The Financial Reporting Council of Nigeria (FRC) has announced plans to integrate Islamic finance services into the country’s financial reporting framework by adopting standards issued by the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI).

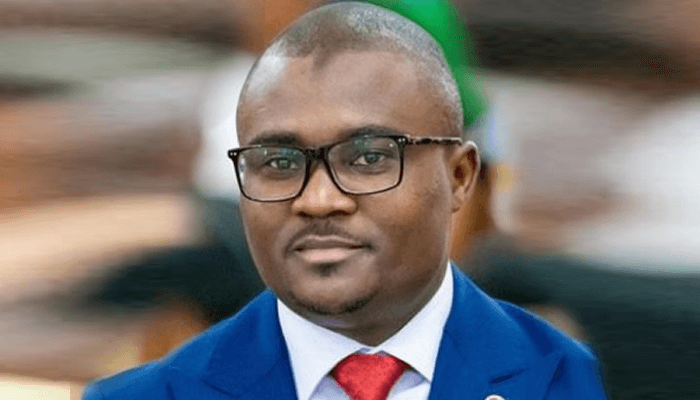

Rabiu Olowo, executive secretary/CEO of the FRC, disclosed this in Lagos during the 7th Africa Islamic Finance Conference. He said the initiative aligns with FRC’s statutory responsibility to set, monitor, and enforce financial reporting standards in Nigeria.

Olowo explained that the rapid expansion of Islamic Finance Services in the country, including growth in Islamic banking, Sukuk issuances, Takaful insurance, and non-interest capital market products, makes it necessary to ensure consistency and global comparability in financial reporting.

“This sector has become a dynamic contributor to financial inclusion, infrastructure financing, and ethical investment alternatives. However, this growth brings with it the obligation for regulators to ensure that financial reporting for Islamic Finance Services is consistent, reliable, and globally comparable,” he said.

Olowo added that adopting AAOIFI standards would complement existing IFRS practices while providing a dedicated framework for the unique contracts and financial instruments used in Islamic finance.

“Nigeria’s financial system is evolving, and our regulatory framework must evolve with it. The inclusion of AAOIFI standards into our national framework is not just a regulatory necessity, it is a strategic imperative for building trust, enhancing transparency, and ensuring that Islamic Finance continues to contribute meaningfully to economic growth and financial inclusion,” he stated.

In his address, Vice President Kashim Shettima, represented by Special Adviser to the President on Economic Affairs, Tope Fasua, said: “Islamic finance has emerged as a powerful ally because the system framework is rooted in ethics, fairness, and shared prosperity.”

Also speaking, Muhammadu Sanusi II, 14th Emir of Kano and former governor of the Central Bank of Nigeria, expressed satisfaction with the growth of the industry.

“We are beginning to see geometric growth in the number of banks that have been licensed and the number that have applied for licenses,” Sanusi said.

He explained that “Islamic financing in its core invests in real assets like roads, power plants, water, and digital networks. In Nigeria, for instance, if we have constant access to electricity, it will easily give us a $1 trillion economy.”

Sanusi concluded that Islamic financing “fits perfectly into infrastructure finance more than any other institution because it is built on truth, where every financing is tied to a real tangible asset that creates jobs and long-term value.”