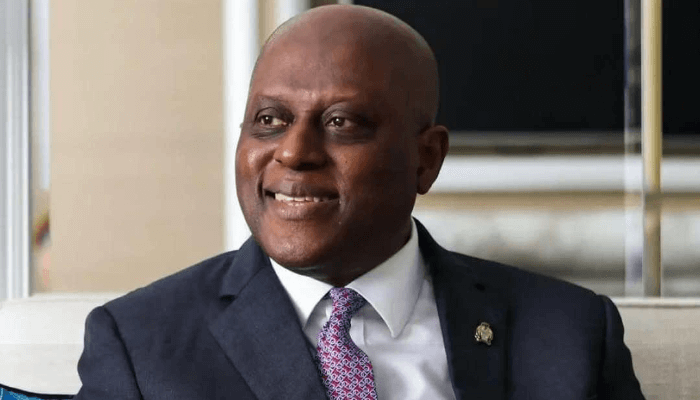

At least twenty-seven banks are raising new capital ahead of a sector-wide recapitalisation programme that is expected to boost lenders’ buffers and drive the country towards its $1 trillion economy, according to Olayemi Cardoso, the Central Bank of Nigeria’s governor.

“Several banks have already met the new capital thresholds, while others are advancing steadily and are well-positioned to comfortably meet the March 31, 2026 deadline,” Cardoso said at the CIBN annual Bankers’ dinner on Friday.

“To date, twenty-seven banks have raised capital through public offers and rights issues, and sixteen have already met or exceeded the new requirements — a clear testament to the depth, resilience, and capacity of Nigeria’s banking sector.”

Read also: Cardoso opens door to rate cuts in 2026

The CBN in March 2024, directed banks to shore up their minimum paid-up capital to N500 billion for international banks, N200 billion for national, and N50 billion for regional lenders. Non-interest banks face lower thresholds of N20 billion and N10 billion, depending on their authorisation.

With less than four months to the central bank’s 31 March 2026 recapitalisation deadline, several Nigerian lenders have already crossed the finish line, securing the capital buffers required under the new rules and setting the pace for the rest of the industry.

Access Bank was the first tier-1 lender to hit the N500 billion new capital threshold for banks with international authorisation as set by the CBN. Its parent company, Access Holdings, announced in late December that it had received regulatory approvals for its N351 billion Rights Issue.

The Holdco said that with the success, the bank’s share capital would increase to N600 billion, N100 billion above the regulatory minimum requirement. With this feat, Access Bank was able to cross the threshold within the same year as the CBN directive.

Read also: Cardoso: CBN unable to restart interventions as ₦4.69trn remains unpaid

BusinessDay in a September report, revealed that Access, Zenith, Stanbic, Wema, Providus, Greenwich, Jaiz, and Lotus have already cleared their requirements, while Globus awaits regulatory confirmation. The CBN governor has however recently confirmed that 16 banks have successfully met the threshold.

“With just four months to the conclusion of the recapitalisation exercise, I am pleased to report that the process is firmly on track. As we strengthen the capacity of our banks, stress-testing this year confirms that Nigeria’s banking sector remains fundamentally robust. Key financial soundness indicators overwhelmingly satisfied prudential benchmarks during the year,” Cardoso said.