AG Mortgage Bank Plc (AGMB) has set ambitious goals which include increasing shareholder value with a 20 percent return-on-equity (RoE), leading green sustainable housing initiatives, and significantly growing customer base and loan portfolio.

Investors have increasingly viewed Nigeria’s real estate investment as a hedge against inflation and a diversification tool, with allocations rising amid declining inflation and stabilising rates.

AG Mortgage Bank Plc – bullish on its target of 20 percent return-on-equity for shareholders – is firmly anchored by Project Momentum 2025-2030 which is a bold strategic blueprint guiding AGMB transformation into a diversified Group Structure encompassing mortgage finance, housing microfinance, development, insurance, brokerage, and rental housing services.

AGMB noted this in its third quarter (Q3) 2025 Market Intelligence Report (MIR) which offers deep insights into the evolving housing finance landscape and economic trends impacting the sector.

Interestingly, the bank’s Q3 Market Intelligence Report noted sheer scale of the residential market, projected to be valued at $2.25 trillion by 2025, confirming massive underlying demand aligned with AGMB’s goal of providing one million mortgages by 2030.

Read also: AG Mortgage Bank eyes 2030 to become Nigeria’s largest Housing Finance Group

AG Mortgage Bank stands ready not just to grow its business, but to help deliver Nigeria’s national housing vision, empowering more families with secure, affordable homeownership and building sustainable communities that create long-term economic prosperity

“Nigeria’s real estate sector, a critical pillar of the economy, is poised for robust growth in 2025 and beyond, driven by urbanisation, infrastructure investments, and policy reforms. As of 2025, the market is valued at approximately $2.61 trillion, with a projected compound annual growth rate (CAGR) of 6.87percent from 2025-2029, reaching $3.41 trillion by 2029,” AGMB further noted in its Market Intelligence Report for Q3.

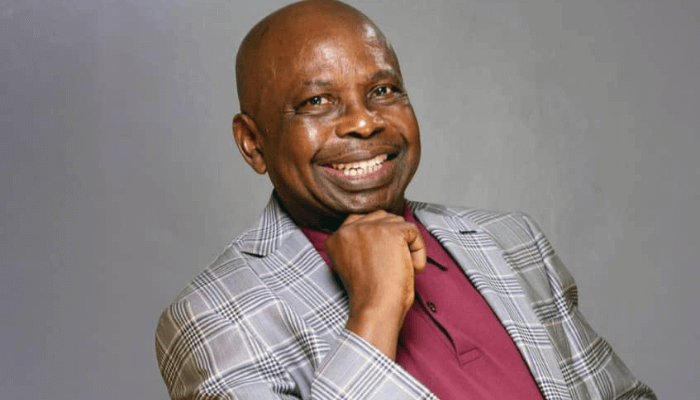

Speaking on the report, Ngozi Anyogu, Managing Director/Chief Executive Officer, AG Mortgage Bank Plc said the Q3 edition of their market intelligence report berths “as we reflect on a landmark moment in the history of AG Mortgage Bank”.

“In September 2025, we proudly celebrated our 20th anniversary—two decades marked by unwavering dedication, impactful innovation, and transformative service to millions of Nigerians.

“From our inception, driven by a bold vision, AG Mortgage Bank has evolved into a trusted institution synonymous with tailored financial solutions that meet the dynamic needs of individuals, businesses, and entire communities,” the managing director noted.

He further said that AG Mortgage Bank Plc will continue to build lasting value and shape Nigeria’s housing finance industry with integrity, innovation, and impact.

“Our recent landmark product exhibition unveiled a suite of innovative offerings – ranging from treasury products designed for institutional investors, to sustainability products supporting Nigeria’s green development aspirations, and digital-first e-business solutions empowering SMEs and entrepreneurs,” Anyogu noted.

Further look at the Q3’2025 edition of AG Mortgage Bank market intelligence report shows that the Construction sector reported strong real growth of 5.27 percent in Q2 2025, while the Real Estate sector contributed 12.80 percent to GDP, growing at 3.79percent.

The real estate market’s outlook for 2025 emphasises steady nominal growth, with residential segments leading at $2.25 trillion (projected CAGR of 7.55percent, reaching $3.01 trillion by 2029. Overall, the sector is expected to grow 6-8percent in 2025, fuelled by the urban influx in cities like Lagos (projected 24 million residents by 2030), Abuja and Port Harcourt.

Nigeria’s renewed macroeconomic stability, government-backed housing reforms and a surging real estate market have created a pivotal moment for AG Mortgage Bank. With over two decades of pioneering leadership in affordable and sustainable home financing, the bank uniquely positions to scale impact by converting strong origination capacity into securitised, investor-grade mortgage assets while expanding access to green, inclusive, and technology-enabled housing solutions.