Since 2015, the Nigerian Exchange (NGX) has expanded by more than 320 percent. The All-Share Index, which hovered just above 34,000 points in 2015, crossed the 145,000-point mark multiple times in 2025. Based on this trajectory, the market reflects an estimated compound annual growth rate (CAGR) of 14 percent.

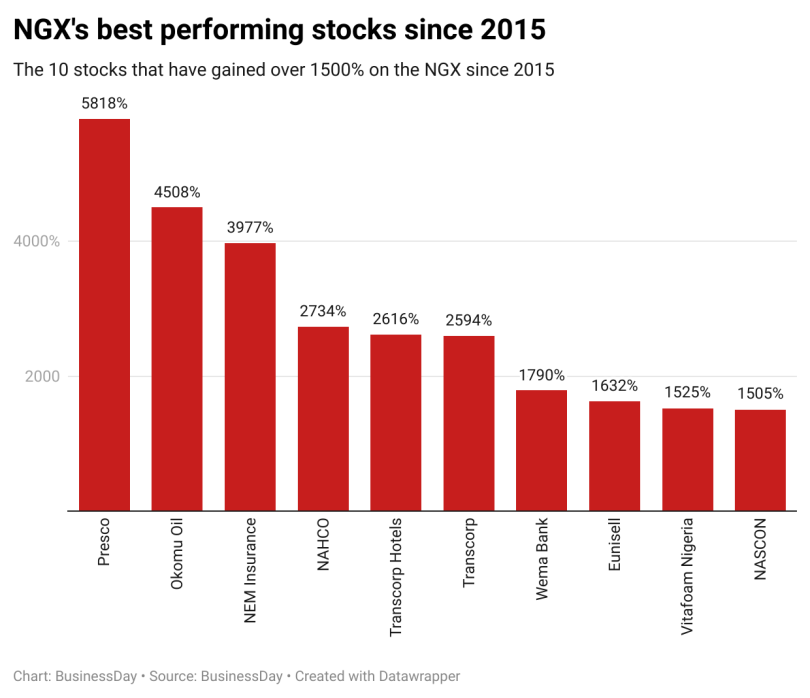

Over the eleven years, the NGX has far outpaced the broader Nigerian economy in real terms. Its growth has been fueled by strong performances across multiple sectors and by companies whose valuations have multiplied several times over. In this report, BusinessDay highlights the top 10 best-performing stocks on the NGX since 2015.

Read More: Here are top 10 best-performing stocks in the NGX for H1 2025 – Businessday NG

Presco Plc, the palm oil producer, is the standout performer on the NGX. Its share price rose from N24.5 in 2015 to N1,450 in 2025, representing a 5,818 percent surge. Today, the company boasts a market capitalisation of $1 billion.

Its annual growth rate of 45 percent has consistently outperformed Nigeria’s inflation levels. Between 2015 and 2024, Presco’s revenue expanded by 1,886 percent, while its net income soared by an even more striking 3,252 percent. The company’s bottom-line growth translates to a 42 percent annual increase in net income.

Okomu Oil Palm, another major player in the palm oil sector, follows with a 4,508 percent jump since 2015 and a 42 percent CAGR. The company experienced a significant revenue expansion, rising from N9.7 billion in 2015 to N130.2 billion in 2024. Profit after tax also increased sharply, from N2.7 billion to N40 billion over the same period.

NEM Insurance recorded one of the most dramatic gains among financial companies. Its share price climbed from N0.65 in 2015 to N26.5 in 2025, marking a 3,977 percent appreciation and a 40 percent CAGR.

The company’s net income rose nearly 4,000 percent between 2015 and 2024, moving from N713.7 million to N29.2 billion. This strong financial performance is mirrored in its market valuation, with earnings per share improving from N0.14 to N5.82 during the period.

Read More: Top 5 best-performing sectors in the NGX in H1 2025 – Businessday NG

Nigerian Aviation Handling Company (NAHCO) began 2015 with a share price of N3.76 and, by December 4, 2025, had reached N106.5. That reflects a 2,734 percent increase and an annual growth rate of 36 percent.

Its stock trajectory aligns closely with its profit expansion. Between 2015 and 2024, after-tax profit grew by 2,292 percent, rising from N537.8 million to N12.9 billion. Earnings per share also climbed sharply, from N0.34 to N6.60.

Transcorp Hotels recorded a remarkable rise, moving from a share price of N5.8 in 2015 to N157.5 in 2025, a 2,616 percent increase and a 35 percent annual growth rate.

Now Nigeria’s largest hospitality group, the company has become one of the country’s billion-dollar corporates, with a market cap of $1.2 billion. Its gross earnings grew from N14 billion in 2015 to N70.1 billion in 2024, representing a 402 percent expansion.

Its parent company, Transnational Corporation (Transcorp), follows closely with a 2,594 percent rise between 2015 and December 4, 2025. The share price increased from N1.52 to N40.95 during the period. In February 2025, Transcorp reached an all-time high of N61.00.

The group has two listed subsidiaries, Transcorp Hotels and Transcorp Power, which have contributed significantly to its valuation.

Wema Bank is the only commercial bank on the list. Its share price rose by 1,790 percent, growing from N1 in 2015 to N18.9 by December 2025. This performance reflects a 31 percent annual growth rate.

The bank’s interest income expanded 9.55 times, from N37.1 billion in 2015 to N354.6 billion in 2024. Wema transitioned from a regional to a national banking licence in 2015, a move that enabled nationwide expansion. Over the same period, total assets rose by 806 percent, from N396.7 billion to N3.59 trillion.

Eunisell Interlinked Plc earned its place on the list after a decade of substantial value appreciation. Its share price climbed from N4.21 in 2015 to N72.90 by December 4, 2025.

The company operates in the electrical manufacturing segment, producing high- and low-voltage cables, transformers, and related accessories. Its most dramatic gains came within the last two years, a 502 percent surge in 2024 followed by a further 307 percent rise in 2025.

Vitafoam Nigeria delivered a 1525 percent increase in share price between 2015 and 2025, representing a 29 percent annual growth rate. Starting 2025 at N5.41, the stock reached N87.9 by December 4. In late 2024, it traded at an all-time high of N94.00.

Its revenue grew from N17.2 billion in 2015 to N82.6 billion in 2024, representing a 481 percent increase over the decade.

NASCON Plc, the salt and seasoning producer under the Dangote Group, posted a 1,505 percent gain between 2015 and 2025. Its share price rose from N6.22 to N99.8 by December 4, 2025.

Between 2015 and 2024, NASCON’s revenue expanded by 744 percent, climbing from N16.2 billion to N120.4 billion. Net income also rose significantly, growing from N2.1 billion in 2015 to N15.6 billion as of 2024, a 640 percent increase.