been raised through domestic sukuk issuances between 2017 and 2025 to support major road and infrastructure projects.

The proposed external sukuk, he said, would complement these domestic efforts.

Diversifying Nigeria’s Funding Base

Tinubu emphasised the importance of expanding Nigeria’s funding sources, proposing that the sukuk may be issued with or without credit enhancement from the Islamic Corporation for the Insurance of Investment and Export Credit (ICIEC), a member of the Islamic Development Bank Group.

He further stated that 25% of the sukuk proceeds may be used to repay high-cost debts, while the remaining funds would be channelled into infrastructure financing.